Every trend has a lifecycle, and Non-Fungible Tokens (NFTs) may be reaching a turning point. Despite a slight recovery in the cryptocurrency market, the NFT sector has experienced significantly reduced activity compared to its peak periods.

With a constantly falling number of participants, fewer transactions and low volumes, experts wonder if any solutions exist to overcome the NFT market crash. If you are an artist looking to sell your creations or someone who merely wants to understand the NFT potential before starting a project, this is the right article for you. We will discuss the factors contributing to this crisis and share our expectations.

Understanding NFTs: A Digital Asset Revolution (or Dilemma)?

Non-fungible Tokens are digital assets similar to a piece of art. These can be digital content, videos, or other media that have been tokenized via a blockchain.

Tokens are unique identification codes created from metadata via an encryption function. While the assets themselves are stored elsewhere, these tokens reside on a blockchain. The connection between the token and the asset is what makes them original and memorable.

For the tech-minded, NFTs are built following the ERC-721 (Ethereum Request for Comment #721) standard and guidelines. These dictate how ownership is transferred, the methods for confirming transactions, and how applications handle safe transfers, among several other requirements.

From Humble Beginnings to the Mainstream: The Early Days of NFTs

Interestingly, NFTs were created long before they became popular in the mainstream. Allegedly, the first NFT, “Quantum,” was designed and tokenized by Kevin McCoy in 2014 on a blockchain, and eventually sold in 2021. The actual rise of NFTs began around 2017, with the successful launch of the CryptoPunks and CryptoKitties projects where the potential of digital collectibles really shined.

Booming Sales and Celebrity Endorsements: The NFT Market Peak

It is well known that celebrity endorsements have helped the market for NFTs grow significantly. Stars like Snoop Dogg, Lindsay Lohan or Paris Hilton, for instance, created their own NFTs to boost their fame and profitability.

Additionally, huge projects like Bored Ape, Decentraland, and others caused the trade volume to skyrocket in 2021, eventually reaching its market peak of $17 billion by January 2022. The hype was so big that even Collin’s dictionary named “NFT” its Word of the Year.

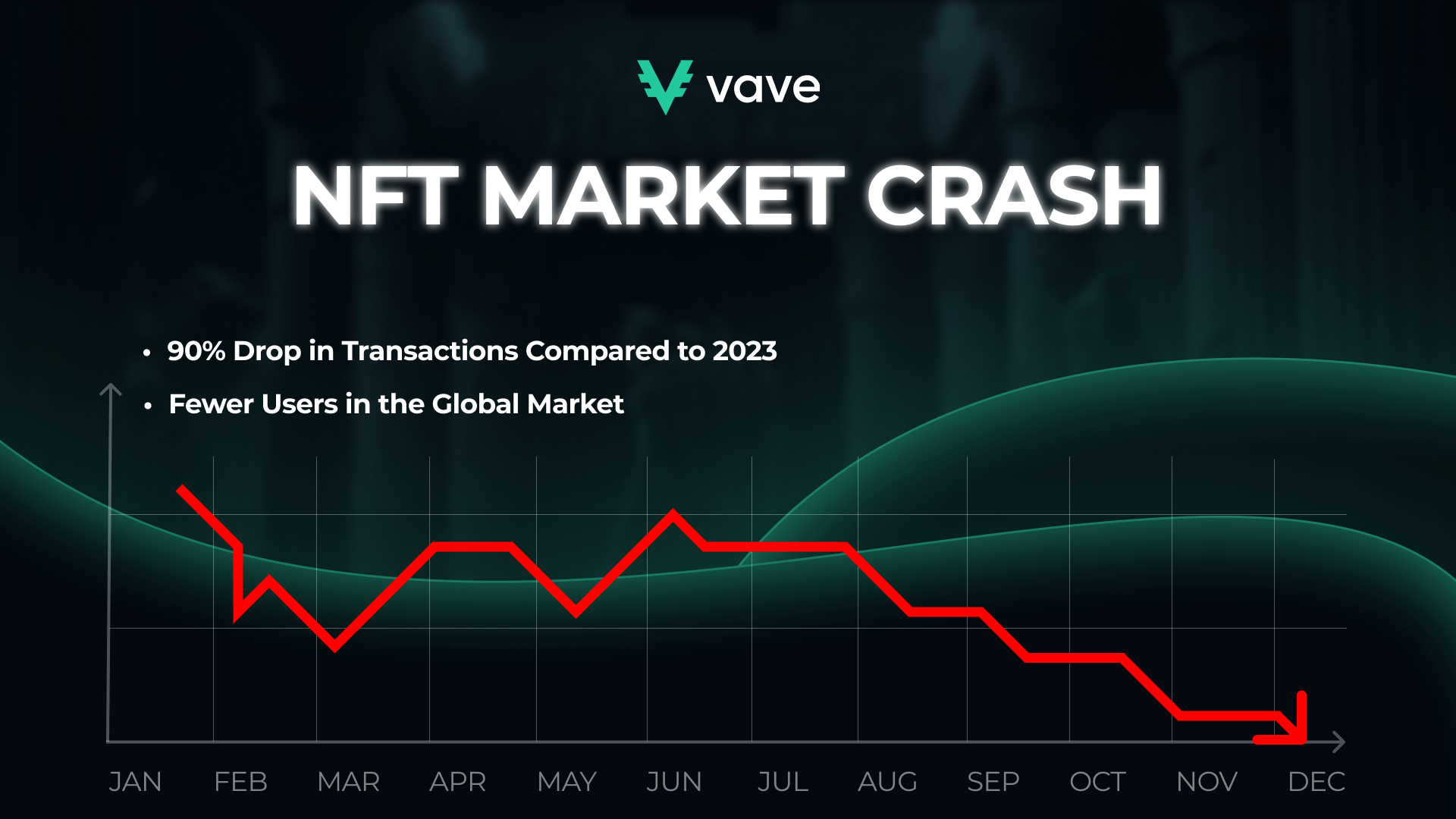

Current State of the NFT Market

In 2024, NFTs face plenty of challenges. Every month, it is said that there is a decline recorded in NFT sales. Plus, we also witnessed the NFT market collapse with a decrease in users in the global market. The NFT transactions are down 90% compared to last year. Therefore, this can be considered a final blow for this crypto activity.

Market Correction and Declining Sales: NFTs Facing Challenges

After the madness of the pandemic era, the NFT market began to show symptoms of anxiety. This led to a significant downturn. This downfall was multifaceted, originating from a mixture of factors. Initially, the charm of NFTs was partly driven by their newness and the hypothetical hype surrounding them. However, the excitement flagged as the market was inundated with an overwhelming number of NFTs, and the old-fashioned economic principles of supply and demand came into play.

Cryptocurrency Dependence and the Impact of Market Fluctuations

The realisation that not all NFTs would retain their value or promise for significant returns started to set in, and this led to decreased buyer interest and market prices. Another major supporter of this descent was the broader economic environment. The NFT boom coincided with economic uncertainty, with the impacts of the Covid-19 pandemic resulting in higher inflation, interest rates and tighter monetary policy.

Scams and Security Concerns: Building Trust in the NFT Market

Some of the major types of NFT scams are fake NFTs, rug pulls, and wash trading. Fake NFT scams happen when people attempt to sell a fake NFT as if it were a real one.

Rug pulls, on the other hand, take place when a team of creators builds an NFT project and accumulates a significant amount of hype. They mostly engage in marketing tactics, make a substantial amount of money, and then entirely forsake the project.

Wash trading is another scam that occurs when someone uses multiple accounts to buy an NFT they already own for a large amount of money. This creates an artificial price floor and dupes the public regarding the real value of the assets in question.

Reasons for the Sharp Decline in NFTs

The steep plunge of the NFT market can be attributed to several integral factors that, conjoined, directed to what many define as a bubble bursting. This downturn in the NFT space was not an isolated event but was significantly influenced by powerful disruptions in the cryptocurrency enterprise and changing global economic conditions.

One reason is the NFT market volatility, meaning that NFTs can go up and down in value incredibly quickly. This is an economic factor and connects to market corrections and how major cryptocurrencies like BTC and ETH also change in value.

Additionally, environmental concerns regarding the use of blockchain technology for low-quality NFTs, together with speculative buyers with little to no understanding of these assets, contributed further to the loss of investment interest and trust.

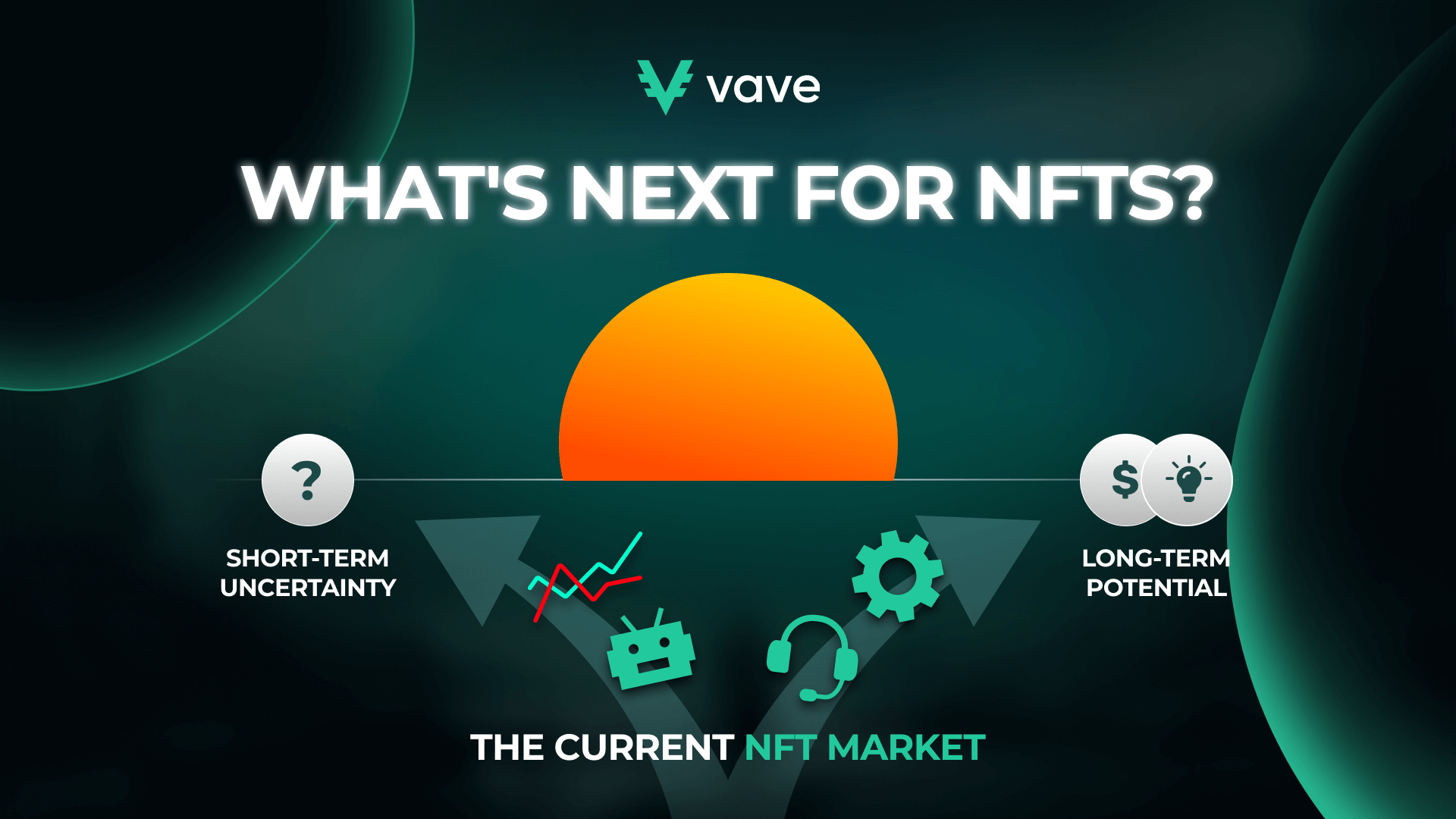

What to Expect in the Future?

Due to the aforementioned factors, the coming months for NFTs are bound to be uncertain. What we know for sure, however, is that they have the potential to expand in various industries, beyond digital art.

Beyond Art: Exploring Potential Use Cases for NFTs

While investors across the globe feel that NFTs are best used only in the case of selling pieces of digital art, the tokens are already finding applications in other fields, such as:

- Music.

- Real estate.

- Gaming.

- Intellectual property and rights.

- Ticketing.

- Voting.

- Fashion and luxury.

For instance, in 2024, the UEFA Champions League launched an NFT-powered trivia competition in collaboration with Mastercard. Fans had the chance to collect NFTs that granted them access to a real-time football trivia game, where they could win UEFA Champions League tickets.

Exploiting the true value of NFTs and integrating them into other industries could greatly reduce their current market decline.

Metaverse Integration and New Digital Experiences

Most of you are aware that the metaverse is a virtual shared platform where users can interact with each other as well as digital objects in an apparently real way. NFTs have an important role to play in the metaverse by providing a way to represent novel digital assets. These can be virtual real estate, in-game items and collectibles.

NFTs and the Evolving Landscape of Digital Ownership

NFTs have become indispensable in the digital ownership landscape. This is because these tokens offer a unique method for digital innovators, creators and artists to monetize their work. The emergence of NFTs has led to the resurgence of the collectibles market as well.

Should You Still Buy NFTs?

Are NFTs still worth investing in 2024? This is a question that is on the mind of perhaps every investor in the world at the moment. Buying NFTs in 2024 depends on diverse factors, including your investment aims. You have to remember that the industry has dropped significantly and this has raised concerns about NFT valuation.

The market is not doing well after the bubble burst, but according to NFT experts, there are indications of a possible revival. You will be heartened to note that the NFT market growth is expected to reach over $3 billion after four years.

A Cautious Approach: Weighing the Risks and Rewards of NFTs

If one were to weigh the risks and rewards of NFTs, it would be clear that there are plenty in both. While the rewards are such that the return on your investment could go through the roof if the economy is in boom, risks such as scams could also hurt your holdings.

As with all investments, you need to read the fine print well and decide what your financial goals are before taking the plunge.

Long-Term Vision vs. Short-Term Speculation

For a lot of investors, it may seem like short-term speculation helps them gain immediate returns on their investment in NFTs. On the other hand, many people want to put their money in for a long time and wait before they cash it in.

There has been proof that NFTs are helpful investments in the short term but with the market crash of late, it may appear as if it may be an option to hang in there and focus on beating the markers. It all depends on what your personal financial goals are and how long you can stay invested in the NFT market.

Conducting Thorough Research and Staying Informed

The emphasis on responsible investing is needed as it will allow you to stay ahead of the game and cut your losses as much as possible. While the boom in the NFT market was sure to have helped a lot of investors get good returns, the risks are such that they may also end up losing all of their money. Hence, you need to conduct thorough research, understand the market’s parameters and stay informed about everything that is happening in the economy.

Conclusion

Despite the decline in the NFT value, several experts believe that these digital assets will remain important in the future. One of the biggest examples of this is the Sandbox NFT marketplace, which has been discussed by various crypto-focused media. Sandbox is a virtual world where users create, own, and monetize digital assets like virtual land and items, all represented as NFTs. This platform illustrates how NFTs can be integrated into gaming and virtual real estate, pointing to a promising future beyond digital art.

You can feel that this industry is waiting for a new peak in cryptocurrencies to regain its value and pace. For this reason, the idea that a useful technology like NFTs will vanish altogether is unrealistic.

The NFT Market: A Work in Progress with Uncertainties and Potential

The challenges faced by the NFT market have initiated the space’s reevaluation and potential development. The market’s downturn has emphasised the demand for greater regulation, to go with transparency, and a focus on sustainable practices. While the NFT market has undoubtedly faced significant challenges, the underlying technology suggests that these assets have a good future.

The Future of NFTs: Adapting and Innovating in a Dynamic Environment

NFTs may encounter some degree of decline with the rise of Artificial Intelligence (AI). For example, art lovers who tend to appreciate manual techniques will no longer be able to distinguish between creative work made of ideas and sentiments and AI work done in three seconds.

In contrast, hope is still alive if seen in the long run. According to numerous NFT experts, the industry will come back in only one condition: this would happen by finding real-world uses for NFTs beyond just buying and selling them for gain.

FAQ

What are NFTs?

What caused the NFT market crash?

Are high Ethereum gas fees contributing to the NFT market's decline?

Can NFTs recover long-term sustainability?