Time sure flies. Ethereum is on a mission to outperform Bitcoin. A year ago, it made a shift called “The Ethereum Merge.” Ethereum finally completed its long-awaited software upgrade. This shift to a more eco-friendly system is a huge step for cryptocurrency, moving Ethereum from Proof of Work (PoW) to Proof of Stake (PoS). The upgrade aims to cut energy use and make the platform more efficient and cost-effective.

In this article, we’ll look into the upgrade, the impact of Ethereum merge on price and the network, and what it means for future energy consumption. Let’s dive in!

What is the Ethereum Merge?

The Merge was a big step for Ethereum, moving it from a proof-of-work (PoW) system to a proof-of-stake (PoS) model to save energy and plan for future growth.

This update linked Ethereum’s main network with the PoS-based Beacon Chain. Previously, the Beacon Chain ran next to the PoW blockchain. Now, validators have taken the place of miners. They stake their ETH to verify transactions and secure the network, reducing energy use.

Can Ethereum be used for everyday transactions? Definitely. The Merge has paved the way for future upgrades like sharding, which split the blockchain into smaller parts to reduce congestion and speed up transactions. These upgrades are designed to help Ethereum handle more transactions and build dApps on Ethereum.

Notably, the Merge didn’t require any action from Ether holders or impact user experience, wallet functionality, or Ethereum assets. Everything on the Ethereum network, including NFTs and DeFi protocols, kept working as usual.

Key Changes Occurred After the Merger: How will Ethereum Scalability Improve?

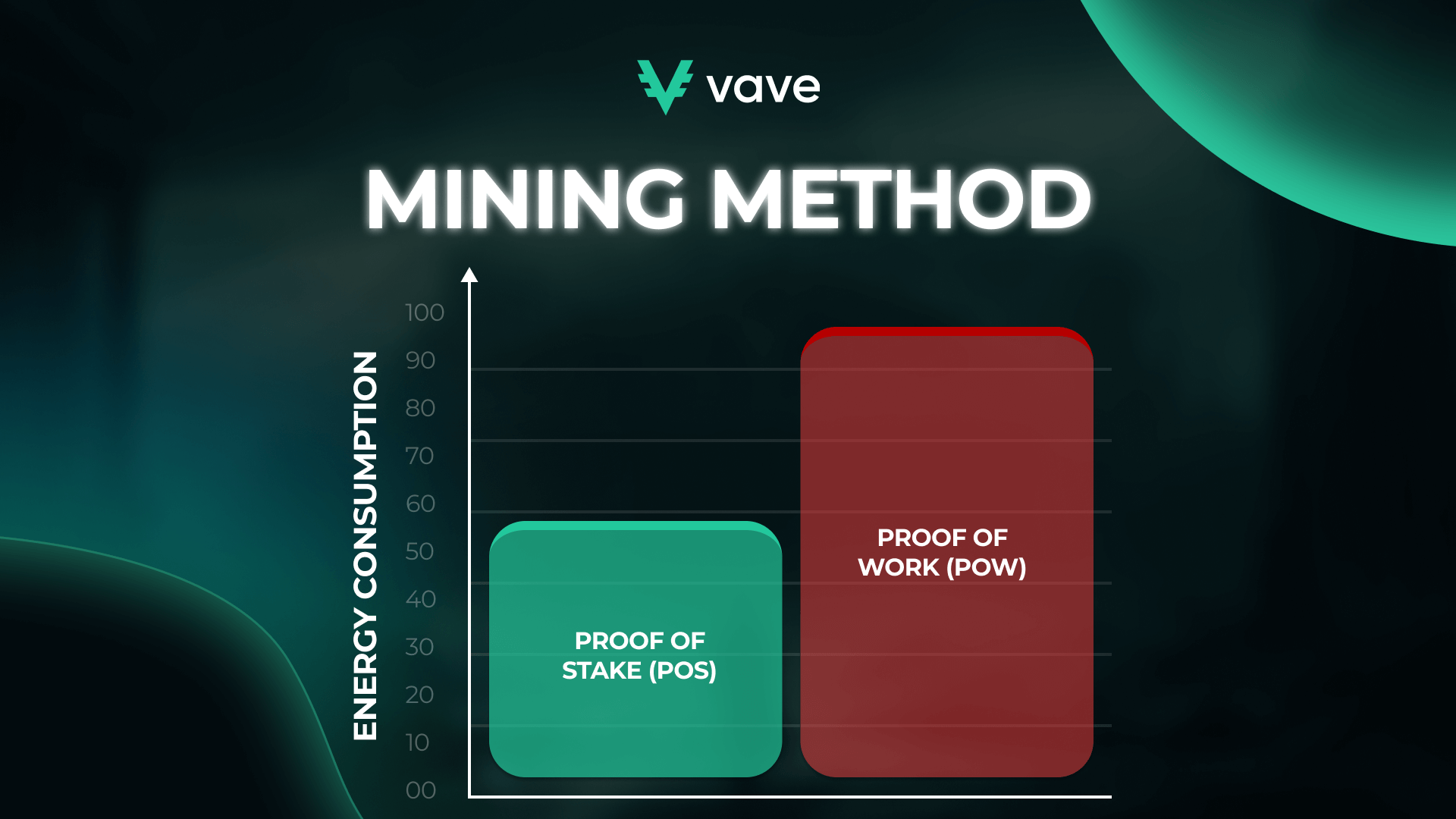

The merger changed from using lots of energy through mining to using staked ETH for network security. This sets the conditions for Ethereum scalability and makes the cryptocurrency more eco-friendly. When we compare Ethereum vs Bitcoin (which uses much energy), the merger lets Ethereum take a greener path. So, there’s an environmental impact of Proof of Stake (PoS).

Let’s look at some key changes from this merger.

Reduced Energy Consumption

The Crypto Carbon Rating Institution (CCRI) noted a 99.99% drop in Ethereum’s energy use and carbon footprint right after the Merge. This massive reduction in carbon emissions put less strain on the environment and made the network more appealing for growth.

However, there have been few updates on Ethereum’s electricity use and carbon footprint over the past year, which is concerning. Recently, CCRI found that both electricity use and CO2 emissions for Ethereum have increased by more than 300% since the Merge started.

To understand the environmental impact of a cryptocurrency, it’s important to consider the whole system, not just the miners or validators. After Ethereum’s Merge, becoming a validator got easier since you no longer need powerful mining rigs. There are now 1 million Ethereum validators. Even though each one uses less electricity, having so many might still lead to higher overall electricity use.

Ethereum 2.0 vs Ethereum 1.0 Price Analysis

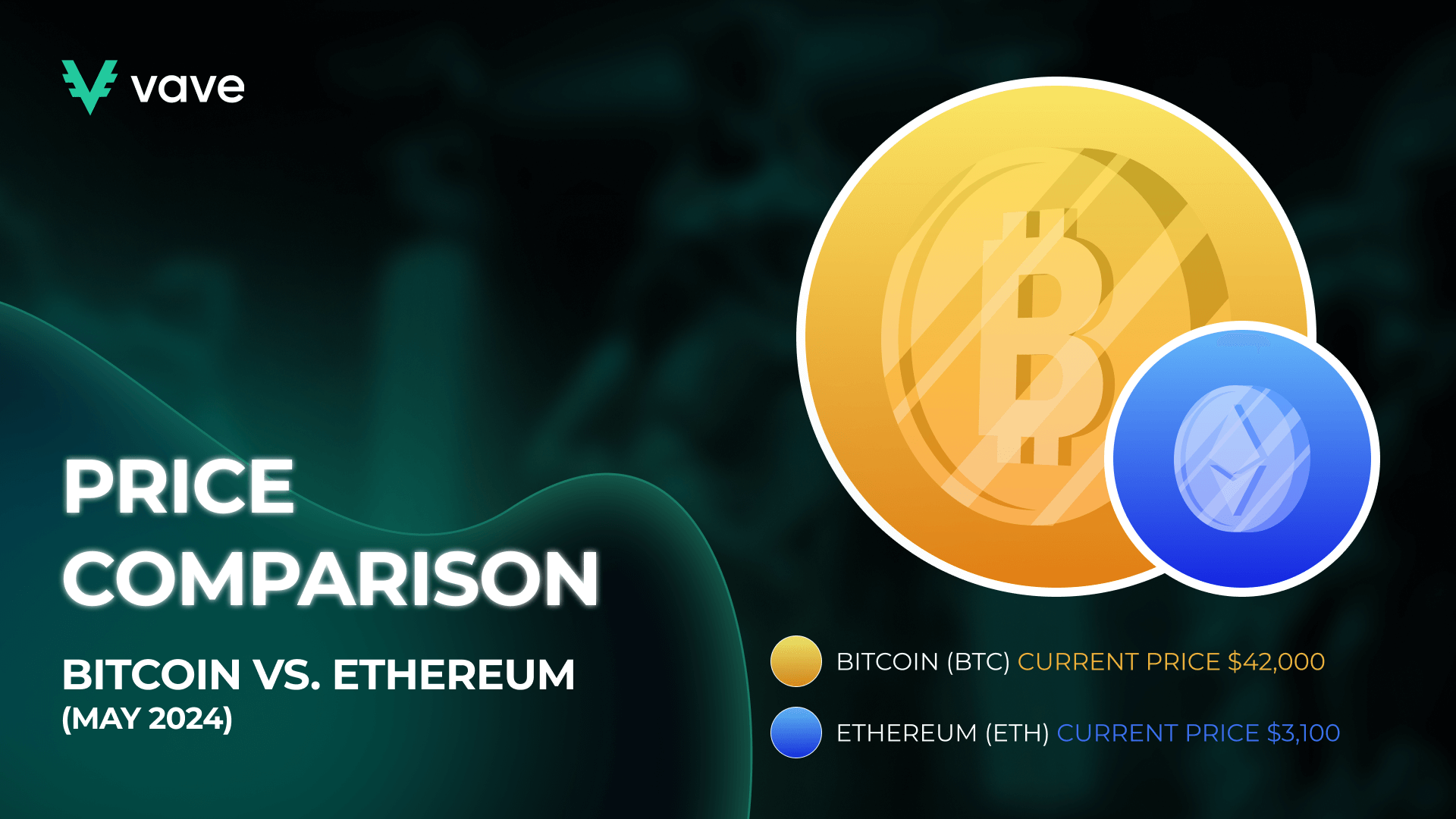

Many crypto fans expected ETH to skyrocket this year after transitioning to Proof of Stake (PoS) and the burning of numerous coins. They thought the price would hit $3,000 or more, and indeed, it did in March. However, it has since dropped. Unfortunately, predicting these trends is tricky, and here’s why ETH’s price has stayed relatively stable.

One big reason is competition with Bitcoin, the top player in the crypto world. In fact, ETH’s price dropped by about 25%. Investors are cautious and waiting for clear price changes before putting more money into ETH.

The uncertainty caused some investors to trade their ETH for BTC just before the Ethereum update. Bitcoin is often seen as a safe way to preserve wealth, and it might take a while for Ethereum to gain the same trust.

Liquid Staking Ethereum

Since the Merge, liquid stakinghas become popular in the Ethereum community. Staking lets anyone earn rewards and help secure Ethereum by locking up ETH tokens, earning steady interest. However, once staked, these tokens can’t be traded or used in decentralized finance (DeFi), which can be a downside for those wanting to maximize their returns.

Liquid staking services, such as Lido, help with staking by allowing users to stake indirectly and get liquid staking tokens (LSTs) in return. Lidois the largest provider, holding 72% of all staked ETH. These LSTs earn interest like regular staked ETH but can also be traded like any other cryptocurrency.

This flexibility makes LSTs attractive to DeFi traders who want easy access to ETH staking. Plus, LSTs let users stake without needing the 32 ETH minimum required for direct staking, opening the door for more investors.

New Test Network – How will the “Holesky” Testnet Impact Ethereum

Ethereum has introduced a new testnet, Holesky, replacing the old Goerli testnet. Holesky is designed to improve staking, infrastructure upgrades, and new protocols for Ethereum.

Holesky, named after Prague’s Nádraží Holešovice subway station, was set to launch on September 15, 2023, marking the first anniversary of Ethereum’s switch from proof-of-work to proof-of-stake. But due to a configuration error, the launch was delayed to September 28, 2023.

Holesky is now the main testing ground for Ethereum’s updates, replacing Goerli, which struggled with Ethereum’s increasing complexity. More than just a testnet, Holesky offers a look into Ethereum’s future and its wide range of blockchain possibilities.

Beyond the Merge: Ethereum Merge Drawbacks and Opportunities

After the merge, crypto miners started using proof-of-stake instead of the energy-heavy proof-of-work to validate new transaction blocks. Now, people can create new Ether (ETH) by staking their existing ETH. The selection process is random, but having more ETH increases the likelihood of being chosen. So, instead of powerful computers, participants can use their large ETH holdings to earn more.

Since the merge, the blockchain’s power consumption has dropped significantly. As Ethereum processes many transactions, this change saves a substantial amount of electricity each year. Some experts believe this merge could make ether more valuable than bitcoin, a shift known in crypto circles as the “flippening.”

In addition, Ethereum’s price has been pretty stable, around $1,600 over the past year, even after the Merge. However, Ethereum’s utility has changed a lot. The amount of staked Ethereum nearly doubled post-merge, showing growing confidence from investors.

But is Ethereum more secure than Bitcoin? Despite Ethereum merge benefits, it does come with some risks. One major concern is the risk of centralization and governance issues. With Ethereum moving to proof-of-stake, validators could shift from miners to stakers, potentially causing these problems.

Scams are another concern, especially with the term “ETH2” being used for the proof-of-stake layer, which could confuse users. Scammers might use this confusion during the merge to trick people into upgrading to ETH2 or swapping their tokens.

Despite these short-termsecurity risks of staking Ethereum, we believe the merger will lead to a boom for Ethereum, driven by new developments, decentralized applications (dApps) on Ethereum, and innovative uses.

Future of Ethereum

Ethereum’s progress since the Merge shows big steps forward in blockchain technology. Changing from Ethereum Proof of Stake (PoS) vs Proof of Work (PoW)isn’t just about updating how transactions are verified, but also about making the blockchain more sustainable and scalable.

A big win from this switch is the significant drop in energy use, which helps address important environmental issues related to blockchain.

However, adopting Ethereum more widely has challenges, mainly because of unclear regulations. As Ethereum evolves, balancing innovation, user involvement, and regulatory rules will be essential. The crypto community is watching closely to see how Ethereum deals with these challenges and shapes the future of blockchain.

FAQ

How does Ethereum stay decentralized with nodes?

What do data providers do in the crypto market?

Why are stakers important for Ethereum?

What Is the difference between Proof of Work (PoW) and Proof of Stake (PoS)?

What are the best ways to stake Ethereum?