OTC desks are vital to the crypto industry, processing large volume cryptocurrency trades that are often too substantial for public exchanges. Handling billions in daily transactions, these desks frequently surpass the volume on major exchanges. They provide institutional investors with an alternative source of liquidity, enabling large trades to be executed with minimal slippage and market impact. This makes OTC desks an essential component of the crypto ecosystem, offering a reliable solution for sizable transactions.

While these are all true, few investors know what crypto OTC desks are, let alone how they work or their benefits. In this article, we’ll cover all these and more, ensuring traders are well-informed.

What are Crypto OTC Desks?

Crypto OTC desks, short for Over-The-Counter desks, are platforms dedicated to buying and trading cryptocurrencies. These could be for crypto-to-crypto or fiat-to-crypto transactions. Crypto whales can buy and sell large volumes of assets without affecting the market.

These desks perform transactions without disclosing any trade-related information to the public through anexchange order book or another means. This helps prevent huge market swings that often occur on exchanges. Before completing an over-the-counter crypto trading deal, the two parties must agree on a purchase price. Whatever is decided, the volume or value stays between both parties involved.

How Crypto OTC Desks Work?

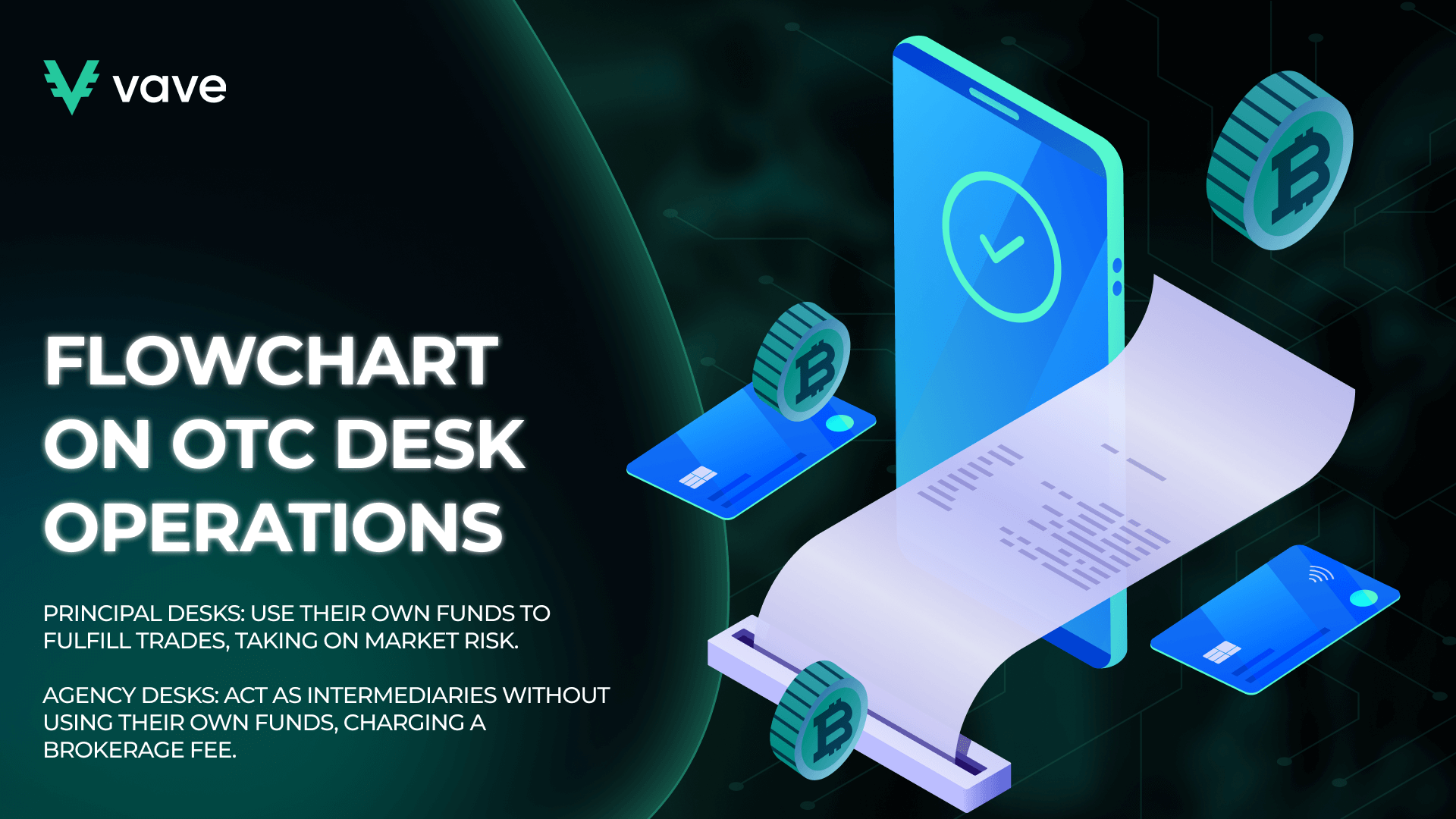

There are two main types of crypto OTC desks, and each works differently. Here is a quick overview of how they process transactions:

Principal Desks

Principal desks take on the risk themselves, using their own funds to acquire the assets buyers need. For example, the crypto OTC desk will provide a price based on current market circumstances in response to a quote request from aBitcoin whale who wants to buy a significant amount of Bitcoin.

The buyer can accept the offer or make a fair counteroffer. If the buyer accepts the suggested price, the OTC desk will find and deliver the Bitcoin to the buyer following the terms of the pre-signed legal contract.

At this stage, the desk determines the best sourcing method by consulting its current network of significant exchanges and other OTC desks. Its objective is to procure the crypto at a somewhat lower average price than the agreed-upon price to turn a profit. Spread is the term that describes the difference between the average price at which the desk buys the assets and the amount it charges you.

After the desk sources the crypto, the buyer will be sent information on where to send their money. Keep in mind that the desk won’t send the cryptocurrencyuntil they get the wire. Ensure you are dealing with a reputable platform before proceeding to not lose your money to fraud.

Agency Desks

In contrast to principal, Agency desks do not take on market risk because they do not guarantee transactions with their own funds. Rather, they serve as a middleman to negotiate a purchase on the buyer’s behalf. They charge a brokerage fee for their services.

So, if an investor wants to buy crypto from an agency desk, they must first fund an account with the platform and specify the price range at which they are prepared to purchase it. After that, the agency desk will try to use their money to buy it at the agreed-upon price. In this case, there’s a chance that the crypto’s price may rise before the desk agent can finish the transaction and fulfill the customer’s order.

Many platforms that provide custody as a service (keeping cryptocurrency) also operate as agency desks. Since they already possess your funds, they will also help you purchase and sell your assets. All you need to do is state what currency and the volume you wish to acquire. When comparing the two types, investors tend to go for Principal desks since the risk is usually on the platform’s side.

Benefits of Crypto OTC Desks

Aside from the obvious advantage of letting investors buy cryptos in bulk without affecting the market, there are other benefits you should know. Here are a few details on some of them:

Better Liquidity

With OTC desks, traders may purchase or sell enormous amounts of cryptocurrencies. They can do this without substantially affecting the market price since they have access to deep pools of liquidity. Traders can effectively acquire or exit positions at favorable prices by using the liquidity OTC desks provide.

Reduced Slippage

Crypto OTC desks have less slippage than traditional exchanges. The term “slippage” describes the gap between a trade’s projected and execution prices. Exchanges can cause considerable slippage in big transactions because they influence the market, which can move the price against the seller or buyer. However, OTC desks can process big orders without generating noticeable price fluctuations, which lowers slippage.

Security and Privacy

Since transactions at OTC desks take place directly between the buyer and seller, they are more private since they are not visible to the open market. Furthermore, trustworthy OTC desks use robustsecurity protocols to protect customers’ assets and private data, lowering the possibility of hacking or unauthorized access. OTC desks are an excellent option for traders who value asset protection and secrecy due to their increased privacy and security.

Regulatory Compliance

Trustworthy OTC desks follow strict internal compliance guidelines to ensure transparency and legality in their operations. While these desks strive to uphold high standards, the broader crypto industry still faces challenges due to a lack of comprehensive external regulation. This gap in regulation can lead to inconsistencies, but approved OTC desks help traders navigate the current regulatory landscape, reducing risks and enhancing trust in the cryptocurrency ecosystem.

Tailored Support

OTC desks offer individualized services catered to each client’s unique requirements. They provide specialized account managers who support clients throughout the OTC trading process. These account managers give market tips, execute transactions on behalf of customers, and offer tailored solutions to their specific needs.

How to Choose the Right Crypto OTC Desk

There are a few important things to take into account while selecting the best Over-the-Counter (OTC) desk for your crypto operations. You can guarantee a seamless trading experience and make well-informed decisions by being aware of these factors. Here are a few of them:

Customer Support

Having quick and dependable customer service will always come in handy. Select an OTC desk that provides quick response customer service by phone, email, live chat, or even social media to handle any questions or concerns that may come up while you’re trading. Ensure customer service is available at least 18 hours daily to address your concerns.

Costs & Fees

To make sure you’re receiving a competitive offer, compare the costs and fee plans offered by several OTC desks. While assessing the total cost of using the desk, look for clear pricing that includes no hidden costs. Take into account factors like institutional crypto trading fees, order sizes, and withdrawal fees. Regulatory Compliance When selecting an OTC desk, prioritize those that adhere to legal frameworks and strict internal compliance guidelines. This ensures transparency and helps protect traders by minimizing legal risks in an industry where comprehensive regulation is still evolving. Transaction Speed Consider transaction speed as a key factor. Efficient OTC desks execute large trades quickly, reducing market exposure and securing favorable prices, which is essential for taking advantage of market movements.

Credibility

Your top priorities should be the OTC desk’s reputable standing and dependability. Look for reputable desks with a history of safely handling large crypto deals. You can check online reviews to see how satisfied users are.

Security Measures

Make sure the desk has top-notch security measures to guard your money and private data against hackers. When it comes to cryptocurrency, look for features like:

- 2FA

- Cold storage

- SSL encryption

Drawbacks of Crypto OTC Desks

Every platform or feature has drawbacks, and OTC desks are no different. While it offers lots of benefits investors can enjoy, it’s best to keep in mind the various potential disadvantages that follow. Take a look at some of them below.

- Lack of Regulation:One of the major issues facing crypto OTC desks is the lack of thorough regulation. This monitoring gap may make users vulnerable to fraud, market manipulation, and security breaches.

- Volatile Prices: Cryptocurrency markets, as many investors know, experience huge price swings. Due to this volatility, OTC desk users are also exposed to lots of risks, which might affect transaction execution prices.

- Long Transaction Process: OTC trades may take longer to complete than those on exchanges, providing real-time order matching. This makes users more prone to unfavorable price swings throughout the transaction process.

- Lack of Transparency: OTC desks use more secrecy than regular exchanges, which offer trading histories and public order books. Due to the lack of transparency, users may find it difficult to check the efficiency and fairness of the market. This might lead to unfavorable trading circumstances.

Conclusion

Over the past decade, crypto OTC desks have emerged and gained significant prominence, becoming an essential part of the market, and now several crypto trading platforms are offering this service. The fact that many desks are already trading billions of dollars every year shows how much this business has expanded.

While regular traders may not have access to them, they are essential to the effective functioning of the crypto market. Thus, if you ever need to buy or sell a ton of cryptocurrency, you can simply get to this side of the market.