What Is Solana (SOL)

First and foremost, Solana is a high-performance blockchain platform designed to support decentralized applications (dApps). Founded back in 2017, Solana first launched its mainnet in 2020, creating a cryptocurrency called SOL.

With its proof of history (PoH) consensus mechanism, Solana has managed to get much faster transaction speeds and lower costs compared to other blockchain platforms like Ethereum.

What is the Purpose of Solana and What Utility Does It Have?

To keep things simple, Solana serves as a platform for building and running decentralized applications (dApps), offering the main benefits of speed, scalability, and security.

Developers can easily make a wide range of applications, including games, financial services, and supply chain management solutions.

Key Advantages of Solana

High Performance

Some of Solana’s biggest upsides are its speed, overall scalability, throughput, and so much more, as thanks to its proof of history (PoH) consensus, Solana can handle a staggering 50,000 transactions per second (TPS). That explains why many startups have chosen SOL when debating between Ethereum and Solana.

Speed and Scalability

50,000 transactions per second is probably just a number for the majority of people with a baseline understanding of the blockchain and cryptocurrency. However, when you compare Solana vs other cryptocurrencies and cutting-edge competitors, it outcompetes in terms of both speed and scalability.

High Throughput

High throughput is another buzzword that gets thrown around from time to time, but in simple terms, it makes Solana suitable for applications that require rapid processing of data. Some of the best applications would be financial trading platforms and decentralized exchanges.

Low Transaction Costs

With Solana’s more efficient POH system and optimized network architecture, they have much lower transaction fees compared to many other blockchain platforms. Because of this, Solana is way more accessible and friendly for applications.

Affordable Fees

Compared to other blockchains, like Solana vs Bitcoin, it offers more affordable fees for sending transactions. For instance, Bitcoin’s average transaction typically ranges from $0.50 to $5.00 depending on the network congestion, while Solana’s is consistently around $0.00025.

Cost Efficiency for Developers and Users

As we discussed, with the available technology, speed, and fees, Solana presents itself as an appealing choice for both developers and users. SOL managed to negate many of the disadvantages of cryptocurrency.

Technological Innovations

Proof of History (PoH)

Proof of historyis used by Solana, and unlike traditional proof-of-work (PoW) systems, PoH doesn’t rely on energy-intensive mining. Instead, it records the history of transactions and events on the blockchain, creating a verifiable timestamp for each event.

Benefits of PoH in Blockchain

- Faster transaction speed: PoH allows for quicker processing of transactions, as we looked at above.

- Increased scalability: It also helps Solana handle a larger volume of transactions, making it suitable for applications that require high throughput.

- Improved security: It provides a more secure and reliable way to verify the order of events on the blockchain.

- Reduced energy consumption: Compared to PoW, PoH is less energy-intensive, making it a more environmentally friendly option.

Solana Ecosystem and Development

Growing Developer Community

Solana has managed to attract a large number of developers who’ve been able to make huge advances to the overall SOL ecosystem. The same developers have been aided by developer-friendly tools, resources, and a supportive community that’s cheered them on every step of the way.

Plenty of people are out there only wondering how high Solana can go, but others are just in it for the passion.

Expanding DApps and Projects

The Solana ecosystem has exploded, with decentralized applications (dApps) and projects popping up all the time. These include DeFi protocols, NFT marketplaces, gaming platforms, and supply chain management solutions for the most part.

Strategic Partnerships and Use Cases

Major Partnerships

Solana has had the opportunity to partner with major players in the technology industry, grabbing a ton of credibility and exposure along the way and leading even more people to invest in it.

Collaborations with Leading Companies

Real Fortune 500 names like Intel, Microsoft, and Andreessen Horowitz have shown interest in Solana’s blockchain use cases. Soon enough, we could have some of these large names running parts of their business of the Solana blockchain.

Impact on Adoption and Growth

The overall clout gained by just having your name uttered in the same sentence as some of the tech giants really can’t be understated; just look at Elon Musk and Doge. That is to say, while Solana’s technology really speaks for itself, its collaborations with other giants have catapulted it into the public mind.

Real-World Use Cases

Solana’s high performance and scalability have made it a popular choice for a variety of real-world use cases and left others simply wondering how to trade on the Solana network.

DeFi (Decentralized Finance) Applications

Solana has become a hub for DeFi protocols, offering services such as lending, borrowing, and trading. The platform’s speed and low transaction costs make it the perfect choice.

NFT (Non-Fungible Tokens) Market

The coin has emerged as a significant player in the NFT market, although much of the money in the space has seemingly dried up. Nonetheless, the platform’s ability to handle a large number of transactions and its low fees have attracted many NFT projects and collectors.

Market Performance and Potential

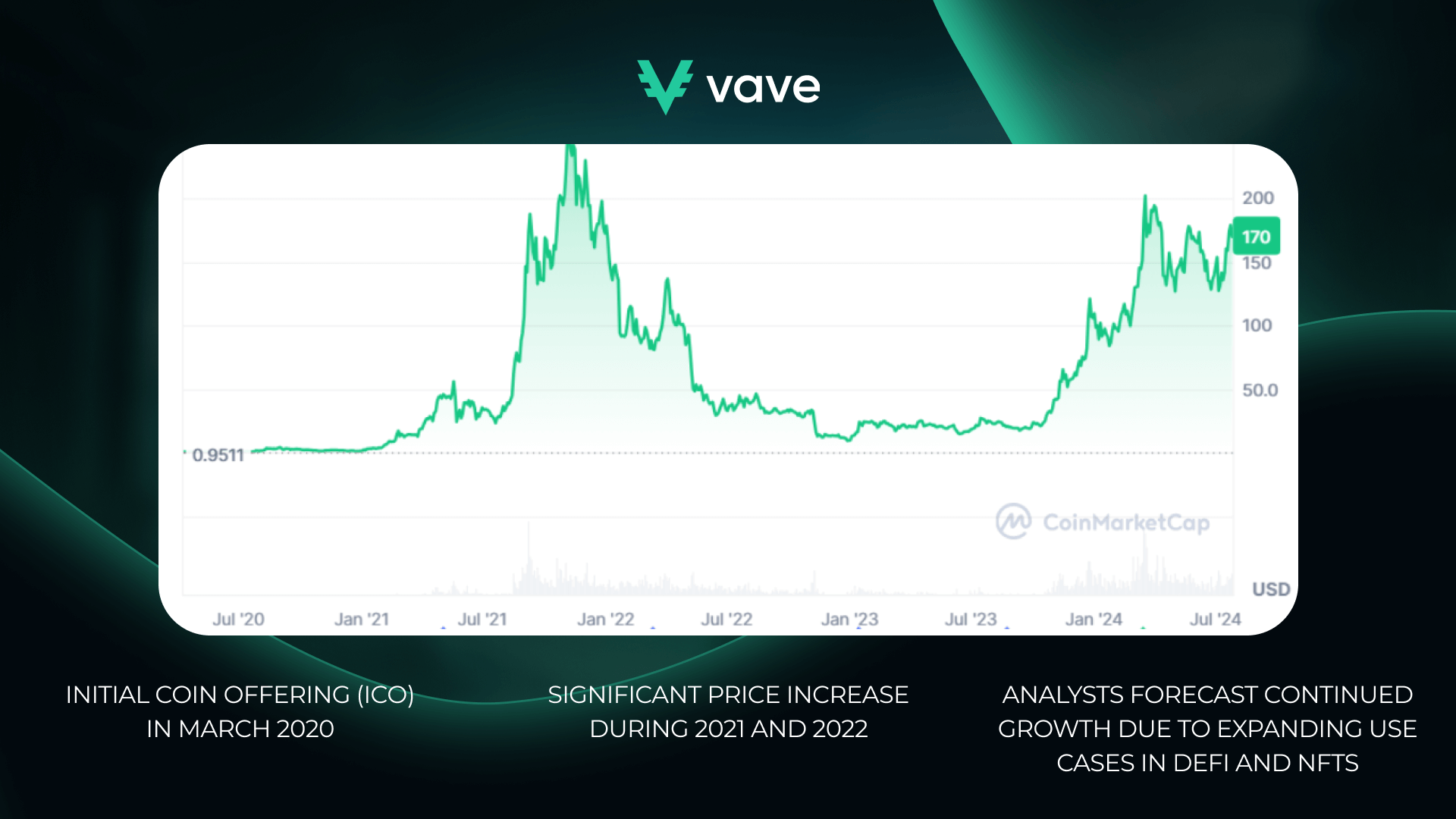

Historical Performance

Solana’s market performance has been volatile, to say the least, but that reflects the broader cryptocurrency market, not just SOL. This has made it hard to give a Solana prediction for today or tomorrow, but overall, it’s performed better than expected.

Price Trends and Growth

The currency has demonstrated impressive growth potential, with its price reaching all-time highs in 2021 at $260.00 before correcting back to its baseline.

However, if the overall cryptocurrency market’s trends are anything to pay attention to, it should be bullish in the future.

Market Sentiment

The overall market sentiment has been quite mixed over the last several years, with different parties wondering, should I buy Solana now or should I sell? As of now, the market is slightly bearish, pushing down the overall confidence people have in the project in the short term.

Future Potential of Solana

Solana Price Predictions and Forecasts:

Many Solana technical analysts predict quite a lot of growth, although it again won’t be today or tomorrow. Experts expect that Solana’s price could soar to $200 by the end of 2024 and even surpass $300 in 2025.

However, you should never take anyone’s word as gospel, so make sure you enter any cryptocurrency positions with a level of caution.

Factors Influencing Future Growth:

- Adoption of dApps: The increasing adoption of decentralized applications built on Solana could drive demand for its native token.

- Technological advancements: Continued advancements in Solana’s technology and infrastructure could enhance its performance and attract more users.

- Regulatory developments: The regulatory landscape for cryptocurrencies can have a significant impact on market sentiment and investment.

- How many Solana coins there are: Solana currently has 466.85M coins in circulation, with about 100M left to be released. As more are openly available, prices could be pushed down.

Risks and Considerations

Market Volatility

Before you buy any cryptocurrency, including Solana, you need to understand that the market is known for its volatility. Since 2016, the market has peaked twice with several periods of little to no losses or gains; before you buy any crypto, understand it won’t always be a bull market.

Understanding the Risks

Prices can fluctuate rapidly and unpredictably, meaning investing in Solana carries the risk of significant losses, just like with any other investment.

Never put more than you can afford into any investment, especially one as speculative as Crypto; you never want to sit there wondering if Solana will bounce back and recover after a drop.

Strategies to Mitigate Risks

To mitigate market volatility, consider diversifying your investment portfolio and adopting a long-term perspective.

In the long term, the price could go up and down, but by 2030, those “Solana will reach 1000” people could be right.

Technological Risks

Solana, like other cryptocurrencies, has far more security measures in place than most other payment forms, but that doesn’t mean there are no vulnerabilities. From having your wallet lost, to Solana having odd inflation rates, stuff can happen.

Potential Challenges

As with any technology, Solana faces a myriad of potential challenges and risks, including anything from security vulnerabilities and network outages to scalability limitations.

In a worst-case scenario, like really bad, let’s say an EMP gets dropped, your Solana, and any other crypto for that matter, will be quite hard to use.

Ongoing Developments and Solutions

While the chances of an EMP dropping on our heads are slim to none, Solana’s developers are continually working to address the real potential risks and flaws to hopefully improve the platform’s security, reliability, and scalability.

FAQ

Why should I buy Solana cryptocurrency and what makes it different?

How can I buy Solana (SOL)?

What are the main use cases for Solana?

Is investing in Solana (SOL) risky?