When Ethereum switched to a proof-of-stake system in September 2022, the project began preparing for its next big move, the “Shanghai Hard Fork”. Once the developers finish the upgrade, the validators working in this network will finally be able to withdraw about 16 million staked ETH. This development is particularly exciting for investors interested in potential profits.

Even though Shanghai Hard Fork’s primary goal was to implement Ethereum Improvement Proposal-4895 (EIP-4895), which allows validator withdrawals, the update included several other enhancements. These changes have now been finalised and are bound to capture the attention of Ethereum app developers and draw the interest of several blockchain users.

In this blog post, we’ll explain the impact of the Ethereum Shanghai Hard Fork and explore potential network effects, future upgrades and the overall outlook for Ethereum.

A New Chapter for Ethereum: The Shanghai Hard Fork Explained

In April 2023, Ethereum received an upgrade known as the “Shanghai Upgrade” or the “EthereumShanghaiHardFork.” This is quite significantly a massive change after “the Merge” in September 2022. The upgrade, as expected, is bound to present many challenges to patrons but is also sure to deliver results quickly.

Economically, it’s anticipated to affect many different sectors. One of the biggest ways in which it has helped the world’s economy is by allowing users access to their staked ether (ETH) funds. This means more liquidity in the market, which in terms encourages investment and potential growth in decentralised finance (DeFi).

The Shanghai Upgrade is bringing quite a few changes, including the Ethereum Improvement Proposals (EIPs). Among them, EIP-4895 is perhaps the most important as it allows users to withdraw their ETH that has been locked up for more than two years. This could affect how people use Ethereum and appreciate its value.

The Merge and Beyond: Ethereum’s Shift to Proof-of-Stake

In September 2022, the major cryptocurrency network Ethereum changed how it works. The event marked the transition from proof-of-work (PoW) to proof-of-stake (PoS) mechanism. Under PoS, Ethereum staking replaced the energy-intensive mining process which was used back in PoW.

If you want to take part in PoS, you must stake 32 ETH at the very least, which can be hard for small-time investors. However, some platforms like Lido and Coinbase let users stake smaller amounts of ETH for a fee. Note that the staking of Ethereum can affect its market cap because the more ETH is staked, the fewer tokens are circulating and available for trading or other activities.

The Role of Validators in Ethereum’s Security

A key responsibility of most validators on the Ethereum network is to propose new blocks of transactions for inclusion in the Ethereum blockchain. Another major role that they play in maintaining the integrity of each network is verifying that a block proposed by a fellow validator is valid. This is known as block attestation.

Sync committees too are an essential part of the PoS framework. Every 256 epochs, which is equivalent to 27.3 hours, a group of 512 validators are chosen to cooperate upon as well as authenticate blockchain snapshots.

Locked Staking and the Need for Withdrawals

The majority of people ask the same question: how high can Ethereum go in light of this upgrade? All users are excited about this hard fork and the staking requirements that come with it. They can also take back their Ethereum that has been stuck for around two years or since their staking began. As a result, this upgrade could significantly affect the Ethereum value and have noteworthy subsequences for the future.

Ethereum Shanghai Update Overview

As we already mentioned, the Shanghai Upgrade that took place in April 2023 is significant as it induced a hard fork, requiring all nodes to upgrade to the new version. The update is expected to bring about a lot of changes in the industry such as ease of use, ease of access and simplicity while doing transactions and scalability improvements. A key component of this upgrade is EIP-4895, which specifically allows for the withdrawal of staked ETH so let’s explore it further.

What is EIP-4895?

EIP-4895 is an Ethereum Improvement Proposal which strives towards modifying the Ethereum protocol. It also works towards enabling validators to withdraw their staked ETH from the network. Previously, validators had to lock up 32 ETH to participate in the block validation process can now withdraw their staked amount following the Shanghai Hard Fork.

This upgrade was programmed in March 2023 and was eventually released on April 12, 2023. The primary objective of the proposal was to secure the Ethereum network and inspire the community to collaborate. Validators knew their staked ETH and rewards would remain locked until a subsequent chain development, which made this update highly anticipated.

EIP-4895 in Focus: Unlocking Staked ETH

While considering this update to the Ethereum network and its effect on validators, you may have some important questions: will Ethereum crash after the hard fork or the opposite, and what is the Ethereum price prediction for 2024? It can be said that going by the initial round of how this news has been received, the future does look extremely promising. According to Forbes Advisor, in 2025 ETH may reach an average of $5,000 with a maximum potential of $6,500.

As an investor, it is good to know that if you staked ETH following the launch of the Beacon Chain in 2020, you can now either withdraw only the rewards you have earned or unstake all your principal ETH amount plus your rewards.

Two Options for Validators: Unstaking Rewards or Exiting Completely

Once the next Ethereum upgrade takes place, validators will have about two options to unstake their ETH. The first involves setting up a withdrawal credential that will automatically unstake the rewards. The second option will be to exit the Beacon Chain and unstake all 32 ETH by removing your validator from the blockchain.

Meanwhile, the timeline for accessing the ETH also depends on how many people will unstake at once. According to Marius Van Der Wijden, a developer at the Ethereum Foundation, validators can only put 16 partial withdrawal requests every 12 seconds.

Potential Network Effects: Increased Participation or Sell-Off?

Based on the generated research since the Shanghai Update took place, it has become exceedingly clear that the potential network effects of it have been increased participation and not sell-off. The latter was expected by many in the industry, but you do not have to worry: the growth of Ethereum has been unparalleled.

What’s Next for Ethereum after the Shanghai Hard Fork?

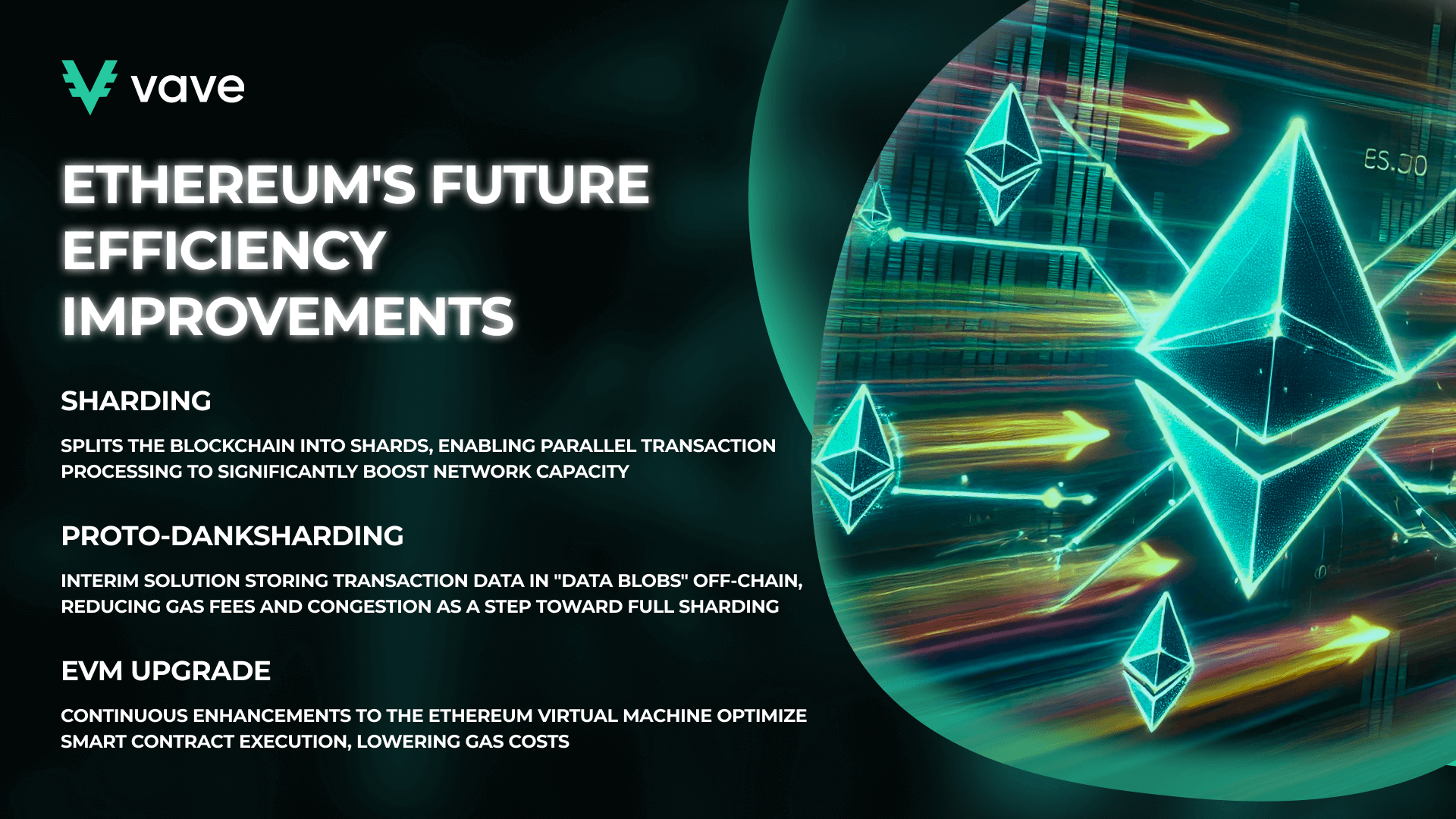

After the Shanghai Hard Fork, the developers wanted to return the ETH that people had staked as quickly as possible. Therefore, they decided to keep the scope of the project relatively small. Some big changes that were supposed to take place in the third quarter of 2023 were delayed. One of them was EIP-4844 (a.k.a. proto-danksharding), which helps the blockchain handle more transactions in an exceptionally smooth manner. This update was later included in the Dencun upgrade, along with other improvements, which took effect on March 13, 2024. These upgrades are expected to further enhance Ethereum’s scalability and efficiency.

Delayed Upgrades: Proto-Danksharding and Ethereum Virtual Machine

You may be interested to know that developers plan to make some upgrades to the Ethereum Virtual Machine (EVM). Proto-danksharding serves as a temporary bridge toward the eventual implementation of danksharding, the conclusive phase of Ethereum 2.0 (Serenity).

The EVM is a program that executes scripts used to perform certain operations usually in the Ethereum blockchain, making the process of creating new tokens on the Ethereum Blockchain extremely easy. In this context, the script is a set of instructions or an algorithm that tells the computer what it needs to do for something to work properly.

A Glimpse into the Future: Ethereum’s Continued Development

Ethereum has enjoyed a strong start to 2024, seemingly setting its sights even higher with multiple positive events on the horizon for the world’s second-largest cryptocurrency. You have to know that the entire crypto market received a boost from the expectation of a Bitcoin ETF approval, and ETH finished the year at $2282.11, up 91% from January 1st.

On Bitcoin ETF approval day, January 10, 2024, Ethereum gained as much as 12% on the anticipation that it would be the next token to have an ETF approved. After a brief slump, however, the crypto markets and Ethereum rallied, and for some time, everything seemed to be fine.

Everybody is expecting a bull market in 2024—especially after BTC’s all-time highs caused by the Bitcoin Halving event and the BTC ETF approval. The meme coin mania has also added to this frenzy and allowed everyone concerned to have a good inkling about the future. This positive sentiment, alongside the launch of already-approved Ethereum ETFs, could be a significant catalyst for reaching another all-time high later on in 2024, despite the current market state.

Another strong indicator of improving macroeconomic factors is the potential U.S. interest rate cuts. While hopes were high at the start of the year, they have faded slightly as the Fed has not yet reduced interest rates. Worry not, however! There are still expectations that the Fed will make an interest rate cut at least once in the next four meetings.

Conclusion

One must say that the future of Ethereum looks hopeful, given the recent surge in its popularity and importance. The key reason behind its success is the Ethereum upgrade, which promises to make the cryptocurrency quicker, more efficient, and more protected.

Overall, the future of Ethereum looks encouraging, and it is expected to remain one of the most favoured cryptos for years to come. All investors are keeping an eye on Ethereum, with some even considering it as a potential investment opportunity. As long as the news regarding Ethereum remains positive, everything should be okay.

Read more:

FAQ

When is the Ethereum upgrade?

Is Ethereum a good investment?

Why is Ethereum going up?