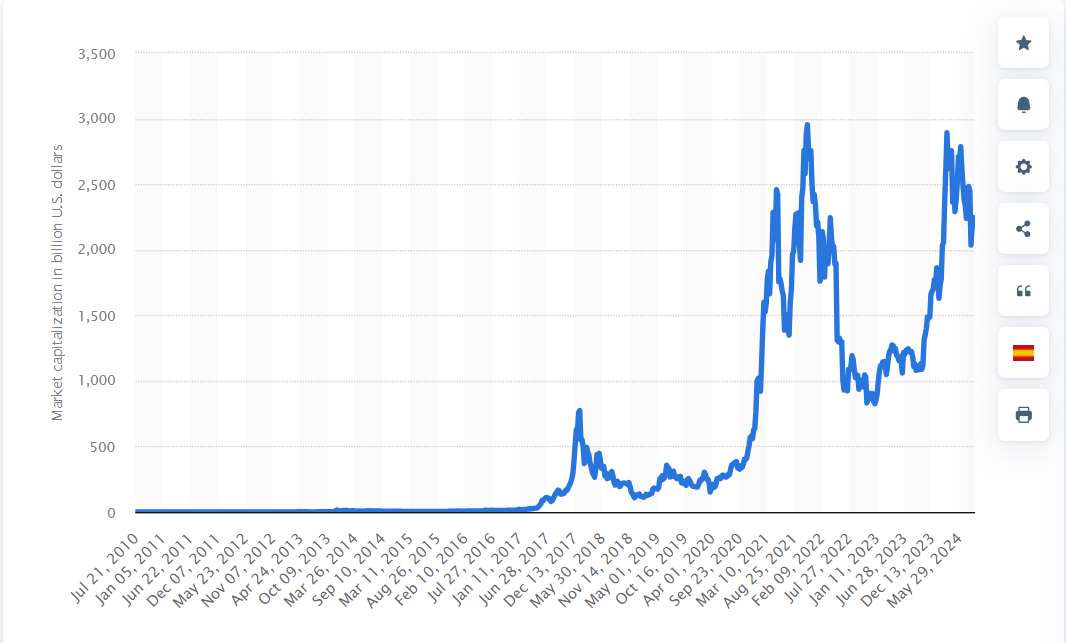

The year 2023 was great for crypto. Prices saw a significant rebound, with Bitcoin increasing 128% and Solana rising 495%. Additionally, crypto stocks surged by 138%, renewing investors’ confidence. Major financial players like BlackRock, Fidelity, and Franklin Templeton made significant market moves.

If we look forward, we can expect even bigger developments. Curious about what 2024 has for crypto? Then check out our top predictions for the crypto market.

Cryptocurrency Market Outlook 2024: Is Cryptocurrency the Future?

The world of cryptocurrency has changed a lot this year. BTC jumped to over $73,000 in March, and the U.S. approved Bitcoin and Ethereum ETFs, attracting big investors. There’s also much talk about Solana ETFs, perhaps launching on Wall Street. These developments are driving more people to adopt crypto, merging digital assets with traditional finance.

Expert Predictions and Conflicting Opinions

In 2024, crypto supporters believe that more advanced blockchain tech will increase the popularity of crypto. Experts say decentralized finance (DeFi) and non-fungible tokens (NFTs) could boost its use, even with current regulation issues.

Economists, however, warn about crypto’s ups and downs. Some believe digital currencies will be essential in finance, though others are doubtful and emphasize the need for strong regulations to prevent financial instability.

The Federal Reserve’s Looming Influence

The Federal Reserve’s actions play a significant role in the future of blockchain technology. With a possible central bank digital currency (CBDC) on the horizon, the Fed’s choices could either support or limit the growth of decentralized cryptocurrencies. While stricter regulations could increase investor confidence, too many rules might suppress innovation in the crypto industry.

Potential Impact of Global Events

Examining past events shows us how the crypto market reacts in different situations. Political instability can lead to fluctuations in cryptocurrency values. For example, during protests or government crackdowns, prices can quickly rise or fall. This is because investors see cryptocurrencies as a safe haven or a way to escape government control.

Economic crises like recessions or currency devaluations are also factors affecting the cryptocurrency market. When traditional financial systems falter, digital assets can be a strong choice for those seeking financial stability and independence.

What Made Previous Years Terrible Years for Cryptocurrencies?

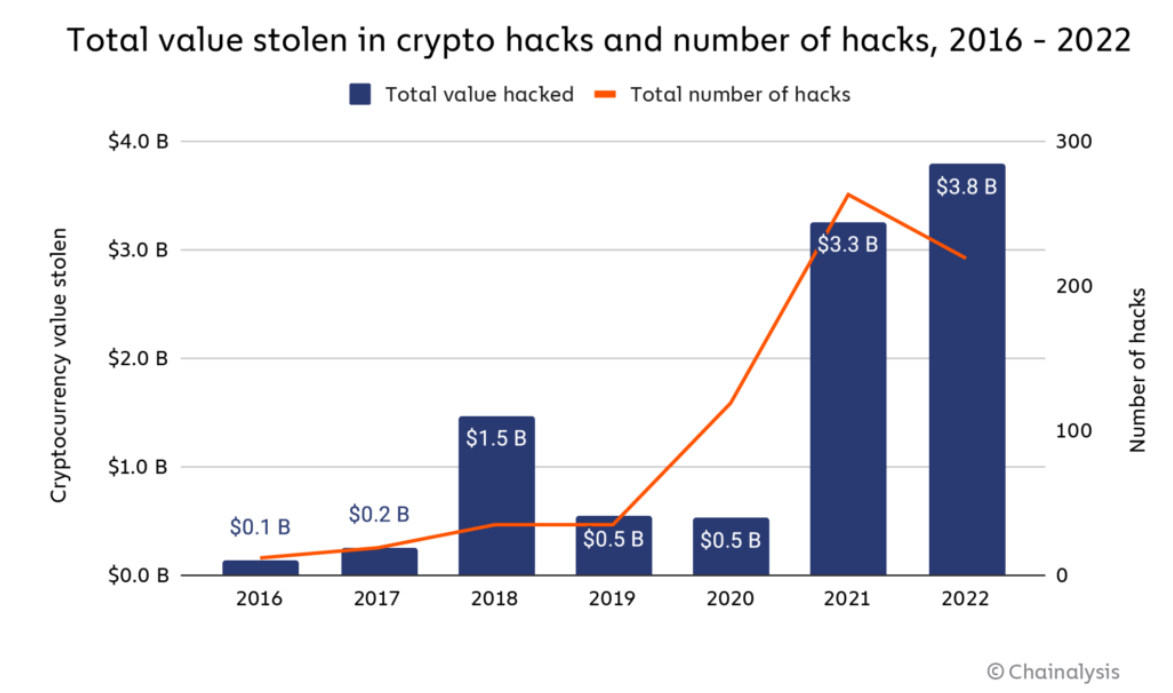

In 2022, crypto hacks reached a new high, with thieves stealing $3.8 billion from cryptocurrency businesses. This number of attacks varied during the year, with significant spikes in March and October. October, though, was the worst, with $775.7 million stolen in 32 attacks.

Major Crashes and Collapses

The cryptocurrency market has experienced significant crashes that have resulted in big price fluctuations and investor concerns. In 2018, for example, Bitcoin’s value dropped from almost $20,000 to around $3,000. Events like the collapse of the Mt. Gox exchange and recent security breaches have revealed weaknesses in the industry.

High Inflation and Interest Rates: A Double Whammy

Cryptocurrencies usually try to keep inflation low and steady. Although many see them as protection against inflation, that has recently rarely been the case.

Bitcoin, for example, is now more tied to the overall market because of big investments from institutions. So, if the market goes down, Bitcoin likely will too.

When inflation news comes out, the Federal Reserve often raises interest rates and tightens monetary policy. This tends to make asset prices, including cryptocurrencies, fall.

Eroded Trust and Uncertain Future

Trust is key for any financial system to grow, and cryptocurrencies have some issues in this area. Scams, fake ICOs, and Ponzi schemes have made people wary of investing. Inconsistent rules across regions also make it hard for digital coins to become widely accepted. Because of these unclear rules and lack of trust, the crypto market’s growth has slowed.

The New Era of Making Money With Crypto

Even with past economic issues and investor doubts, the crypto market remains strong. Inflation is not the only challenge, however. So, let’s explore how to invest in cryptocurrency now and in the future.

What Is the Concept of GameFI: Should I Invest in GameFi?

Looking for the best cryptocurrencies to invest in 2024? Check out GameFi, a hot trend in blockchain and cryptocurrency. GameFi blends gaming with finance, allowing players to earn real-world rewards through their in-game activities. Unlike traditional games, where rewards remain in the virtual world, GameFi gives players cryptocurrencies, NFTs, and other blockchain technology applications beyond crypto.

These assets can be traded, sold, or used in the broader crypto market. With play-to-earn models, DeFi mechanisms, and NFTs, GameFi makes gaming both enjoyable and potentially lucrative for gamers and investors alike.

Move-to-Earn (M2E): Is Move-to-Earn a Good Investment?

Move-to-Earn takes the GameFi idea and rewards your physical activity with cryptocurrencies or digital assets. Using mobile tech, fitness apps, and blockchain, it tracks actions like walking, running, or cycling. The longer and harder you exercise, the more you earn. In general, M2E platforms ensure fair rewards. This trend makes staying healthy fun and financially rewarding, changing how we think about exercise.

Non-Fungible Tokens (NFTs):

The world of Non-Fungible Tokens offers a lot of opportunities. You can create unique digital items like art, music, videos, or collectibles and sell them on NFT marketplaces. Another option is to invest in NFTs that might grow in value.

Trading such assets is similar to trading stocks, where you can benefit from price changes. You can also offer services related to NFTs, like storage, authentication, and verification, to support buyers and sellers.

Remember, though, that this market is still new and has its risks. It’s important to do thorough research and seek advice from a financial advisor before investing.

The Future of Cryptocurrency in 2024 and Beyond

Of course, cryptocurrency prices and popularity matter, but what’s really crucial is how blockchain technology will develop in the next decade. Solving issues like decentralization, scalability, and security is essential for cryptocurrency to be widely accepted and not just viewed as a speculative investment.

The Potential of Blockchain Technology

Blockchain technology, once famous for cryptocurrencies, is now transforming many industries. Initially used in finance, it’s now expanding to other sectors too. Statista predicts that blockchain’s market value might hit almost $1,000 trillion by 2032.

From finance and healthcare to supply chain management and voting systems, blockchain can revolutionize traditional methods and drive major advancements globally.

Responsible Investment and Sustainable Growth

Investors and stakeholders should push for transparency, regulatory compliance, and ethical behaviour. Due to the environmental concerns of energy-intensive processes like Bitcoin mining, there’s currently a focus on sustainability.

Many blockchain projects are looking into energy-saving methods like Proof of Stake (PoS) and environmentally friendly practices. Responsible crypto development also means focusing more on protecting consumers and fighting money laundering and terrorism financing. Adopting these practices could boost the credibility of the crypto industry in the long run.

Navigating the Crypto Space: Staying Informed and Cautious

Since the market can be unpredictable, it’s crucial to understand crypto assets. Learning about them helps investors make smart choices and avoid false information. By being cautious, diversifying investments, and keeping up-to-date, you can benefit from various crypto opportunities.

A Market Poised for Change

The cryptocurrency market is at a crucial moment. Advances in blockchain, shifting cryptocurrency regulations in 2024, and market trends suggest both opportunities and challenges ahead. As more institutions get involved and technology advances, the crypto world is set for major growth and change in the next few years.

Invest Wisely and Do Your Own Research

Doing your own research is crucial for making informed financial decisions. Try to learn the basics of any projects you’re interested in, keep an eye on regulations, and follow industry news. Also, diversify your investments and watch market trends to reduce risks.

Crypto’s Future: Unfolding with Every Transaction

Cryptocurrency’s future is shaped by each transaction, innovation, and regulation. As blockchain technology advances, a decentralized and transparent financial system becomes more plausible. Staying informed and involved allows investors and enthusiasts to be part of this evolving landscape and see the growth of digital currency.

FAQ

What are the top cryptocurrency predictions for 2024?

Will cryptocurrency be taxed in 2024?

How can beginners buy cryptocurrency safely and profitably?

What is the future of crypto mining in 2024?