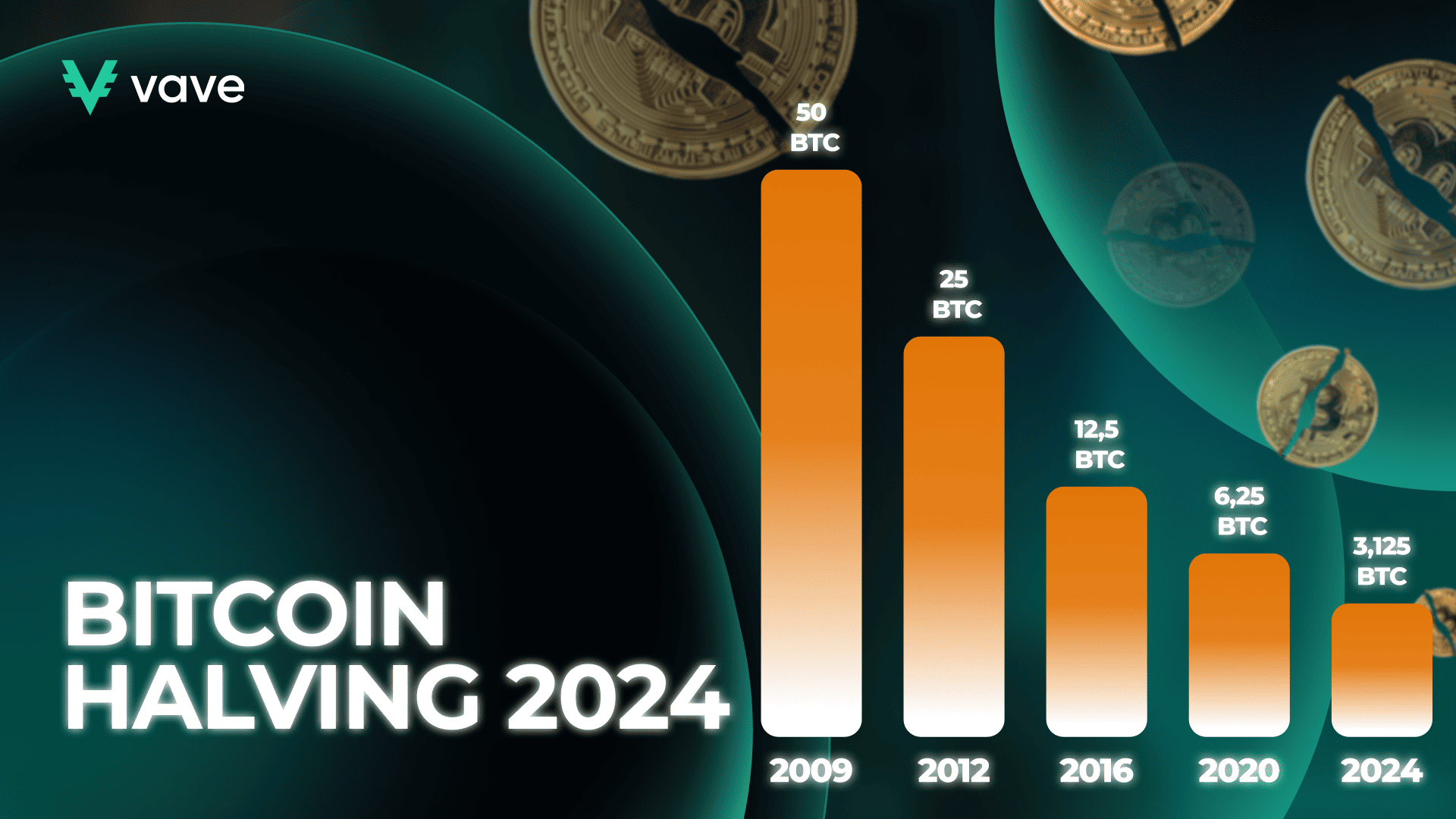

The halving of the cryptocurrency Bitcoin (BTC) is known as a ‘significant event.’ Approximately every four years, the BTC mining payouts are cut in half. The last stage of this progression is estimated to occur no sooner than 2140.

In this guide, we will focus on the April 2024 Bitcoin halving. Read on to learn about the event’s timeline, impacts, major concerns, and advantages.

Bitcoin Halving Schedule and Predictions

Before reviewing the outcomes of the BTC halving in 2024, it’s important to answer the question: What is the BTC halving?

Simply put, this is the event where the miner’s reward for every BTC block is reduced by half. In other words, the amount of Bitcoins a miner earns to complete a transaction will now be 50% less.

After every 210,000 blocks, the supply of the coin reaches its limit of 21,000,000. Halving is one of the critical events in the life of a BTC holder. This process is fundamental as it lessens the rate of inflation and slows down the introduction of new Bitcoins, preventing an oversupply in the market. Consequently, this scarcity keeps the value of Bitcoin intact.

The 2024 Bitcoin halving occurred on April 19th, with miners’ rewards dropping from 6.25 BTC to 3.125 BTC. Initially, the price of Bitcoin experienced some fluctuations. It briefly dipped following the event but later surged to trade around $98,000 by November 2024. Predictions suggested that the value may continue to rise, potentially surpassing $100,000 in the coming months. And, indeed it appears that those predictions were spot on as Bitcoin hit the $100,000 price mark in December marking a new milestone for the crypto market.

Looking ahead, the next Bitcoin halving is projected to occur in 2028.

How Bitcoin Halving Affects the Bitcoin Market

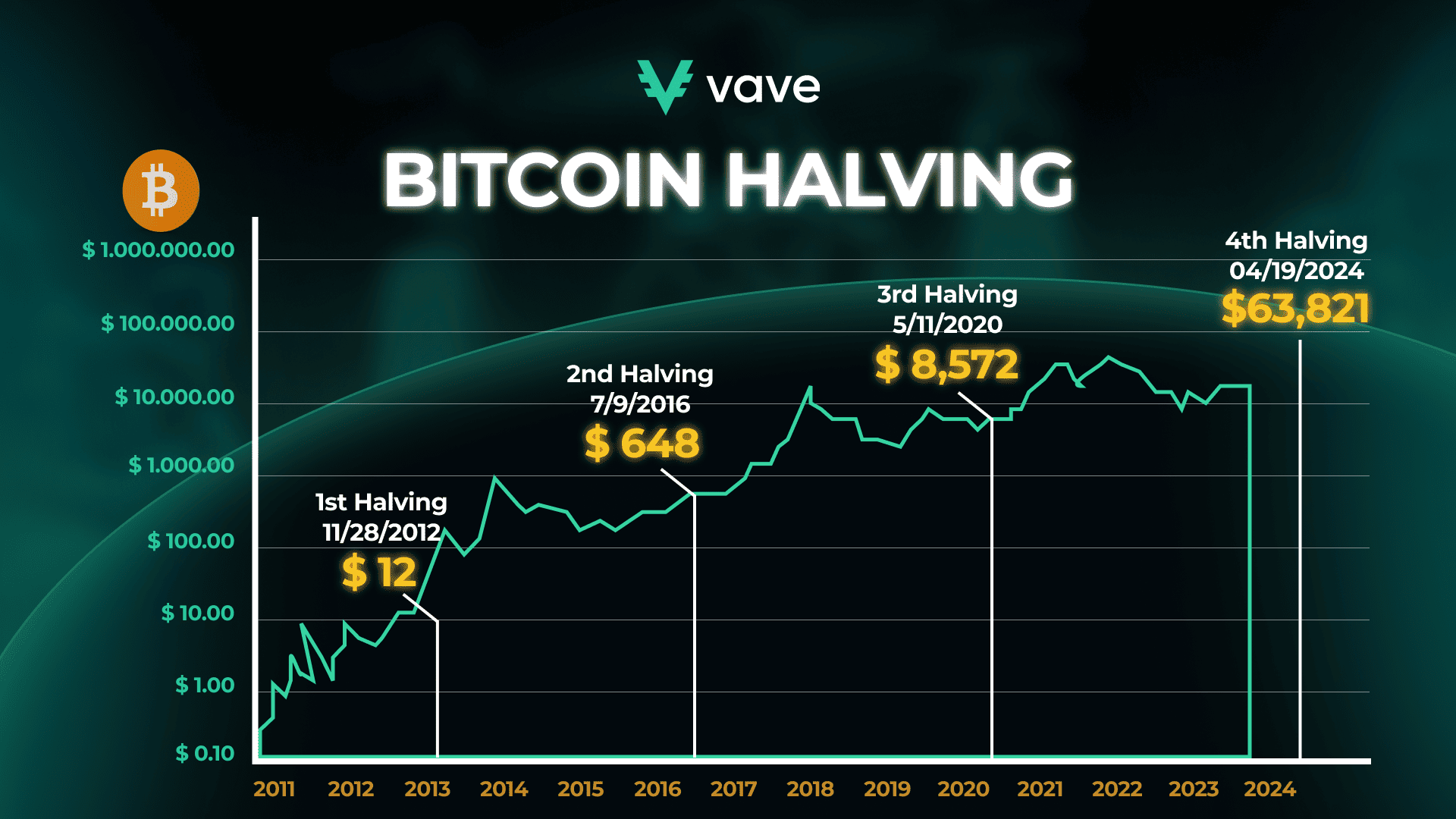

The Bitcoin price, after halving, often tends to rise, although this pattern is not guaranteed. Here’s what history and the 2024 halving tell us:

- 28th November 2012: The first-ever Bitcoin halving. The price of BTC grew from $12 to $1,110 by December 2013.

- 9th July 2016: The second Bitcoin halving cycle. BTC’s value increased from roughly $648 to over $19,500 by December 2017.

- 11th May 2020: Before the event, the value of BTC was $8,572, rising to $64,000 in April 2021.

- 19th April 2024: On the day of the supply cut, Bitcoin was priced at $63,821. After an initial dip, however, it rebounded to approximately $98,000 by November 2024.

Although previous records suggest that Bitcoin prices often surge after halvings, external factors like financial regulations, and market conditions could also influence Bitcoin’s value.

Effects on Bitcoin Mining in 2024

Bitcoin mining and halving are closely linked. Here’s how the 2024 halving impacted BTC mining:

- Lower Rewards for miners: After 2020’s halving, miners received 6.25 BTC for mining one block. In 2024, this number went down to 3.125 BTC. The reduction caused several mining operations to shut down and concentrate their efforts elsewhere due to low profitability.

- Scarcity: After the Bitcoin halving event for 2024, the overall Bitcoin supply cap tightened. If investors hold their BTC, this could continue to drive demand and make Bitcoin even more valuable in the long term. In fact, by November, the BTC price surged to around $98,000.

- Hashrate Changes: Initially, lower rewards reduced participation from less profitable miners, resulting in a temporary drop in hash rates in 2024. However, many miners adopted more efficient technologies which eventually helped stabilize the network.

Potential Risks and Opportunities

Here are the risks and opportunities related to the BTC halving:

Market Volatility

Bitcoin prices are likely to be unstable during halving events, and even investment prices before and after the halving could be affected. This is because investors react differently to changes in the supply structure. Consequently, crypto volatility may serve to the advantage or disadvantage of BTC traders.

Operational Expenses

It might not be economical for most miners to operate with such low rewards. To remain in a winning position after the halving, they will have no choice but to improve or make their equipment more efficient. That way, they can mine more blocks and get more coins.

Investor Sentiment

Inflation and interest rates are economic indicators that may change Bitcoin investors’ attitudes. If the market is bearish, BTC traders could shift their positions and liquidate in favor of selling. This may cause a dramatic fall in the value of Bitcoin. However, it offers an opportunity for people to invest in BTC at a cheaper price.

Preparing for Bitcoin Halving 2028

The 2024 Bitcoin halving has already happened, but the next one is on its way and will likely occur in March or April 2028. That’s why, if you’re an investor, consider these strategies to make the most of this event:

- Analyze Market Trends: Stay updated about the history of Bitcoin prices following previous halving events. Afterward, compare what happened then against today’s market conditions. That way, you can make better investment decisions.

- Diversify Your Investment Portfolio: Bitcoin is a volatile cryptocurrency. Predictions about its value rising aren’t set in stone. Therefore, your investment portfolio should include more than just Bitcoin. By doing so, gains from other assets can surpass potential BTC losses.

- Think Long-Term: Consider the long-term halving effects on Bitcoin prices. While BTC might dip after a halving episode, its value could skyrocket months or years after.

Expert Opinions and Analysis

Although there is general agreement that demand will not decline, the supply cut will undoubtedly slow down the rate at which new Bitcoins are created.

Since most Bitcoin investors tend to hoard (never sell) their tokens, the value of Bitcoin will only increase. These theories already fell apart in the years following the 2016 and 2020 halving events.

Aside from this, economists generally conclude that Bitcoin’s halving will further strengthen its case as a deflationary asset. A coin that saw a rise in value due to a reduction in supply is referred to as a deflationary asset. As a result, Bitcoin will expand widely throughout practically the entire world.

Some analysts predict that Bitcoin’s value will increase. For example, Bitwise predicts that Bitcoin’s price will exceed $200,000 in 2025. They note, though, that given the state of the market, the optimistic outcomes of these events might not materialize right now. In the long run, though, everything ought to level out, with Bitcoin’s value rising. More conservative estimates suggest a price increase of at least 100% by the 2028 halving, putting Bitcoin around $120,000.

According to forecasts made by cryptocurrency experts regarding the future of Bitcoin halving, miners will likely suffer some hardship due to decreased Bitcoin incentives. But they will manage to weather this headwind by investing in every cost-effective BTC block mining technology. There are worries that the reduction in miners’ rewards could affect the network security, so they’ll probably have to diversify their income streams.

Naturally, traders will also be affected and experience market volatility as the supply of BTC decreases. Eventually, they will either benefit from it or suffer the consequences. It’s possible that the coin could reach a new all-time high but that depends on its continued adoption and general economic trends.

Conclusion

The impact of the 2024 Bitcoin halving goes beyond a mere reduction in miner rewards. This event dictates the value of Bitcoin itself, affecting investors and the larger economy. That’s why, understanding the impacts of Bitcoin halving is important as it helps you manage the associated risks and opportunities.

FAQ

What is the significance of Bitcoin halving in 2024?

How does Bitcoin halving affect Bitcoin mining?

What are the historical impacts of previous Bitcoin halvings on price?

What Were the Impacts of the Halving on Bitcoin’s Price?

When is the Next Bitcoin Halving?