It’s no secret that cryptocurrency is making waves in the business world. What began as a small interest has now turned into a real payment option for companies in many industries. But why exactly are businesses embracing digital currencies like Bitcoin and Ethereum? Let’s walk through the reasons, challenges, and some real-life examples of brands that are leading the charge in crypto adoption. Along the way, we’ll also sprinkle in a few fascinating facts that will keep you up to date with this exciting trend.

The Reasons Businesses Are Adopting Crypto Payments

There’s no denying that crypto has a lot to offer. But what makes it so appealing to businesses? Here’s a breakdown of the key reasons.

Saving Money

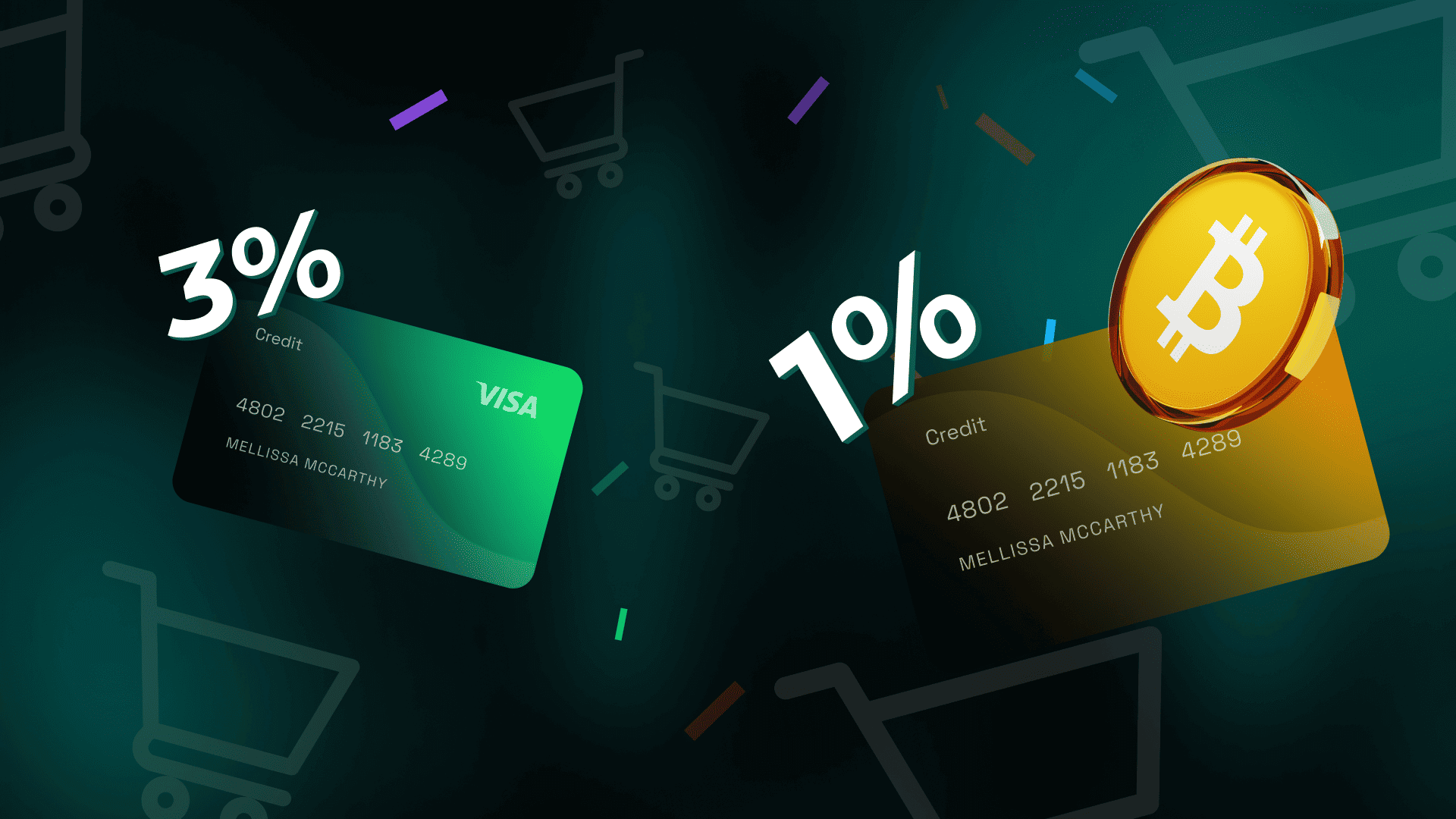

Let’s start with the most obvious benefit – saving money. Traditional payment methods, especially for international transactions, often come with hefty fees from banks and payment processors. In contrast, crypto payments can significantly cut down these costs by removing intermediaries.

Here’s an interesting tidbit: On average, businesses can save up to 3-5% on transaction fees with crypto payments compared to credit cards. This may not sound like much initially, but for companies processing thousands of payments, those savings quickly add up.

No More Fraud or Chargebacks

If you’ve ever run an online store or worked in e-commerce, you know the headache that comes with chargebacks. Crypto, however, eliminates that problem. Since blockchain transactions are irreversible, businesses don’t have to worry about fraudulent chargebacks. Once a transaction is confirmed, it’s final.

Fun fact: This feature alone is a massive draw for many retailers and e-commerce platforms looking to reduce losses from fraudulent disputes.

Find New Clients

Crypto users tend to be younger, tech-savvy, and willing to spend their digital assets. By accepting cryptocurrency, businesses can tap into this growing customer base. A recent Deloitte survey revealed that 85% of merchants believe accepting crypto allows them to attract new customers, while 77% say they’ve adopted it to lower transaction fees. Offering crypto as a payment option is like opening your store’s doors to a whole new crowd.

Benefits of Crypto Payments for Businesses

So, what’s the benefit for businesses when it comes to crypto? Besides helping cut costs and reach a bigger customer base, cryptocurrency offers several other useful advantages.

First off, transactions are a lot faster compared to traditional banking, especially for international payments. With crypto, there are no more waiting days for funds to clear – payments are often processed in minutes. This can make a big difference for businesses that need quick access to their cash flow.

Another key benefit is that businesses can operate globally without worrying about currency conversions. Whether you’re selling products to someone in Japan, Germany, or anywhere else, accepting crypto means you can skip the hassle of dealing with exchange rates. This makes international business smoother and more efficient.

And it’s not just theory – over 300 major companies around the world, including well-known names like Microsoft and PayPal, are already accepting cryptocurrencies. By joining them, businesses can open up new opportunities and simplify their payment processes.

In short, accepting crypto can streamline operations, speed up transactions, and open doors to a global crypto market.

Challenges of Crypto Payments for Businesses

Of course, it’s not all sunshine and rainbows. Adopting crypto payments also presents some challenges.

Volatility and Price Fluctuations

One of the most significant challenges is the volatility of cryptocurrencies. Bitcoin’s value, for example, can swing by hundreds or even thousands of dollars in a single day. This makes it tricky for businesses to know exactly how much they’ve earned from a transaction. Many companies manage this by immediately converting crypto into fiat currency (like dollars or euros) to avoid the risks of price fluctuations.

Scalability and Transaction Processing Speed

While crypto can be fast, there are moments when the network gets congested. This can lead to slower transaction processing times, especially during periods of high activity on blockchains like Bitcoin. It’s like traffic jams during rush hour—you can still get there, but it takes a bit longer.

Security Concerns and Potential Hacking

Security is another issue. While blockchain is incredibly secure, businesses must still take precautions to protect their crypto assets. Think multi-factor authentication, secure wallets, and strong passwords. After all, we’ve seen cases where companies have lost millions due to hacking.

Popular Brands Adopting Crypto as a Form of Payment

It’s not just small startups getting into crypto. Big brands are also making the move, proving digital currencies are here to stay. Let’s take a look at some of the companies using crypto and see how they’re leading the way. You’ll be surprised at how fast it’s becoming popular!

Microsoft

Microsoft was one of the first major companies to start accepting Bitcoin payments back in 2014, allowing customers to use the cryptocurrency to purchase games, apps, and other digital content. As a tech giant, Microsoft’s decision to embrace crypto signaled its belief in the future of digital currencies.

PayPal

In 2020, PayPal took a huge step by allowing its users to buy, sell, and hold cryptocurrencies like Bitcoin, Ethereum, Litecoin, and Bitcoin Cash. Not only that, but PayPal also lets users spend their crypto at millions of merchants globally. This move is one of the main reasons why many experts believe crypto is moving towards mainstream adoption.

Tesla

Tesla, led by Elon Musk, briefly accepted Bitcoin as payment for its electric vehicles. Although the company paused this option due to concerns over Bitcoin’s environmental impact, Tesla still holds a significant amount of Bitcoin in its reserves. Tesla’s Bitcoin holdings were valued at over $1.5 billion when it first invested.

The Future of Crypto Payments

The future of crypto payments looks incredibly promising, with many exciting developments on the horizon.

Potential for Wider Adoption Across Industries

We’re already seeing crypto being used in industries beyond tech and retail. Travel platforms like Travala let customers book hotels and flights using over 100 different cryptocurrencies. As more industries experiment with digital currencies, we could see crypto payments becoming the norm rather than the exception.

Regulation and Standardization

Governments around the world are starting to pay attention to cryptocurrency and working on clear rules for it. These new regulations can make crypto usage safer and easier for businesses, offering clear guidance on taxes and legal requirements. Having such regulations is a positive step because it can give crypto a strong legal base, and make more businesses feel confident about accepting it.

The Rise of Central Bank Digital Currencies (CBDCs)

Many central banks are exploring the idea of creating their own digital currencies, known as Central Bank Digital Currencies (CBDCs). These government-backed assets could offer the benefits of crypto with the stability of fiat money. For you to know, nearly 86% of the world’s central banks are researching or developing CBDCs.

Impact on Traditional Payment Methods

As crypto grows, it could start competing with traditional payment methods. While credit cards and bank transfers won’t disappear anytime soon, businesses that offer additional payment options will have the upper hand. Think of it as giving your customers more choices – and we all know how much people love options.

Final Take

Cryptocurrency offers businesses a new way to handle payments, with benefits ranging from lower fees to reaching a new, tech-savvy audience. However, as with any innovation, it comes with challenges like volatility and security concerns. Brands like Microsoft, PayPal, and Tesla are already leading the way, and the future looks bright as more industries adopt digital currencies. With clearer regulations and the rise of CBDCs, crypto payments are set to play a major role in the future of e-commerce.

FAQ

Can a cryptocurrency transaction be canceled?

Why is the Bitcoin system considered safe and transparent?