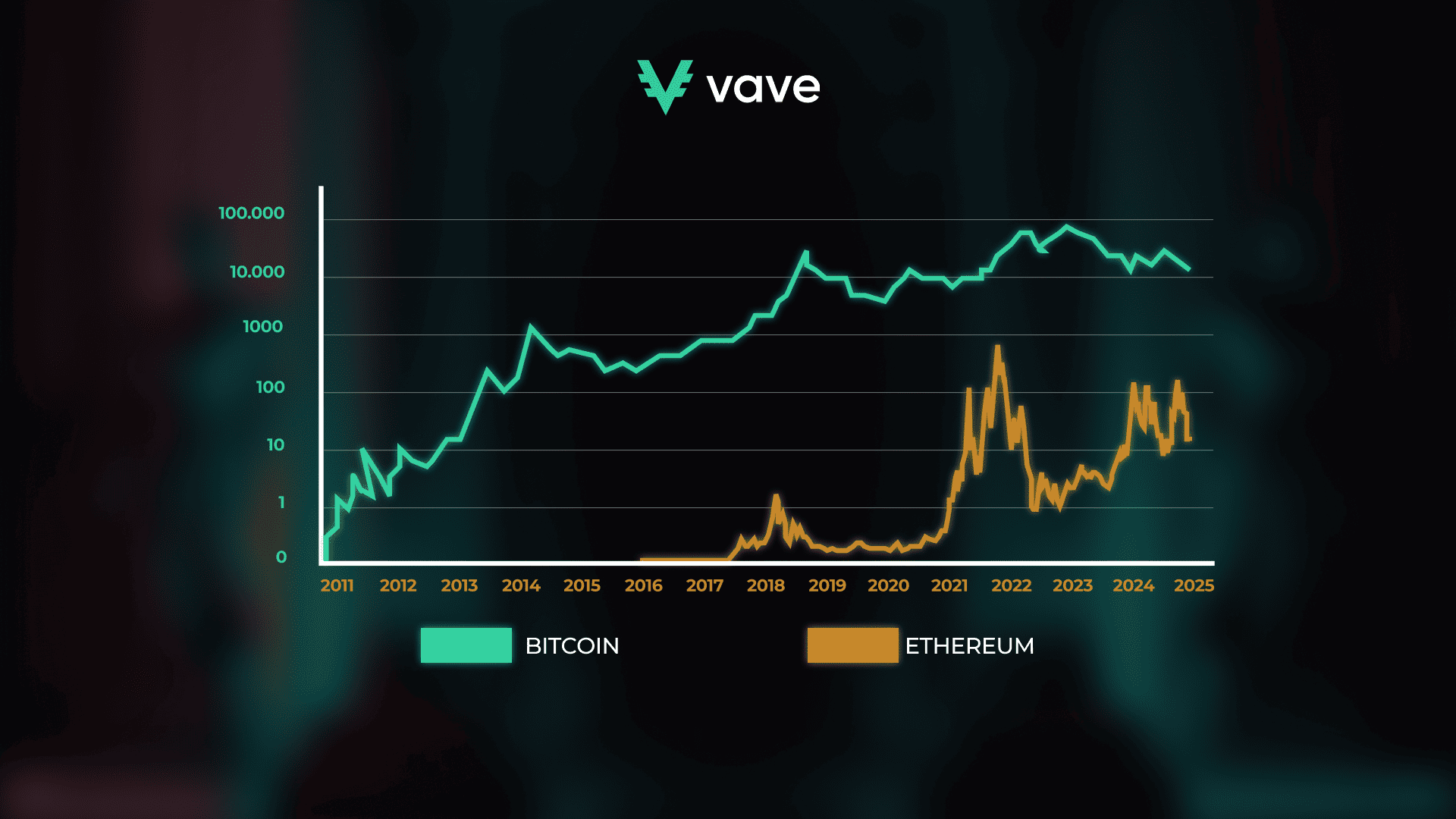

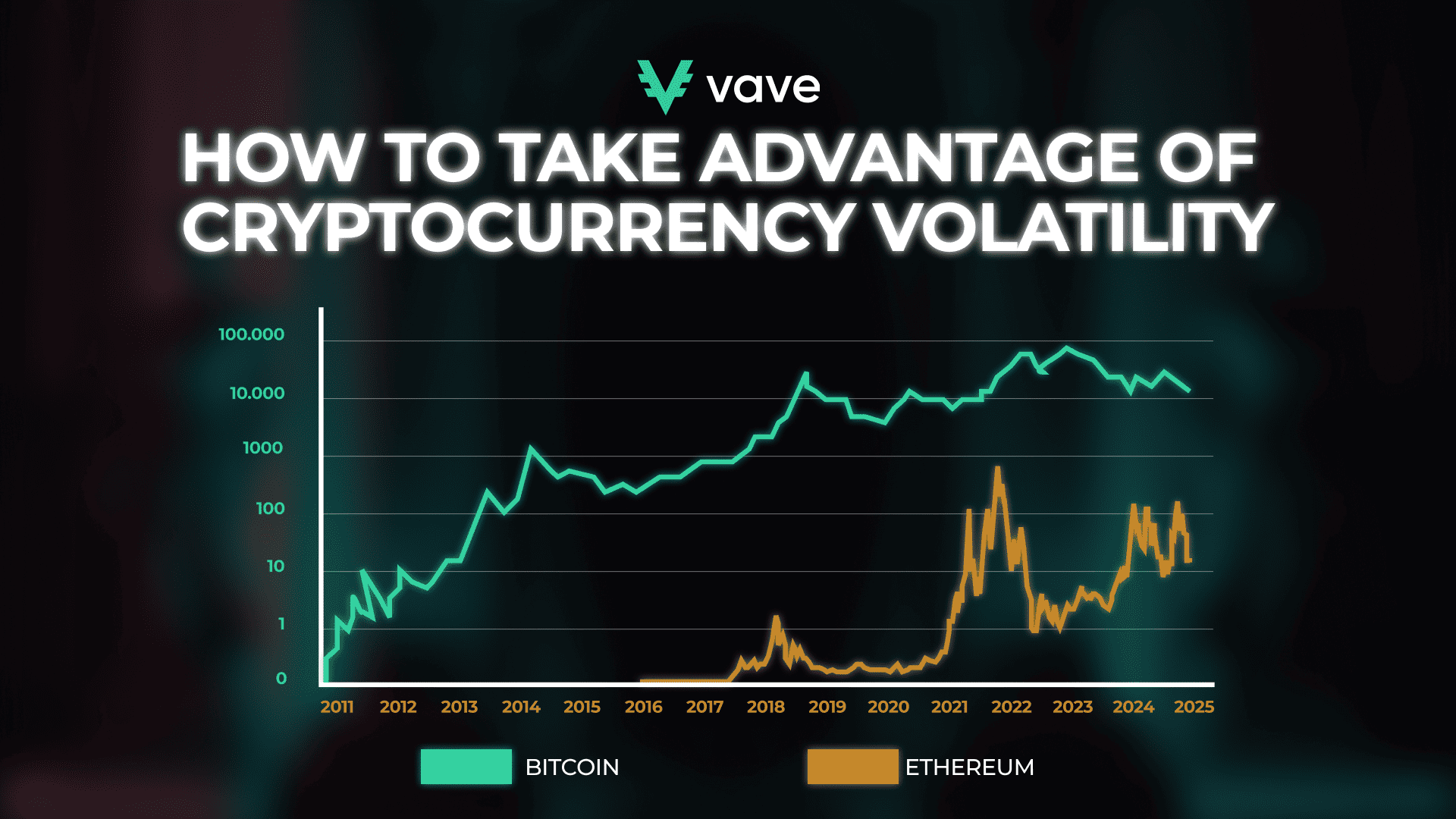

The cryptocurrency space is known for its instability. Prices can rise to unimaginable peaks or fall within minutes. This is why many people are still skeptical about investing in it. Despite this, cryptocurrency volatility can be a good thing if you know how to take advantage of it.

Learning to ride the waves of crypto volatility can help you make a lot of money, and reduce risk. This article covers tested crypto investment strategies to help you capitalize on the market.

Understanding Cryptocurrency Volatility

Volatility in cryptocurrencymeans a sharp change in value. It’s largely caused by crypto’s unregulated market. Here are some influential factors:

- Speculation rather than tangible assets

- Announcement of regulatory news

- Technological factors like network updates can positively affect crypto, while security breaches can negatively affect it

- Crypto with limited liquidity is at risk of price fluctuations

Leveraging Arbitrage Opportunities in Volatile Markets

Arbitrage trading is one of the easiest forms of trading. All you need to do is find price discrepancies and profit from them.

Due to crypto market volatility, price differences on your assets are frequent, which creates opportunities for you to invest. This is a guaranteed way to make money from crypto at relatively low-risk profits. It’s just buying a cryptocurrency on one exchange at a lower price and selling it on another at a higher price.

To successfully execute this strategy, you need speed and accuracy, as well as to take note of trading fees and withdrawal times. Specialized tools that track crypto market instability can help identify these flash-in-the-pan opportunities.

Profiting from Short-Term Price Swings

As we pointed out earlier, the price of crypto moves fast. This in itself creates an opportunity for you to earn quick profits. Scalping and day trading are examples of short-term trading strategies that capitalize on these movements for multiple small wins.

You’ll need to first learn technical analysis, follow news related to the crypto market, and set stop-loss orders for risk management.

If carried out successfully, this can be an extremely lucrative way to earn from the volatility in cryptocurrency. However, it requires a disciplined mindset and real-time engagement with market conditions.

Utilizing Leverage Carefully for Maximizing Gains

Using leverage allows you to control larger positions with less capital. Here’s what we mean: high-volatility crypto gives you high-profit potential while investing very little.

Despite the potential for big wins, this strategy is a double-edged sword. You can earn big, no doubt, but at a higher risk compared to the two crypto investment strategies above.

The safest way is to make sure you use platforms with margin trading. Also, set strict stop-loss limits and only invest what you can afford to lose.

Implementing Trend-Following Techniques for High Volatility

As the name implies, all you need to do here is to follow trends. You can use a crypto volatility tracker like cryptometer.io and cryptorank.io to analyze past data and current patterns and decide when to buy or sell.

Here’s how to go about trend following: buy into momentum when the trend is bullish, as this can lead to higher returns. In a downturn, you can short-sell. What makes this stand out among other cryptocurrency investing strategies is that if you are at a loss, you can switch to safer assets like stablecoins. This can help mitigate losses.

Hedging Against Market Downturns with Stablecoins

Unlike the earlier strategies listed above, hedging is less concerned about capitalizing on cryptocurrency volatility. Instead, it focuses on protecting your assets against sudden market dips.

To execute this strategy, you need to use stablecoins, as most stable cryptocurrencies are fiat-pegged tokens that can help stabilize your assets.

Incorporating stablecoins into your overall tactic will make sure that your portfolio remains the same despite the unpredictable nature of the market.

Utilizing Volatility Trackers and Market Insights

Similar to every other form of investment, you need tools and insights to become a successful crypto investor. Crypto market volatility trackers will enable you to navigate and identify trends, make well-informed decisions, and adjust your strategy accordingly.

![]()

Tools for Monitoring Cryptocurrency Trends

Keeping tabs on crypto trends gives you an edge, irrespective of the strategy you use. Here are some tools that offer real-time data and insights into crypto volatility.

- Crypto Volatility Index (CVI)

- CoinMarketCap & CoinGecko

- TradingView

- Blockchain Analytics Tools

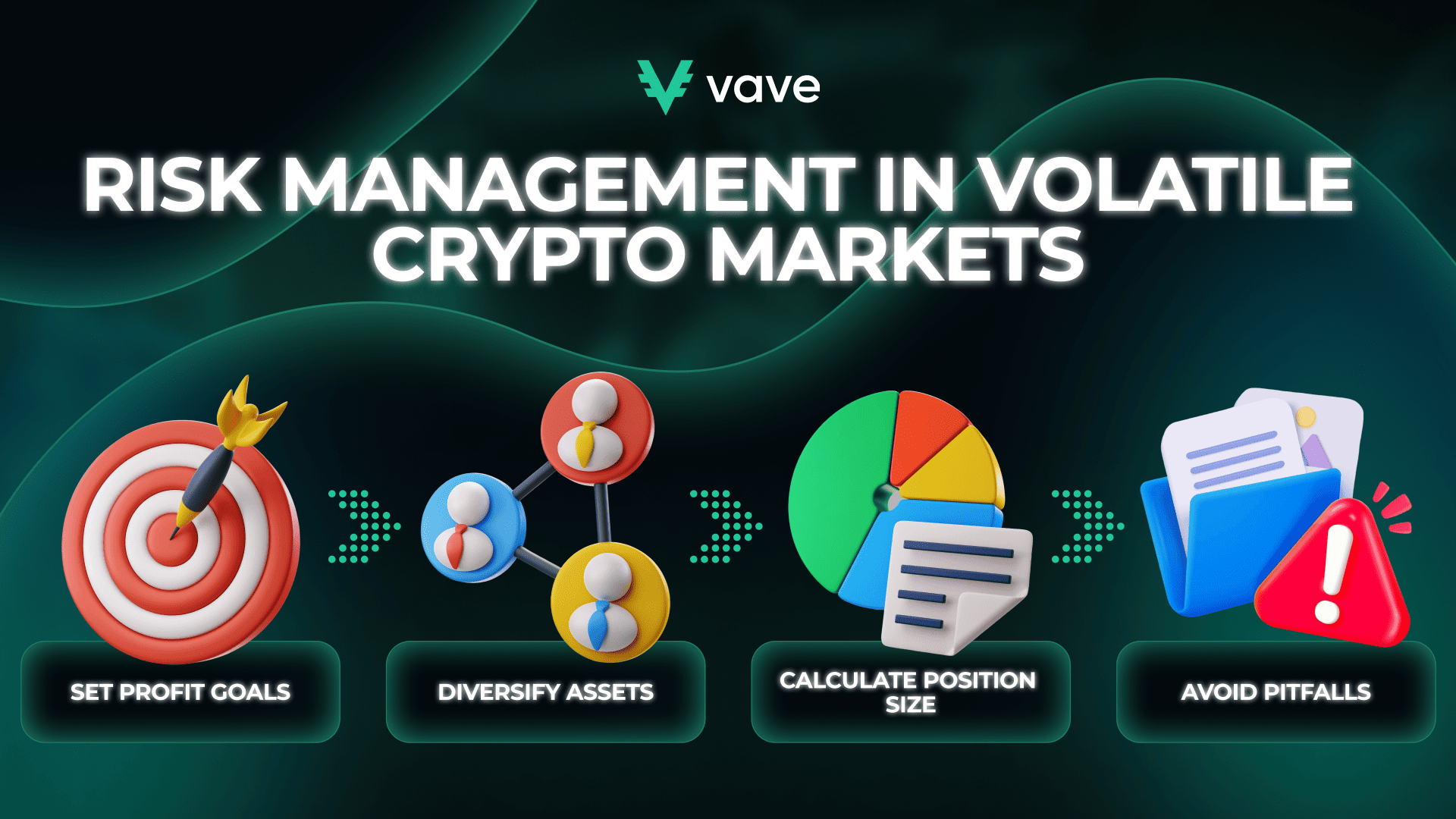

Risk Management in Volatile Crypto Markets

Crypto investments offer you the opportunity to earn money; however, they come with some levels of risk. Most new investors end up quitting within the first few months because they can’t cope with the intensity of crypto instability.

This is where risk management comes in. It’s the difference between a successful and unsuccessful trader. With proper risk management, you can make profits, even with occasional losses.

Below are five risk management strategies that show how to make money from crypto, even in the unpredictable market.

Setting Realistic Profit Goals to Reduce Emotional Trading

Setting realistic profit targets is one of the best crypto investment strategies. There are numerous stories about how investors make millions of dollars in a day. These tales can result in emotional decision-making. Emotional trading with the level of volatility in cryptocurrency automatically means devastating losses for most of us.

Using Dollar-Cost Averaging to Manage Market Swings

This is an established Bitcoin investment strategy for dealing with unstable crypto markets. Dollar-cost averaging (DCA) is a method for entering and putting in the same amount of money regardless of the price.

This method avoids getting caught up in massive market swings and minimizes your chance of entering at a bad time.

Protecting Investments with Diversified Crypto Assets

Diversification is the bedrock of risk management. It’s done by distributing your assets to keep you out of a single market. This way, if one of your crypto experiences a loss, your remaining assets stay safe. A diversified approach strikes a balance between the potential for growth and stability when facing the most volatile crypto market.

Calculating Position Size for Controlled Exposure

Know your exposure. The best way to go about this is to first calculate how much you want to invest and then how much you want to lose per trade. This allows you not to risk all of your money on a single trade.

Avoiding Common Pitfalls in High-Volatility Crypto Trading

Trading high-volatility crypto can be lucrative, but it’s also a minefield. Common mistakes include over-leveraging, chasing momentum, and not applying stop-loss orders, all of which can lead to severe losses.

To navigate volatility in cryptocurrency, you should apply patience and don’t stop learning.

FAQ

What are effective strategies for making profits in volatile crypto markets?

How can I track and monitor crypto market volatility effectively?

Which cryptocurrencies are most profitable for day trading?

How can I manage risks when trading high-volatility cryptocurrencies?