With the rise in popularity of digital coins comes the need for secure crypto platforms to buy and sell these assets. Since the beginning, new sites have been popping up almost every year offering similar services.

Choosing the right platform requires research, which can be time-consuming and stressful. Therefore, to save you the anxiety, our experts have taken the necessary steps to carefully review the top crypto exchanges for 2024. Continue reading to find out more.

Criteria for Evaluating Crypto Exchanges

Before selecting the best crypto exchanges, we had to consider certain criteria to ensure they provide the best services. Here are the key ones:

Importance of Security, Features, and Fees

The first factors we considered were security, fees, and features. These are unquestionably must-haves for any crypto exchange.

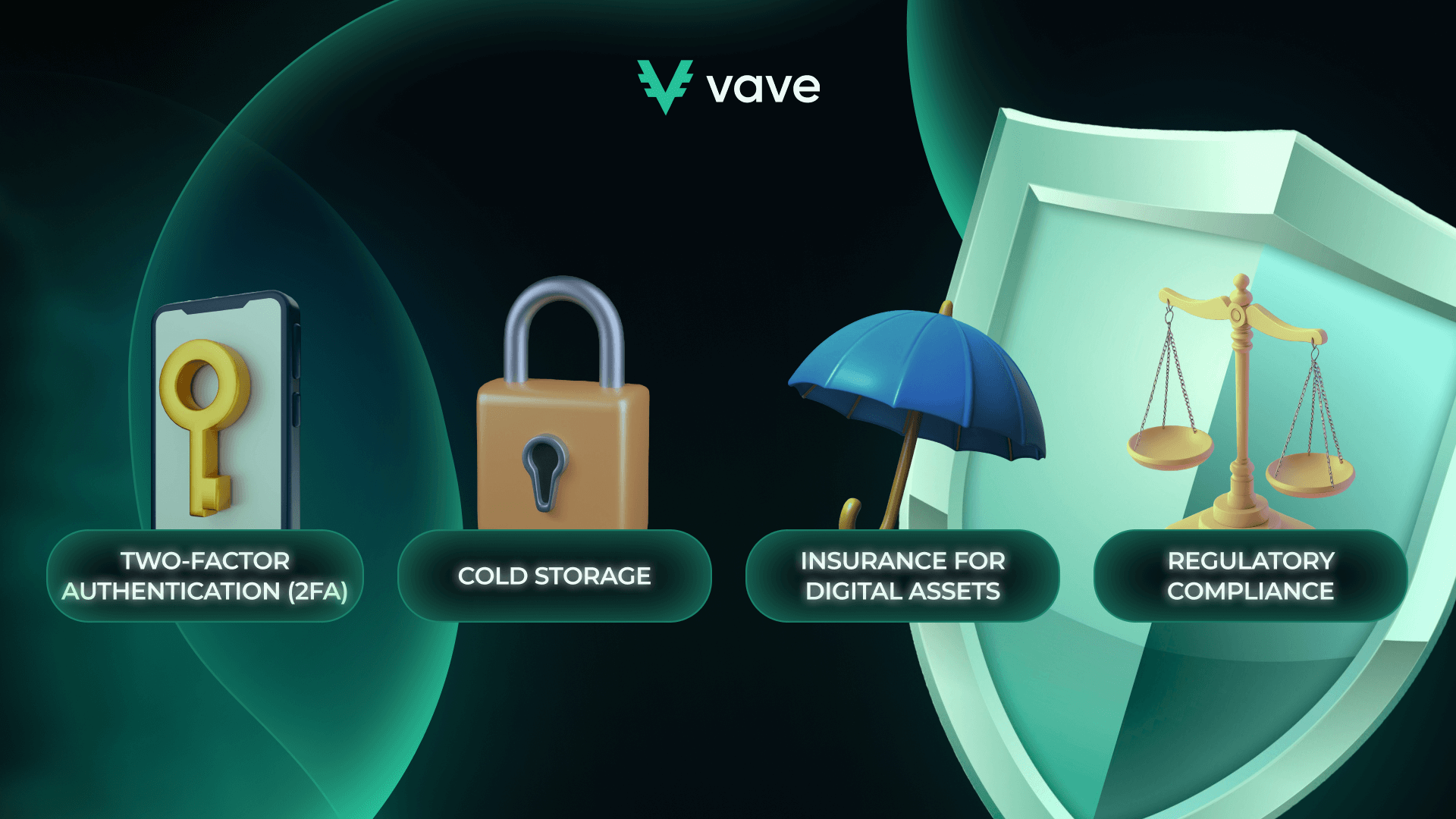

In terms of crypto exchange security, we reviewed each platform’s safety measures, making sure they offer:

- Two-factor authentication (2FA)

- SSL-encryption methods

- Cold storage options for user funds

Most traders often go for sites that offer extra cryptocurrency exchange features that make them stand out. Thus, we looked for platforms that had charting options, limit orders, and staking. For this 2024 crypto exchange review, our experts also analyzed both trading and withdrawal fees and chose sites without hidden costs.

Additional Factors to Consider

While security, fees, and features of crypto exchanges are a must, other factors like customer support and user experience are also important. Therefore, our experts tested the availability and responsiveness of customer service teams. We tried all available channels, including live chat, email support, and social media.

Our Vave team also considered user interface (UI), picking only those platforms that are user-friendly and intuitive. We also verified if they adhere to regulatory compliance. Finally, mobile accessibility was another factor we took seriously, as many traders prefer to use secure crypto exchanges on their phones.

Top Crypto Exchanges to Watch in 2024

Here are the top 2024 exchanges, based on our analysis:

1. Kraken

Kraken is one of the most reputable cryptocurrency exchanges, offering top-notch security features. Thanks to its straightforward interface, you can easily browse through the platform. It supports over 200 different cryptocurrencies, including popular ones like Bitcoin and Ethereum. In addition, Kraken provides alternatives for both institutional and individual investors in a few fiat currencies.

The platform also offers margin and spot trading as part of its services. With a margin, you may borrow up to five times your account balance in order to boost trade volume and liquidity.

2. Gemini

Gemini is a popular online crypto exchange platform for trading digital assets. Founded by the Winklevoss twins in 2014, the site has a user-friendly interface suitable for both novice and experienced traders.

Known as one of the best exchanges for Bitcoin, it covers more than 100 types of cryptocurrencies. Besides that, there are other interesting features like income-earning accounts, staking, and a credit card offering rewards.

In addition, it offers more complex features for advanced traders, such as API connectivity and ActiveTrader. Gemini also offers tutorials and guides via its Cryptopedia. The brand has mobile apps for investors to make and take their trades with them on the road.

3. Crypto.com

Crypto.com is another well-known cryptocurrency exchange famous for providing top customer support to its users. Since its beginning in 2016, the company has dedicated itself to offering nothing but the best.

Crypto.com currently offers more than 250 coins and has very low fees. The brand has its own native token, CRO, and those who hold it enjoy special bonuses. One of the most popular Crypto.com services is its Visa Card, enabling users to spend their cryptocurrency in certain stores and get cash back.

You also get to enjoy:

- DeFi earning

- DeFi lending

- Staking

- Cryptocurrency wallets to help manage private keys

When it comes to support, the platform has several channels, including phone, live chat, and email. You’ll even find lots of guides to help you navigate the website.

4. KuCoin

Coming in fourth is KuCoin, also known as “The People’s Exchange,” which is recognised for supporting over 700 cryptocurrencies. Having opened its doors in 2017, the brand has become one of the highly reputable crypto trading platforms to trade digital assets. KuCoin offers its services straight from its headquarters in Mahe, Seychelles.

The platform, known as one of the best exchanges for altcoins, has its own native token, KCS, which investors can use to reduce fees. To help traders in need, KuCoin also offers a feature where you can lend crypto and pay it back with interest. Another attractive perk is the smooth site navigation.

Thanks to KuCoin’s Earn feature, you can accumulate passive income through various crypto staking and saving plans. There is also a helpful community where experienced investors can share useful information and educational content.

5. Coinbase

Finally, we have Coinbase, which is one of the largest and most trusted crypto exchanges for beginners. You can trade with over 200 digital tokens right on the platform. To ensure the safety of its users’ assets, Coinbase saves 98% of the total deposits in a safe cold wallet.

If you are looking for more trading features, you can try Coinbase Pro, which offers advanced charting options. The brand has also positive reviews from thousands of users. Additionally, there is a tutorial option (Coinbase Learn) which provides users with the necessary information they need to know about trading. With all these said, Coinbase remains one of the best crypto exchanges to use in 2024.

What Is a Crypto Exchange?

Crypto exchanges are online platforms where you can buy, trade, and sell assets like cryptocurrencies and NFTs. First, you sign up with the site and complete the exchange verification. Afterwards, you get an account to trade these tokens. These platforms give you access to features like future trading and margin accounts.

Types of Crypto Exchanges

You can find three types of crypto exchanges online, and each operates differently. In the following section, we’ll provide a brief overview of them.

Centralized Exchanges (CEX)

A centralized exchange, or CEX for short, is a platform operated by a single server while following strict governance guidelines. Firms like Binance facilitate transactions between buyers and sellers and charge a fee for their services.

CEXs provide a simple and familiar trading experience. As a result, they allow new users to navigate the crypto market with ease. Despite these advantages, there are a few drawbacks you need to know.

First, since the exchange stores all funds on the server, it’s vulnerable to hacks. Secondly, they can have limited crypto liquidity, which could lead to higher fees and longer transaction delays.

Decentralized Exchanges (DEX)

Decentralized exchanges are the opposite of CEX and operate independently of a central authority. They use peer-to-peer transactions and let users utilise smart contracts. Popular examples are Uniswap or PancakeSwap.

DEXs provide several benefits, including better security and faster transaction speed. However, there are some drawbacks that you should be aware of, such as low trading volumes and limited liquidity.

Hybrid Exchanges (HEX)

Hybrid exchanges offer the best of both sides, combining the advantages of DEXs and CEXs. They allow users to trade cryptocurrency assets on a centralized platform while still enjoying the advantages of decentralized Bitcoin trading.

These exchanges provide large volumes at reduced transaction costs, together with the much-needed security. HEXs also enable Ethereum trading in a large number of currency pairs. IDEX, for instance, is a popular hybrid exchange, built primarily on Ethereum.

Types of Fees: Trading, Deposit, Withdrawal

When trading, there are several crypto exchange fees you need to pay at various points, but not many traders can differentiate them. Here is what you need to know:

Trading Fees

Trading fees are the extra charges you pay when you buy or sell crypto on an exchange. They come in two types.

- Maker Fee: It applies when your order isn’t immediately matched by an existing order, adding liquidity to the market.

- Taker Fee: It is charged when your order is immediately matched with an existing order, removing liquidity from the crypto market.

Deposit Fees

These are fees you pay when transferring funds. While this is true, most low-cost crypto exchanges only charge for fiat deposits using cards or wire transfers, not cryptocurrency.

Withdrawal Fees

Like most platforms that deal with real money, withdrawals usually come with a fee and this is no different for an exchange. The value of these charges depends on the currency and payment method you use.

Other Fees

There are other parts of an exchange that may require you to pay a fee for a service. For example, there are charges for:

- Lending money

- Account upgrades

- Quick buy option

Choose the Right Crypto Exchange

Choosing the right crypto exchange requires you to consider a few factors. These include:

Comparing Security Features

Picking an exchange with tight security is important, as there are lots of hackers out there trying to steal funds from unsuspecting users. Go for platforms with SSL encryption, two-factor authentication (2FA), and cold storage. These help protect your assets from any dangers.

Analysing Key Features

Ensure the crypto exchange offers your preferred features to make your trading experience easier. Look out for options like:

- Charting

- Margin trading

- Limit orders

- Automated bots

- NFT marketplaces

- Asset management

Fees and Costs

Before opening an account, it’s important to learn about cryptocurrency exchange fees. These can significantly affect your investment returns. Exchanges normally impose fees for trading and withdrawals, but other transaction costs may also apply.

Tips for Minimising Costs

Here are some tips for minimising costs when trading on the top exchanges for traders:

- Choose low-fee crypto exchanges.

- Take advantage of crypto staking or earning programs.

- Opt for maker orders instead of taker orders.

- Use the exchange’s native coin for discounts.

- Trade in higher volumes to reduce fees.

Responsible Gambling

While many people think responsible gambling only applies to casino or sportsbook players, it also applies to crypto traders. Here are some strategies to help you during your trading sessions on the best exchanges for staking:

- Set your budget and don’t go past it.

- Don’t let your emotions get in the way of your trade.

- Diversify your portfolio.

- Take breaks in between sessions.

Conclusion

In conclusion, the key to enjoying a safe trading experience is choosing the right cryptocurrency exchange. By considering factors like security, low fees, and transparency, you can trade cryptocurrencies with confidence.

FAQ

What should I look for in a secure crypto exchange?

How do fees vary between different crypto exchanges?

Are there any exchanges with particularly low fees?

How can I ensure the exchange I choose Is reliable?

What are the types of fees in crypto exchange?