Previous years were not a smooth ride for crypto investors. From bullish optimism, fueled by true crypto believers like El Salvador’s President Nayib Bukele’s crypto price predictions that Bitcoin could hit $100,000, to the detrimental effects of Russia’s invasion of Ukraine, the collapse of the Terra Luna (aka LUNC), the bankruptcy of FTX collapse, and the abrupt freeze of crypto lenders’ withdrawals.

DeFi investors – individuals investing in volatile cryptocurrencies and crypto-based assets such as non-fungible tokens (NFTs) – found themselves facing a number of daunting challenges.

It’s no surprise that by the end of the year, Bitcoin had dropped under $17,000. Looking back on the crypto crash of 2022, it’s clear that it was a period that shook investors’ beliefs in digital money.

In this crypto investment advice for beginners, we’ll explore the feats and clashes of the year that quaked the crypto landscape the most.

Bear in Mind the Bear Market

According to the review ‘A brief history of Bitcoin crashes and bear markets’, written by crypto expert Helen Partz, 2022 became the third most bearish year after the insane fall of 2011 when Bitcoin collapsed from $32 to $0,01 over the course of a few days, and 2015 spectacular downhill from $1,000 to below $200. Right after showing all-time highs in 2021, Bitcoin and Ethereum, the No.1 and No.2 cryptocurrencies halved down in the same year.

Bitcoin’s fall was especially spectacular in absolute numbers as it went down from $68,000 in November 2021 to around $17,500 in June 2022. Ethereum repeated the trend, spiralling from $4,800 in late 2021 to just over $1,000 in 2022. As you can see, the Bitcoin price history of 2022 was dramatic throughout most of the year.

As a trader, you must consider crypto money’s high volatility and prepare for new ups and downs, not shaping a weak hands pattern. Cryptocurrency is here to stay and its high volatility can be considered an advantage rather than a hindrance. The bear market in crypto will not vanish; we simply must adapt to it.

It is the nature of digital money, so we must deal with it. Bear and bull markets are constantly alternating in the global economy and crypto. That is why instead of panicking, we must open up new opportunities and horizons.

FTX Collapse and Rise of Cold Wallets

FTX, which was one of the largest crypto exchange platforms, is now a bankrupt company. This was the most notorious event in the crypto world in 2022, contributing to overall negative trends of the year.

This high-profile crash caught the world’s attention and initiated a scrutiny of the problem identified, motivating investors to become more safety-conscious.

As confidence in crypto exchanges diminished, crypto users tended to move their digital assets to cold wallets and semi-cold platforms, such as MetaMask or Trust, instead of hot wallets. This trend became a part of the broader crypto security tips and practices. Indeed, hot wallets are more convenient for operational purposes, such as quick transactions and crypto exchange. However, when it comes to security and reliability, there is no better option than cold crypto storage.

This slump, with investments evaporating and the FTX main currency, FTT, vanishing, was about more than losing faith or funds in the crypto world. What was a bearish trend for whales turned out to be the loudest rekt for common investors, especially those outside of the US.

On the Hook of the Global Financial System

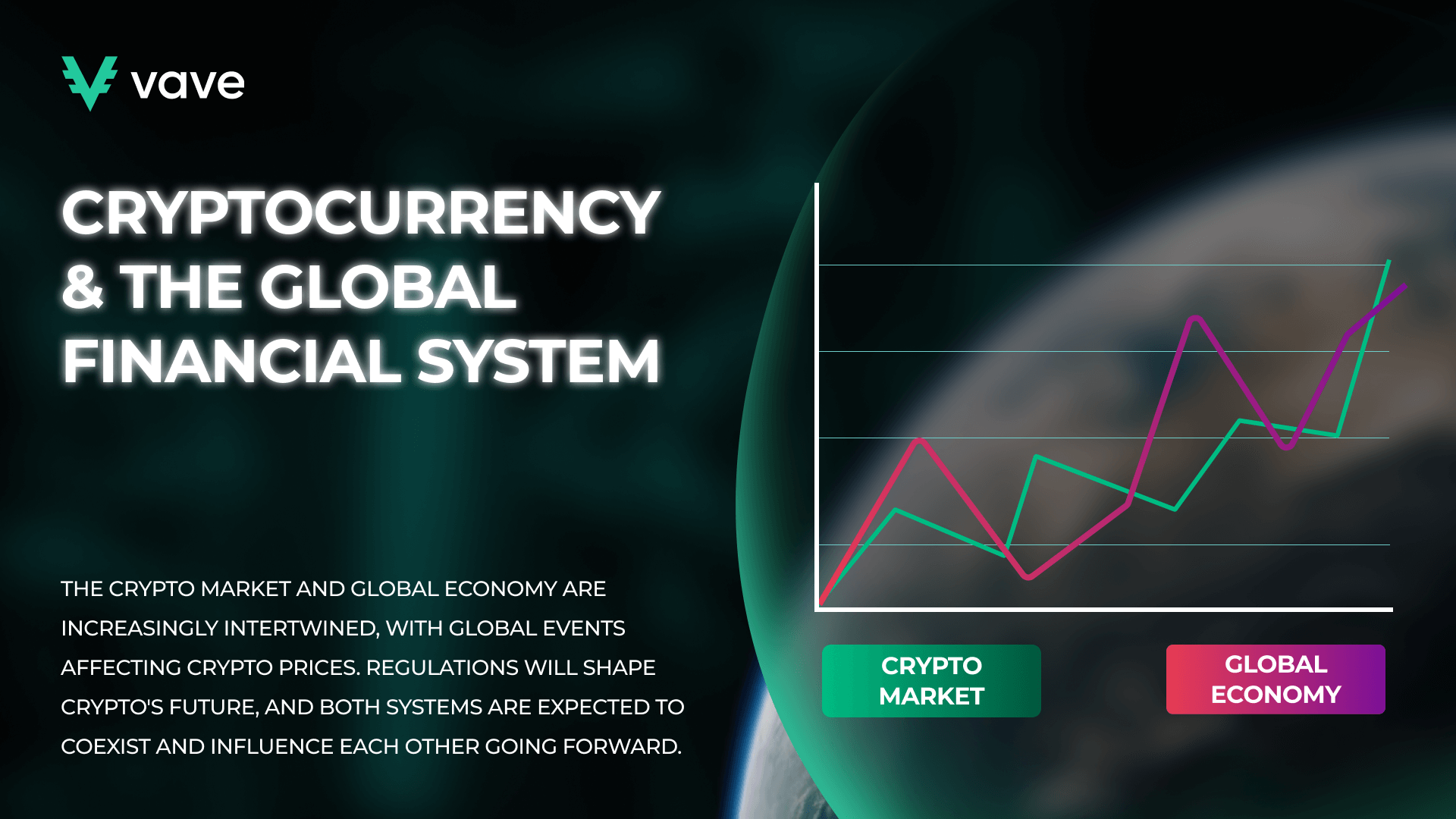

2022 revealed another sign of digital assets’ reliance on the traditional financial system and the global economy. It has become evident in 2022 that the Federal Reserve’s rate hikes can be a headwind to digital currencies.

Crypto prices, like other financial assets, were significantly influenced by the Federal Reserve’s monetary policies. During periods of high liquidity and low interest rates, cryptocurrencies experienced substantial growth from 50% to 90%. Like it or not, they are now an integral part of the global financial system. This integration means that they are influenced by broader economic factors and cannot operate in isolation.

It is no secret that the US Federal Reserve decisions create a correlation between regulatory activities and major events in the crypto world. For instance, as mentioned in NextAdvisor’s article on ‘How Another Fed Rate Increase Could Impact Bitcoin’s Price’, if the stock market dips because of a Fed rate hike, the crypto market likely will, too. NextAdvisor is a leading international finance analytics project created in collaboration with TIME. Things also work the other way around. In fact, any Fed rate change could influence the crypto market.

Upcoming Crypto Regulation

While there’s still a long way to go, the past years have seen some progress on the regulatory front regarding crypto assets. The shocks in the crypto space have led to more government intervention, encouraging industry experts to reflect on this rising trend.

After the catastrophic events that have unfolded in the crypto market, it is clear that more regulation could arrive soon. Marcus Sotiriou, a market analyst at digital asset broker GlobalBlock, thinks that the collapse of DeFi lenders is the reason why regulators have been looking to implement draconian controls over cryptocurrency.

It is probably too early to use terms like ‘draconian,’ but it is evident that more regulation is coming.

Back in March 2022, President Joe Biden signed an executive order calling on government agencies to study the ‘responsible development’ of digital assets, including stablecoins.

Later, the U.S. Department of the Treasury published the first framework stemming from President Biden’s executive order on cryptocurrency, outlining how the US should engage with other countries regarding digital assets.

This framework would lead to more control in three fields — exchanges, lending, and broker-dealers. It also led to more communication with industry participants on how to come into compliance or, in cases where the framework already exists, modify some of that compliance.

Potential Benefits of Regulation

The benefits of crypto regulation are obvious; it is meant to decrease volatility and keep cryptocurrency stable. More information exchange leads to more transparency, which can be a useful thing for the markets.

Recent global regulatory efforts, such as the EU’s MiCA regulation and new frameworks in the US and Australia, aim to bring more oversight and security to the crypto industry. It would have been great to jump several pages and check out the chapter ‘Crypto Regulation 2024!’ Unfortunately, though, the time machine has not been invented yet.

Future Events to Watch in the Cryptosphere

The future of cryptocurrency is brighter than it might seem. Though Bitcoin and altcoins remain very volatile, slowly but surely their price is rising, exactly according to the legendary HODL strategy. Think of Bitcoin’s price in the beginning: a mere $0.09! Now, you can get thousands of dollars for this coin; impressive, isn’t it?

This is why regularly monitoring cryptocurrency market price changes over time is essential. One of the biggest events was the Bitcoin halving in April 2024. Historically, halvings have always pushed the coin’s price up so will crypto recover in 2024? As we move into the latter part of the year, analysts are predicting a potential breakout for Bitcoin by the end of September. Additionally, the approval of spot ETFs and pivotal regulatory updates from the US and Europe are expected to shape the market. And what will be the best crypto wallets in 2024, you may wonder? Again, the Bitcoin halving and those upcoming events may affect what wallets make the shortlist.

Brief Summary

2022 has brought some significant events that shook’n’shaped the current trends in the crypto world. Let’s sum up what has become the actual due date:

- Clear current bear cycle with leading cryptocurrencies, such as Bitcoin and Ethereum, going down.

- There was a clear impact of FTX collapse on the crypto market. It led to heavier reliance on cold wallets, such as Trust or MetaMask, in search of more safety. The question of how to choose a safe crypto wallet is as important as ever.

- Apparent signs of crypto dependence on the world financial policy: the government or Fed decisions could influence crucial indicators, such as the $/crypto exchange rate.

- More regulation: crypto was meant to be incorruptible, decentralized, and independent of any government regulations. However, things are changing because digital money is a part of the world’s financial system now. This is the reason why regulators tend to be more inclusive.

With those mentioned above, only one thing is clear: crypto has come through stormy seas in 2022, but it is now searching for a route to a safe haven. This is why the bear may hopefully turn into a bull in 2024.

Investing in Crypto: A Call for Caution and Research

As we just checked potential future events affecting crypto in 2024, such as halving, it is time to wonder: How will it influence crypto investing? Again, we can put some faith in the HODL strategy and hope it works again.