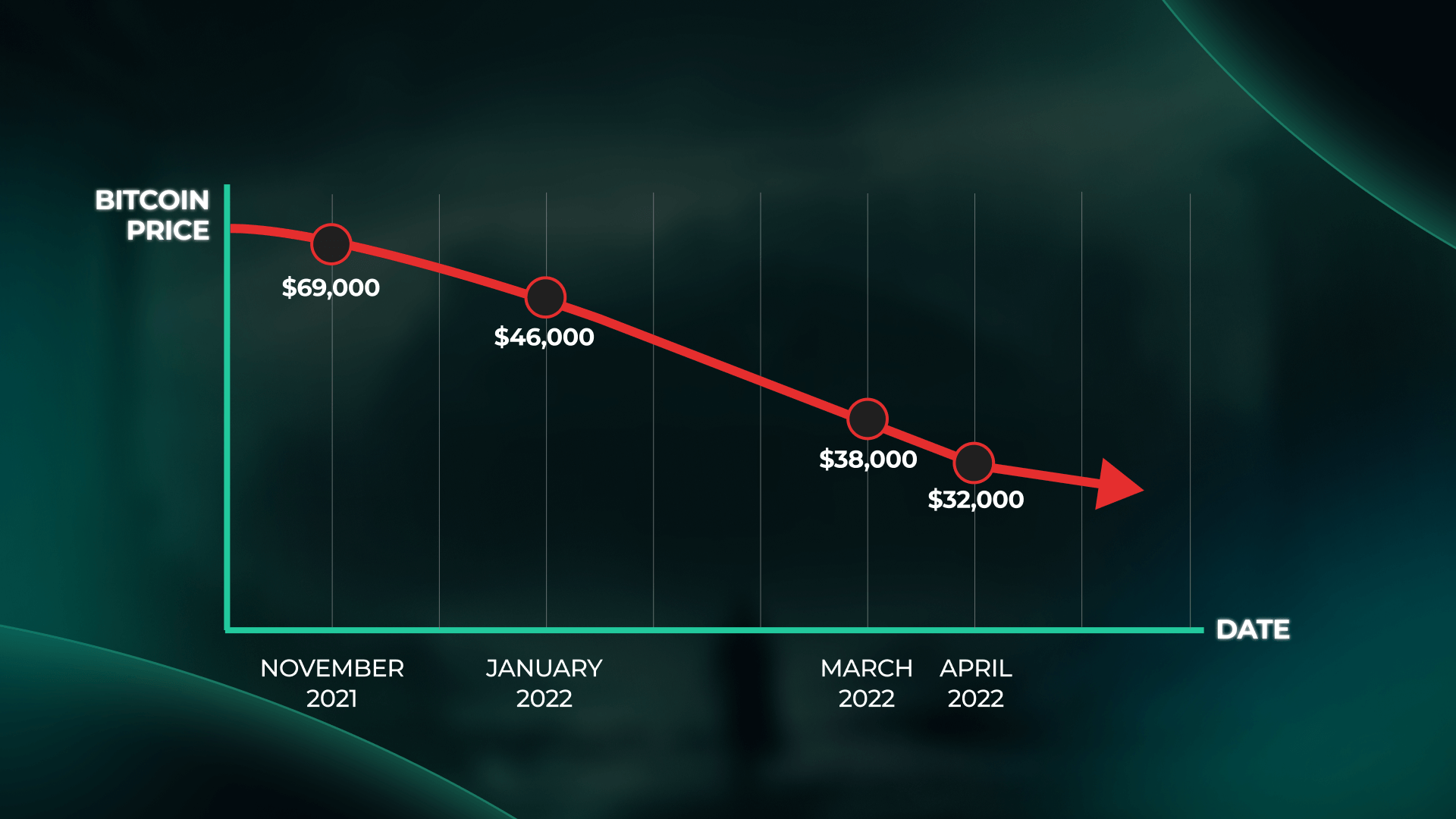

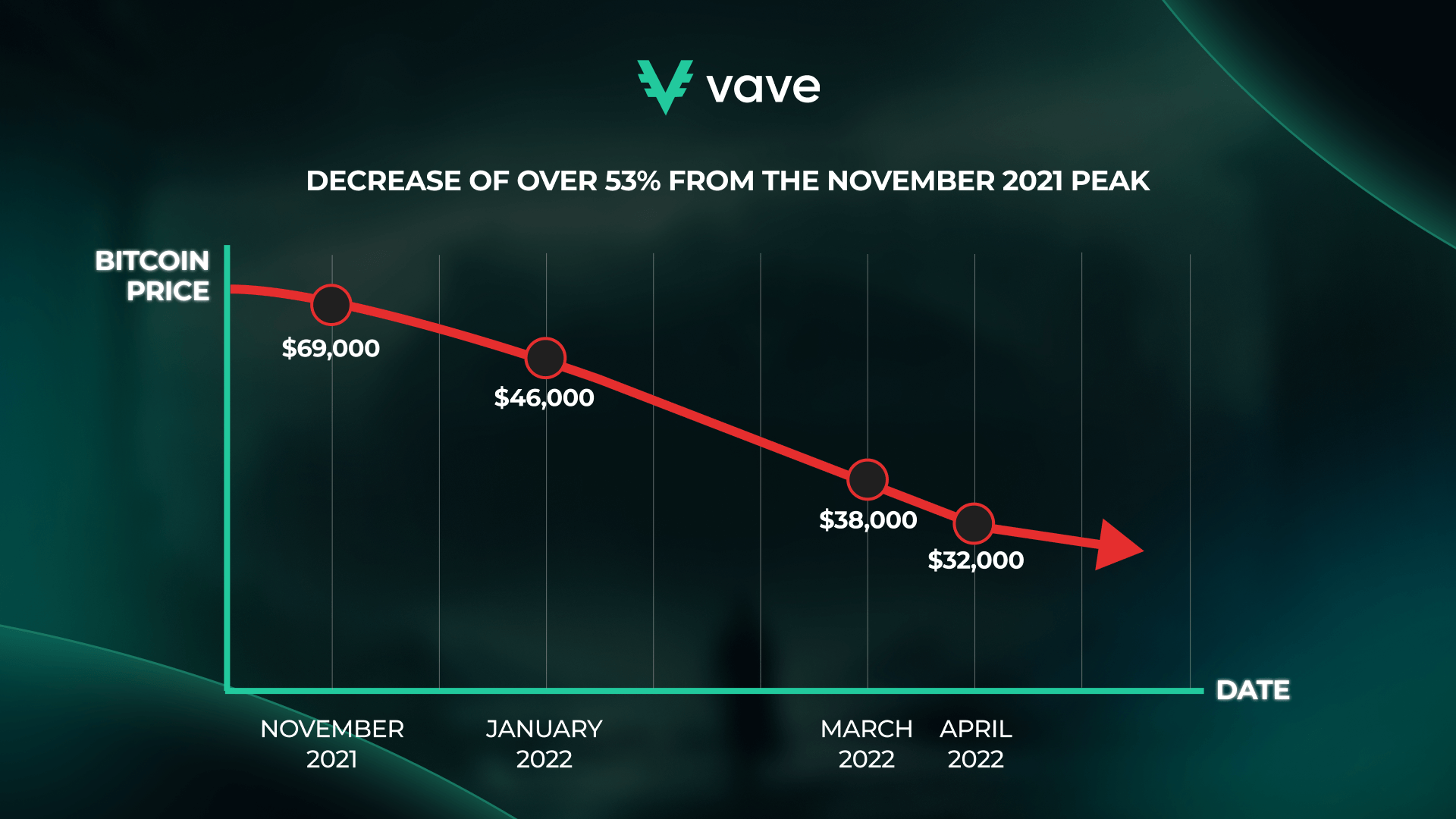

In 2022, the phenomenon known as “crypto winter” greatly affected cryptocurrencies. This period was quite similar to the “Winter of Discontent” made famous by the writer John Steinbeck. Bitcoin, Ethereum, and other cryptocurrencies faced a considerable drop of over 53% in their prices which greatly affected investors. This has also influenced speculators and made them envision the worst-case scenarios.

By April 2023, however, Bitcoin prices surpassed $30,000. This made analysts believe that the crypto winter was over. However, others warned that Bitcoin and other cryptocurrencies had not fully recovered, and were still struggling, just as before.

In this article, we will dissect the crypto winter in detail. We’ll first explain what it is and why it occurs. Then, we will evaluate when the crypto winter will come to an end. You have come to the right place – so let’s get started!

What Is Crypto Winter?

Curiously, “crypto winter” draws inspiration from the famous phrase “Winter Is Coming” in the TV show “Game of Thrones,” which means potential conflicts. So, let’s begin by defining what a crypto winter is.

For those unfamiliar with the term, it is a prolonged period of declining prices in the cryptocurrency industry, similar to a bear market. It involves a significant decline in cryptocurrency rates and market capitalization, typically recognized when persistent downfalls occur over at least three months. Such drops cause a negative sentiment and a lack of interest in buying digital currencies.

Since there are no warning signals during such challenging times, caution and tolerance are paramount. One of the most devastating crypto winters occurred in 2018 when Bitcoin dropped to $3,000. Ask any investor – it was a tough time!

It’s important to note that crypto winter is not just about traders or investors; it also affects the employees of exchanges. Take Gemini, a popular crypto exchange, which declared layoffs in the crypto winter that hit the market in 2022. You need to understand that the fall of Bitcoin suggests problems at all levels, impacting employees, investors, traders, and even the broader financial ecosystem such as tech companies reliant on blockchain technology.

Causes of the Recent Crypto Winter

As we explained earlier, a crypto winter is a period when cryptocurrency values go down. As a result, fewer people are willing to trade or invest in them. In 2022, the crypto market encountered a big descent, causing investors to lose trust in crypto. The major factors that triggered the event were high inflation rates in the U.S. as well as the collapse of major cryptocurrencies, exchanges and crypto lenders. Let’s take a deeper look at the factors and some of the major companies involved.

Companies Going Bankrupt

It goes without saying that some popular crypto companies faced a lot of problems while the crypto winter was going on. Celsius Network, a crypto bank, stopped people from withdrawing their money, which eventually led to its bankruptcy. Another company, Three Arrows Capital, a cryptocurrency hedge fund, couldn’t repay the money they had borrowed, so they too had to declare bankruptcy. Furthermore, the collapse of FTX, a major cryptocurrency exchange, was a severe knockout to the crypto market. Quite rightly, it was considered one of the greatest collapses in the USA since the 2008 financial crisis.

All these issues made people lose confidence in the crypto market and instilled fear and lack of investment, which eventually contributed to the bank run and closure of the Silicon Valley Bank (SVB) in March 2023.

TerraUSD and LUNA Breakdown

In 2022, there was a big concern regarding the UST and LUNA cryptos. These coins were supposed to be stable and safe, but they ended up causing a lot of trouble to investors and speculators. People were willing to wager that LUNA could become the next Bitcoin within a few years.

UST was supposed to maintain a regular price of one dollar, and LUNA was expected to appreciate in value. If you had one, you could exchange it for the other as they were interconnected. All of this seemed initially promising for investors.

In May 2022, however, everything started to fall apart. LUNA’s value, which was $116 in April, plunged dramatically to just a tiny fraction of a penny. The situation resembled a classic bank run with every investor trying to get their money out but of course, this was a big challenge.

It was a terrifying time for the industry and businesses that relied on crypto in general. This breakdown caused a long-term impact on people’s minds and is likely affecting their investment confidence to this day.

The Russian-Ukrainian Conflict

The ongoing conflict between Russia and Ukraine greatly impacted the cryptocurrency market as well. When the war escalated in 2022 (it originally started in 2014), it created economic uncertainty and took a toll on crypto.

As tensions rose, the prices of cryptocurrencies like Bitcoin, Ethereum and Cardano went down. People feared the war and preferred to keep liquid cash instead of holding onto their crypto assets. This massive sell-off caused prices to fall.

How to Manage Your Crypto Portfolio During a Bear Market

While it may be a big challenge for investors to maintain confidence in the crypto market during a bear run, it can be more rewarding for them to stay put and be patient in the long run. Here are some ways in which you can steer clear of danger to some extent during a crypto winter:

- Don’t invest more than you can afford to lose.

- Beware of the herd mentality.

- It’s OK to make portfolio adjustments.

- Carefully evaluate each crypto project.

- Consider buying the dip.

When Will It Be Over?

While the market has seen some recovery from the downturns of 2022 and early 2023, it remains volatile and unpredictable. Some experts believe that we still haven’t escaped from the crypto winter, given the ongoing challenges, instability due to conflicts, and market fluctuations. While it is impossible to determine specific dates or events, analysts look at historical trends to predict when the market might improve. However, this is no easy task considering what’s happening across the world.

The Bitcoin Halving Cycle and Its Potential Impact

Many experts are excited about the Bitcoin halving cycle which took place in April 2024. It will likely affect all cryptocurrencies in the long term, as Bitcoin often sets the trend for the broader market. The halving occurs approximately every four years, where the reward for mining new blocks is reduced by half. Historically, Bitcoin halvings have been followed by significant price increases, as reduced supply can lead to higher demand. While it’s hard to predict the market challenges ahead, experts believe that improvements might be noticeable at the end of 2024.

Currently, investors are closely watching economic factors such as inflation and interest rates, which also play a significant role in the crypto market’s performance. While it is hard to say for sure if the crypto winter is over, many factors need to align for the market to improve.

Future Of Crypto

In 2024, the future of cryptocurrencies looks promising despite the concept of crypto winters. Individuals are expected to invest more in crypto and take part in its adoption. We will also likely see more people relying on Ethereum and Bitcoin’s success. Plus, regulatory frameworks will become more prominent, reinforcing trust among crypto users.

Similarly, we will also see cooperation between crypto and conventional banks. It is a win-win situation for both organizations. This is because cryptocurrencies are bound to expand their presence in society, while traditional banks must ride the wave of evolution in financial technologies.

Finally, technological developments will address scalability and pace of transactions. Decentralized finance (DeFi) will continue to expand, providing innovative financial solutions.

Is it Safe to Invest in Crypto During a Winter?

History has proven that whenever stock markets take a beating, they recover with time. However, we do not have a lot of precedents to go by when it comes to matters of crypto, which is why investors are always hesitant to invest during winter.

Some inexperienced traders may feel that they are being challenged beyond their means during winter, and this may lead them to sell all their assets. However, experienced investors ride the wave and like to make sure that they buy the dip when it takes place and have confidence in their digital assets. Ultimately, it is all about how long the investors can stay put and the strategies they set to follow.

Conclusion

A lot of investors are bound to question if the crypto winter is over. As you know, previous cryptocurrency winters lasted years. The same can happen with the current bear market as well. Nevertheless, all of the information shared above is here to help you predict the next move for Bitcoin and other cryptocurrencies and gain some valuable knowledge.

FAQ

How does predicting the end of the crypto winter impact lenders and their analysis?

Can blockchain and NFTs contribute to the recovery and survival of the crypto market?