Since the first appearance of cryptocurrencies, people have been dubious about their prospects. More than 15 years have passed, however, and today they have proven to be an effective tool for payments and trading.

Throughout history, we have seen various ups and downs. If we remember the initial value of Bitcoin, you could only purchase several pizzas with it. However, everything changed during the massive upsurge in 2017 when BTC exceeded the $20,000 mark.

In 2024, crypto experienced multiple downturns, losing significant value. Between March 12 and May 1, BTC price went down by approximately 23% whereas ETH saw a deeper fall of about 31%. August 4 was no different when Bitcoin’s price dropped by 15% within a single day. According to CoinGecko, these drops were part of a broader market sell-off that wiped out around $367 billion from the cryptocurrency market.

In the following article, we will talk about investing in cryptocurrency for beginners and the methods to avoid potential risks.

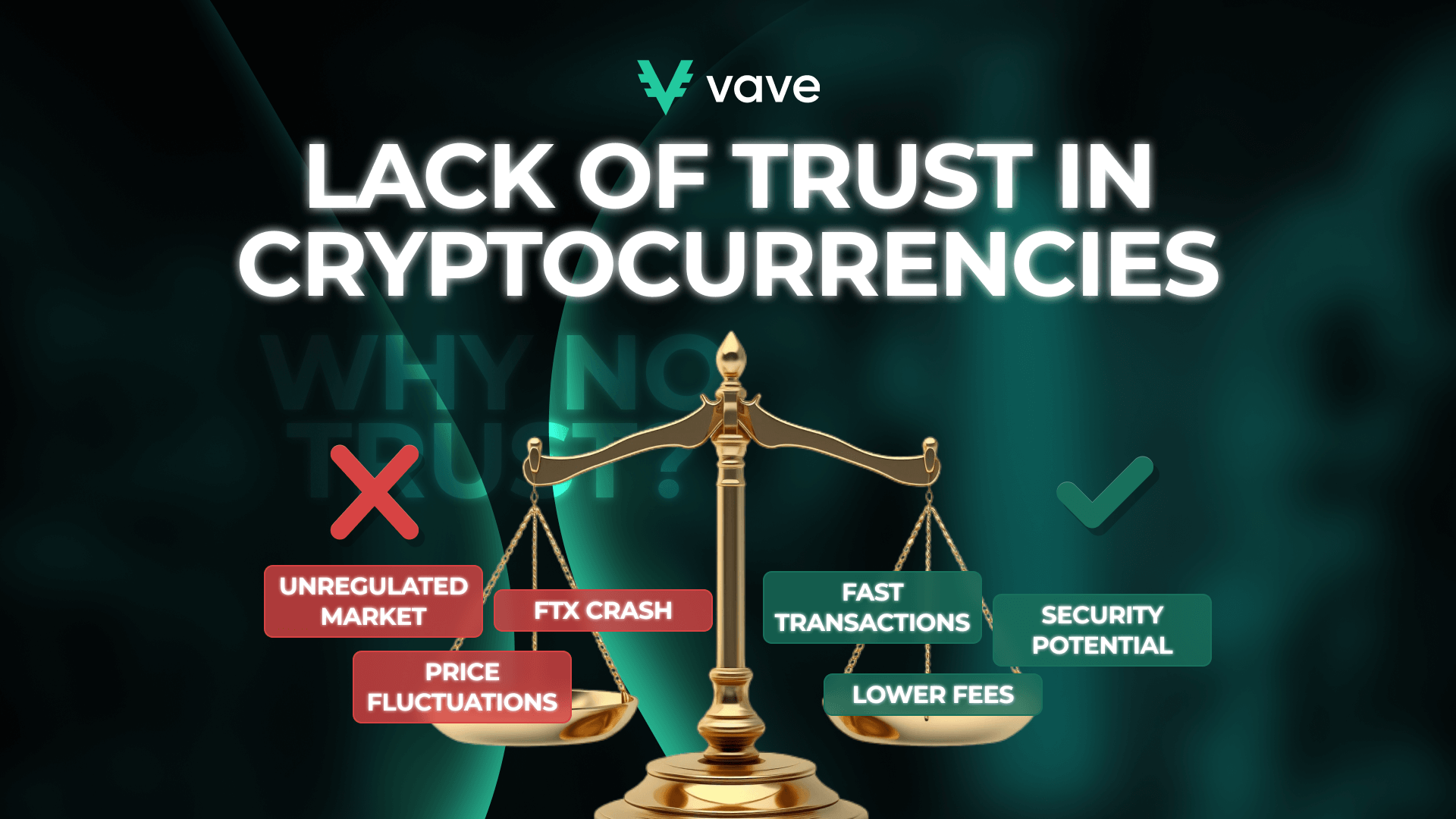

Why There’s Little Trust for Crypto?

Trust in cryptocurrency is low due to several factors. First of all, the crypto market is highly volatile. Prices could go up and down rapidly, causing suspicions about whether it is a worthy investment. Sudden price crashes can lead to major financial losses for traders.

Additionally, the prevalence of fraudulent schemes has further eroded trust. A lot of people don’t know how to protect themselves from crypto scams. Unfortunately, phishing attacks and fake investment opportunities are common in the industry. Scammers exploit the decentralized nature of cryptocurrencies, making it harder to recover stolen funds.

What Are Big Brands Doing to Rectify the Situation?

Big brands in the crypto world are taking various steps to address concerns and build trust. One significant action is improving transparency and regulatory compliance. Leading exchanges and platforms, like Coinbase and Binance, are working closely with regulatory authorities. They follow strict Anti-Money Laundering (AML) and Know Your Customer (KYC) protocols.

In addition, many companies are investing in educational initiatives. Blockchain Education Network (BEN), for instance, is a non-profit organization focusing on university students with the goal of preparing and teaching them Blockchain technology. CryptoZombies is another example of an interactive platform where users can learn how to code smart contracts through fun tutorials.

Some brands are also developing insurance policies to protect against theft and hacking. For example, Coinbase offers insurance for digital assets held in their online storage. Others, like Binance, provide Two-Factor Authentication (2FA) to protect user accounts.

Crypto Experts’ Advice

Predicting what happens with cryptocurrencies can be tough even for financial experts. First of all, understanding the blockchain technology behind crypto is pivotal, as many people don’t fully know how it works.

At the same time, you should always follow the latest updates and information on the Internet. You can search for different resources, where you can find tips for staying informed about crypto regulations, as regulations heavily influence the crypto world.

Despite numerous suggestions, we have decided to pick out the most critical ones for you. Our top three tips are:

- Avoid hasty decisions.

- Keep your assets with you.

- Invest in the right options.

Avoid Rash Decisions

The first thing you have to consider in 2024 is avoiding rash decisions. The crypto market is known for its volatility and making impulsive choices based on sudden movements can lead to financial losses. Rely on credible sources of information.

One way to stay grounded is by looking for market analysis. If you don’t know where to find reliable crypto market analysis, search for high-authority sources. CoinMarketCap, TradingView or CryptoQuant, for example, are well-favoured among traders and investors.

Take the time to understand the information, assess your financial situation, and develop a long-term strategy. In the fast-moving world of cryptocurrency, patience and research are your best tools to protect your investments.

Keep Your Assets With You

Keeping your assets with you is a fundamental concept. Instead of leaving your funds on exchanges, use private wallets, as exchanges are generally more vulnerable to hacks. Cold storage options, like hardware wallets, provide greater security from potential cyber threats.

Furthermore, it’s necessary to focus on creating a diversified crypto portfolio. Diversification helps minimize the risks associated with the volatility. So, spread your investments across different types of cryptocurrencies such as Bitcoin, Ethereum, and stablecoins. Finding the right balance between security and a well-chosen portfolio can help you manage your assets better and handle market fluctuations.

Invest Only in the “Right Options”

When investing in crypto, especially if you are a beginner, focus on choosing the right options to minimize risks. Not all cryptocurrencies are good investments, so you could start by researching established coins like Bitcoin and Ethereum. They have the largest market caps and trust among people. Bitcoin, in particular, has been around since 2009 so carrying the heavy “digital gold” title is no coincidence.

Avoid investing in lesser-known tokens or meme coins just because of hype or promises of quick profits. Dogecoin indeed paved its way to the top, starting as a mere joke, but its value remains extremely volatile to this day. So, instead of testing your luck, focus on cryptocurrencies with solid use cases, a reliable development team, and active communities, such as Ethereum.

Additionally, it’s crucial to invest only what you can afford to lose. Consider using dollar-cost averaging (DCA), which means investing a fixed amount at regular intervals, reducing the impact of market fluctuations. For example, you can invest $100 in Solana every month, no matter its price, to average out the cost in the long term.

Challenges and Risks Remain

Despite growing interest, challenges and risks remain in the market. One of the primary concerns is the extreme volatility, making it difficult to predict whether cryptocurrency prices will go up or down. Prices can fluctuate dramatically within hours due to regulatory news or technological advancements. As history taught us, a single tweet from Elon Musk can cause extreme price swings.

Security risks also persist, with hacking, phishing attacks, and fraudulent schemes targeting investors. Attacks like the 2021 Poly Network heist, where more than $600 million were stolen, only highlight the importance of using secure wallets and trusted platforms.

Additionally, regulatory uncertainty is a major challenge. Governments worldwide are still formulating rules around cryptocurrency, which could impact prices. So, investors should remain cautious and well-informed about these risks before entering the market.

Where Are We Heading?

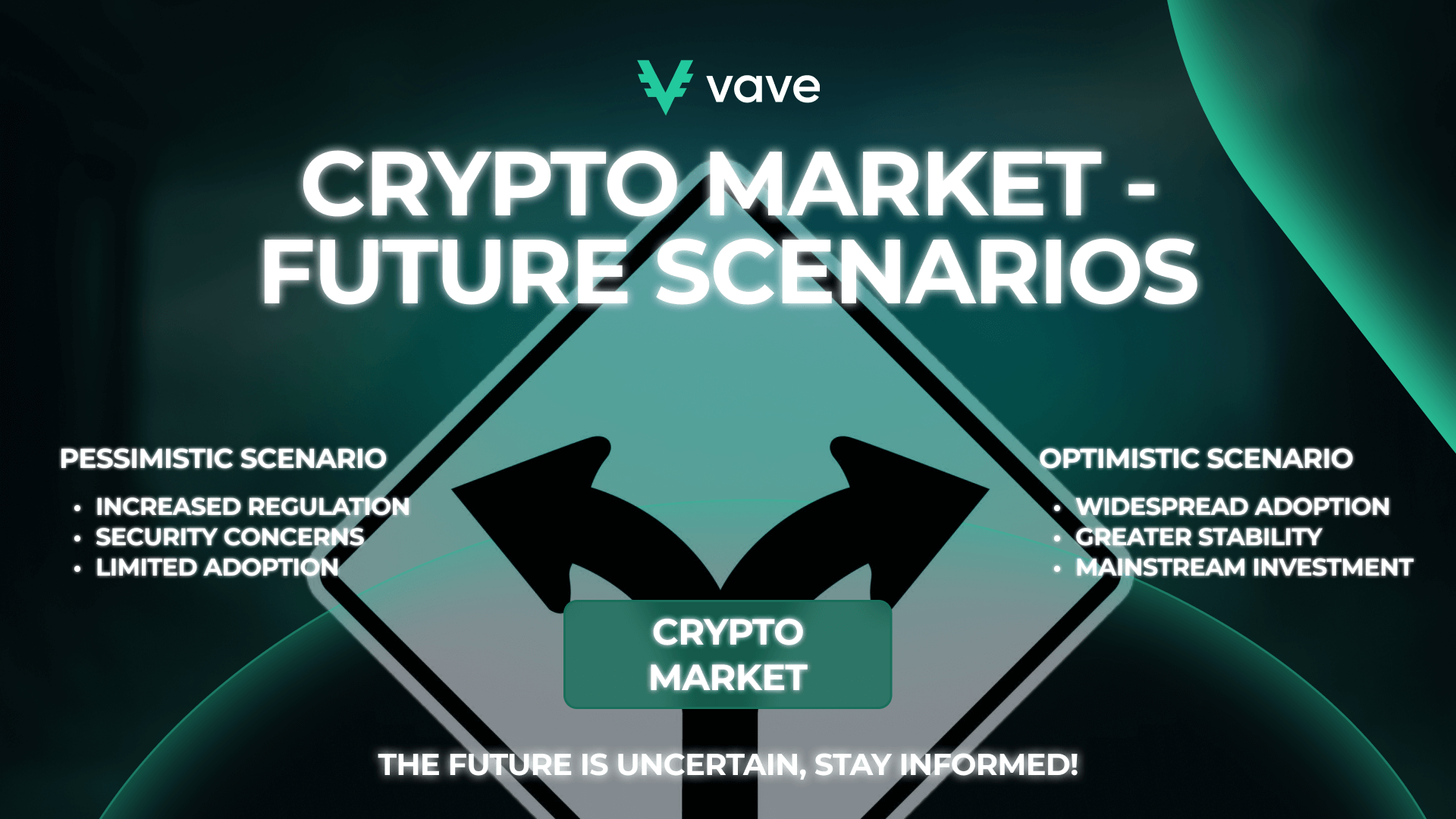

The future of cryptocurrency is full of uncertainties. The debate often centres around an optimistic vs pessimistic crypto outlook.

On the optimistic side, proponents believe cryptocurrency adoption will continue growing. More businesses, governments and individuals are embracing blockchain technology as they believe that advancements in DeFi will drive future growth. Tesla and PayPal, for example, have already started accepting Bitcoin.

The pessimistic outlook, however, highlights concerns about regulatory crackdowns, market volatility, and the potential for major security breaches. Sceptics fear that harsh regulations or technological limitations could hamper innovation.

The debate has been ongoing since the emergence of cryptocurrencies. So, let’s have a more detailed look at both scenarios.

Pessimistic Scenario

One of the main concerns is increased regulatory pressure from the government. Eventually, it could limit the use and trading of digital coins. If regulations become too strict, investor confidence could be reduced.

The volatility of cryptocurrencies poses a risk too. Unlike traditional investments such as stocks and bonds, crypto assets are highly unpredictable.

Security issues are another concern in the pessimistic scenario. Hacks, fraud, and other malicious activities could undermine trust in the market.

Optimistic Scenario

In an optimistic scenario, cryptocurrency predictions suggest a bright future for digital assets. As more companies adopt blockchain technology, the potential for usage grows. This can ultimately lead to higher demand.

Moreover, advancements in DeFi and improved scalability, such as Ethereum’s transition to a proof-of-stake consensus mechanism, could attract more investors. We could eventually see new financial ecosystems offering greater efficiency and security than traditional banking systems.

Additionally, clearer and balanced regulations could provide the necessary framework to protect investors. These factors could create an environment where cryptocurrencies become mainstream, fostering long-term market stability.

Wrapping Up:

As we look ahead, the future of cryptocurrency remains double-sided. On one hand, the continued growth of blockchain technology suggests that cryptocurrencies will not lose relevance. With advancements in DeFi, NFTs, and smart contracts, digital assets have the potential to revolutionize various industries.

On the other hand, challenges such as market volatility, regulatory scrutiny, and security risks persist. How these issues are addressed will play a crucial role in shaping the future. For investors and enthusiasts, staying informed and cautious is essential.

Investing for the Long Term

Is cryptocurrency a good investment for the long term? Well for that you need to evaluate both sides of the coin. Cryptocurrencies like Bitcoin and Ethereum have been spiking over the past decade. Many believe that digital assets will become increasingly integrated into the global financial system.

However, with prices subject to significant fluctuations, the unpredictability can make long-term investing in cryptocurrency risky, especially for those who are not prepared for potential downturns. It’s essential to diversify your portfolio. Include more stable traditional assets alongside crypto.

For long-term investors, patience and a strong risk tolerance are key. While cryptocurrency has shown promise, it’s crucial to remember that it remains a speculative investment, and its long-term success is not guaranteed.

FAQ

How should I act when the cryptocurrency market drops?

What are the benefits of buying cryptocurrency at a low price?

How does crypto regulation affect the cryptocurrency market drop?