In the world of blockchain technology, crypto trading has gotten really famous. It’s a highly volatile business that can be very profitable and involve significant risks. So, whether you’re just starting or an expert, you must know how to take care of your digital wallet. This way, you won’t lose much money in the bear market.

This article will address the question: ‘What is risk management in crypto?’ and explain how to safeguard your capital while maximizing your profits. We’ll give you some advice to help you keep your money safe from crypto trading risks like sudden price changes, trading mistakes, and other negative things that can happen. So, let’s start learning!

Crypto Risk Management Practices

In trading, risk is all around us! Actions we do to improve our future might not always go well; sometimes, they can worsen things. Sometimes things happen that are completely out of our control, and you could become a victim of gift card scams or worse. But if we’re ready for tough times, our strong will and ability to wait can help us get back on track.

This idea also works with blockchain. Whether you trade crypto every day or invest for a long time, using your capital to make more money also means you might lose some. This is why we prepared a crypto trading risk management guideline with five different tricks and plans to manage unpredictable situations and keep your digital wallet as safe as possible.

1. Only Spend what you’re Okay with Losing

An essential aspect of risk management in crypto trading is to avoid placing more money than you can afford to lose. This means you should only use money you don’t need for other important stuff when you’re trading. By doing so, you won’t feel too stressed or make bad choices because of your feelings.

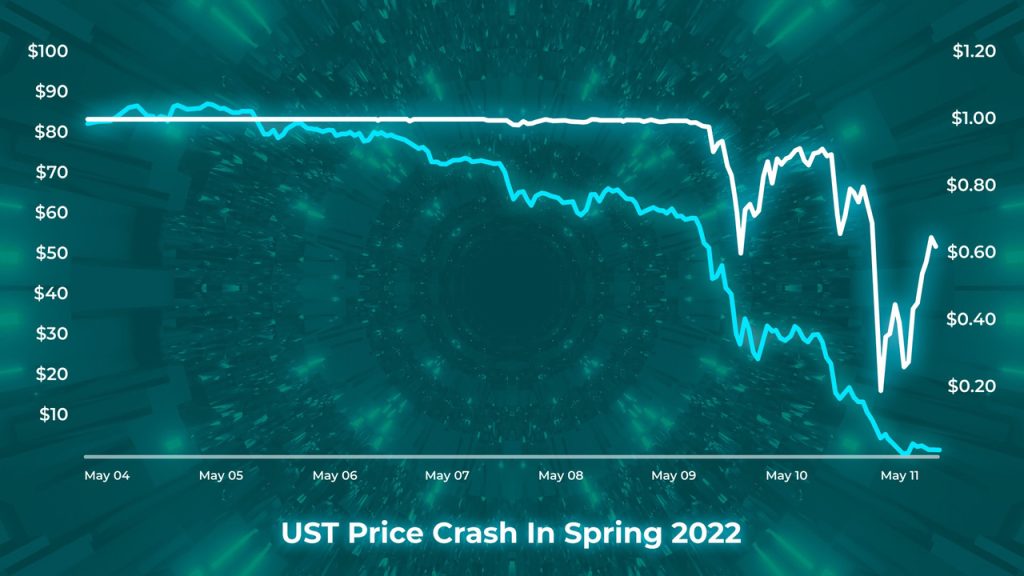

This rule goes for all kinds of trading, but especially for cryptocurrencies. As previously mentioned, cryptocurrencies can change a lot and quickly. Hence, if you use more money than you can afford to lose, you might end up in a really bad situation.

Furthermore, there’s another thing to know called “leverage.” It’s like using borrowed money to trade; it can make you win and lose more. Thus, it’s essential to understand how leverage operates and its potential impact on your crypto trading.

2. Using a “Stop Loss” Order in Crypto Trading

The “Stop Loss” is a helpful crypto risk management tool that prevents you from losing too much when a trade goes wrong. It’s comparable to a line you draw in the sand – if the price surpasses that threshold, you exit the business. This approach allows you to regulate potential losses. It’s common to experience losses occasionally, and the “Stop Loss” assists you in handling them by determining in advance an acceptable amount to lose in a trade.

However, some traders believe they don’t require a “Stop Loss,” assuming they can accurately judge when it’s time to exit the market. Yet, they overlook that the market can spring surprises and undergo rapid changes. Furthermore, lacking a “Stop Loss” makes estimating potential losses in an unfavorable trade challenging, thus complicating risk management.

3. Locking in Gains with a “Take Profit”

Let’s talk about one of the best crypto risk management strategies, “Take Profit”. It’s similar to “Stop Loss” in a certain way. However, it is all about collecting the money you’ve earned. This tool assists you in exiting a trade when the price reaches a level where you’d make a profit.

An idea of the potential profit helps you determine the risk you’re willing to accept. Furthermore, this risk-free crypto trading advice will guide you in staying in control while buying or selling digital coins.

4. Being Realistic in Crypto Trading

One of the common mistakes that beginner traders make is setting unrealistic scenarios and expectations. You know, having realistic goals is extremely important for dealing with the risks of cryptocurrency trading. You can’t expect to make significant money quickly without anticipating potential losses.

Although we advise you to maintain an optimistic outlook, vigilance distinguishes losers from winners. Thus, setting sensible goals may help you to manage your emotions while trading — such as avoiding excessive greed, fear, or hope.

5. Use Reputable Crypto Exchanges

To trade safely, using two or three trusted cryptocurrency exchanges is better. Pick ones that many traders know and use. Additionally, read what others say about these trading websites. These testimonials will help you know if these crypto trading platforms are safe and reliable.

Because when we dispatch our trading capital this way, we automatically lower the chance of getting tricked or having problems in the future. All in all, this careful way of thinking doesn’t just protect your money; it also helps keep the crypto trading world safe and trustworthy for everyone.

Conclusion

Before you jump into action, it’s crucial to attach great importance to risk management in cryptocurrency trading. After all, your goal in making such a decision is to make gains or generate profits in the market. That’s why it’s so important to understand the risks involved.

FAQ

What are trading limits in the context of crypto risk management?

How does risk management consider the potential risks (and potential returns) in cryptocurrency trading?

What is the role of cold storage in managing the risk of digital asset loss?