For years, cryptocurrency has been one of the most popular investment trends. However, as much as there are profitable crypto investors, scams have also increased. The most notorious of these scams is the crypto rug pull. In this article, we’ll provide tips for spotting a rug pull and safety measures to prevent falling victim to scams.

What is a Rug Pull?

A rug pull is the term used when developers of a crypto project withdraw support and liquidity from their new project immediately after it’s released, leaving investors with worthless tokens. Here’s how it typically unfolds:

- Creation of a Project: Developers create a new token or project, make bold claims, and hype the product to attract buyers.

- Attracting Investors: They attract investors by promising high returns and generating hype through social media and influencers.

- Liquidity Withdrawal: Developers remove all liquidity from the project once enough money has been invested.

- Escape: Developers disappear with their investors’ money. Because of the lack of new developments, the project collapses.

Examples of Rug Pulls in Crypto History

There have been many rug pulls over the years; however, the following are some of the biggest in cryptocurrency history.

Squid Game

The Squid Game token was introduced in October 2021, inspired by the Netflix series. It witnessed a spike in popularity after the show’s debut. The company behind it promoted the project as a play-to-earn cryptocurrency. But before the project was completed, the developers took off with an estimated $3.36 million of investors’ money, and the token’s price plummeted to zero.

OneCoin

OneCoin was a Ponzi scheme packaged as a cryptocurrency. Launched in 2014 by the Bulgarian Ruja Ignatova, the project attracted billions of dollars from investors worldwide despite having no actual blockchain or coin. Ignatova disappeared in 2017, and authorities eventually admitted that OneCoin was a scam. Investors lost nearly $4.4 billion in one of the most significant and devastating crypto scams to date.

Luna Yield

In 2021, a yield farming project called Luna Yield on the Solana blockchain conducted a rug pull just a few hours after its launch. Its anonymous team disappeared with roughly $10 million worth of investments. Luna Yield’s departure also revealed the dangers posed by decentralized finance (DeFi); a way out is to identify and avoid these rug pulls.

How to Identify Rug Pulls

There are signs, and you should look out for them to avoid falling victim to a rug pull. These signs can be seen if you check for social authority, project liquidity, token allocation, and the project whitepaper. In this section, we will explore these crucial signs and how they can help you identify crypto rug pull.

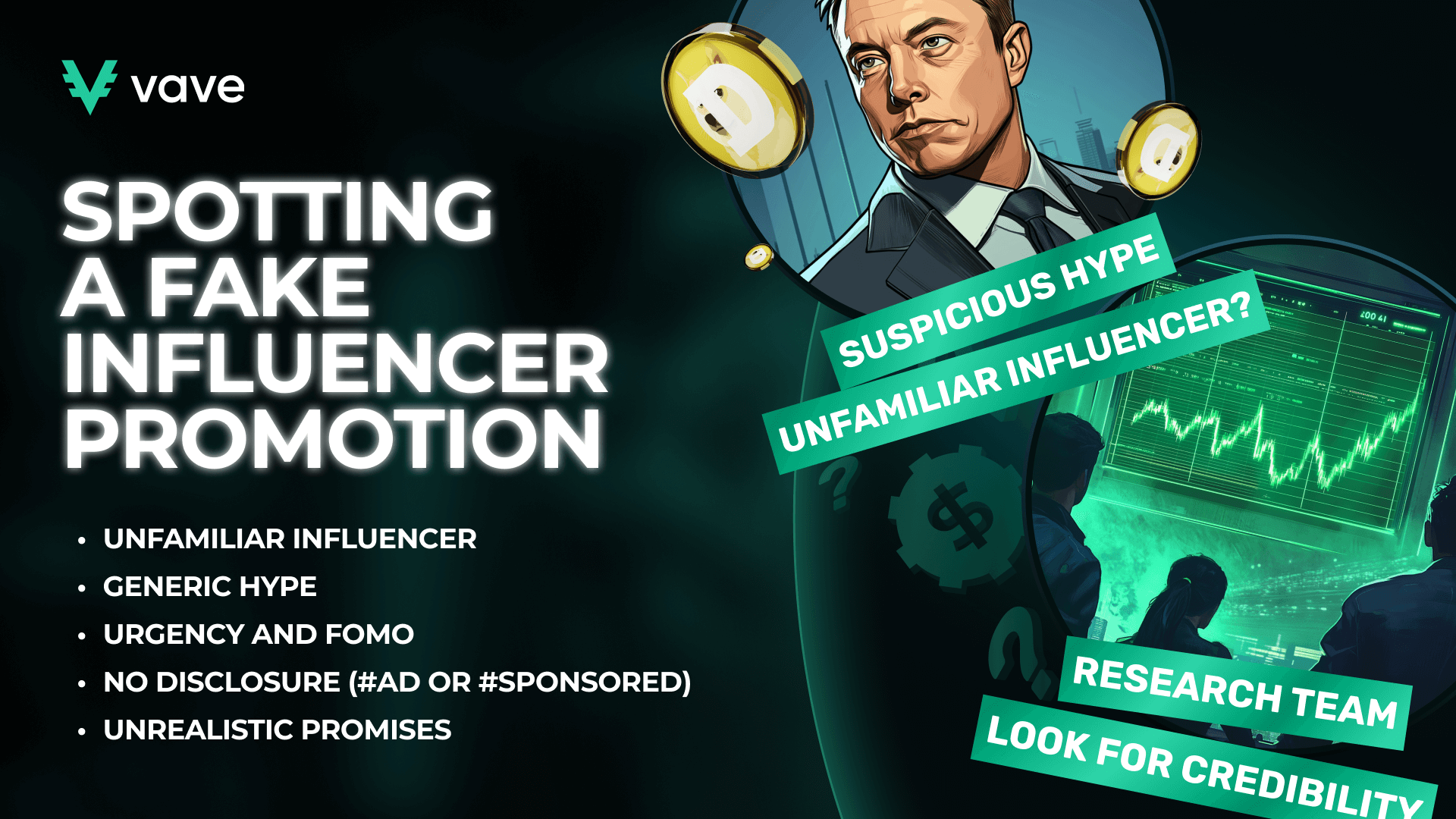

Social Authority

While there are many factors to consider if you want to know how to identify a rug pull before investing, social media answers many questions. Look at how active they are on Twitter, Telegram, Discord, or Reddit. A legitimate project typically has an active community of developers who talk to potential investors openly and consistently.

While this method works, some rug-pull projects can go the extra mile to scam you by creating a fake social media presence. So, compare their subscribers with engagement. Avoid projects with many subscribers but only a few active members. Additionally, take note of media coverage. Reputable crypto blogs will cover legitimate projects, whereas rug pulls will likely be covered only by low-quality or paid-for-promotion sites.

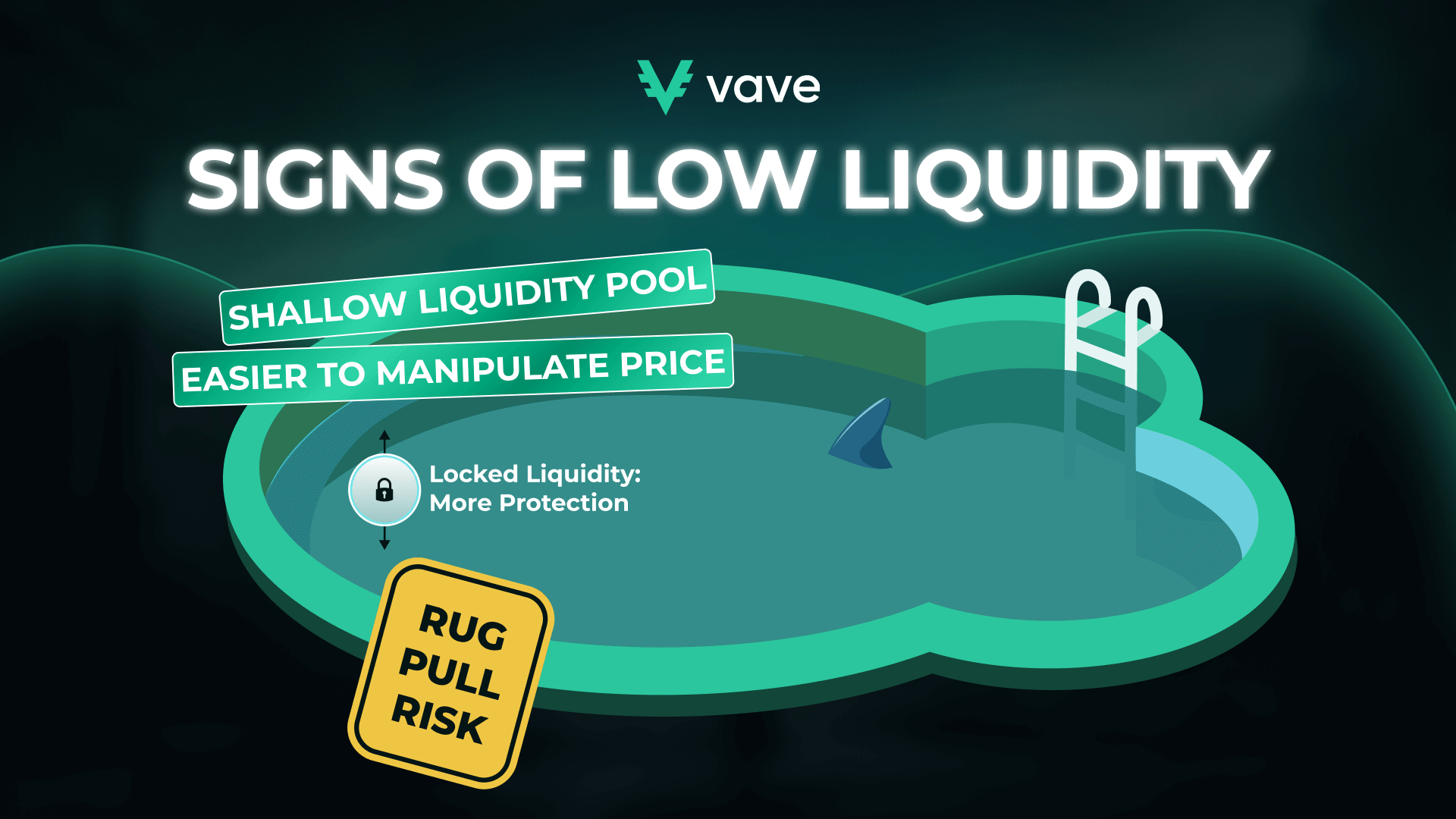

Project’s Liquidity

Among the red flags for crypto scams, look out for if the project lacks secured liquidity. Developers can withdraw all investors’ money without checks or adequately protected liquidity. Look out how much liquidity the token has on decentralized exchanges and if they are locked. Locked liquidity in crypto ensures your tokens can’t be withdrawn at any time by developers. Another factor you should look out for is the token’s trading volume.

Low trading volume, especially for a project claiming to be popular, is a strong indication of a potential rug pull. A balanced and transparent liquidity pool is less likely to house a scam.

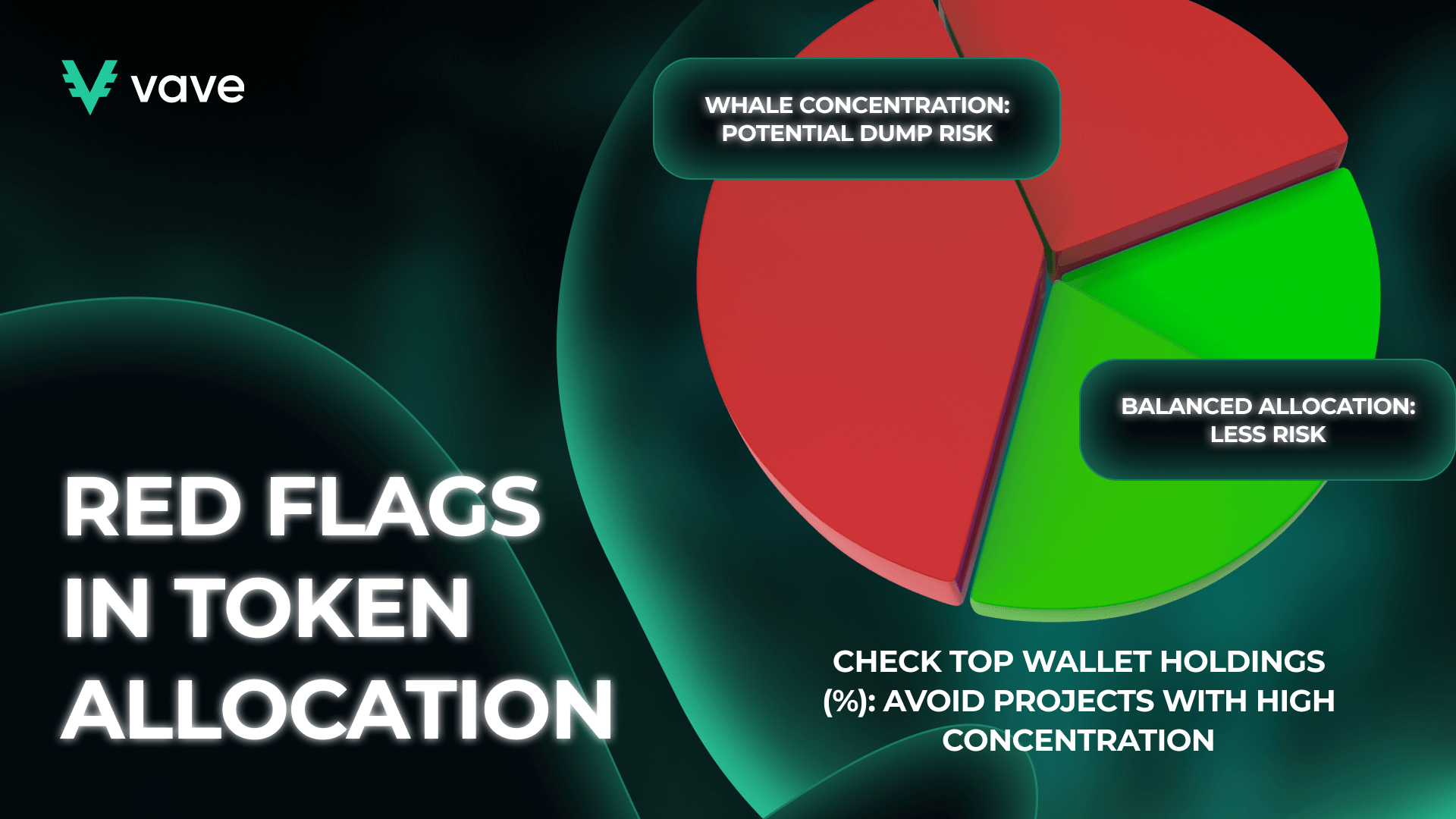

Token Allocation

Other tools to identify crypto scams are to check for projects with low token distribution. If a chunk of the token supply is allocated to developers or held by just a few insiders, then the project will likely be a scam. This kind of central control creates opportunities for price manipulation or sell-offs that could tank the token’s value. Similarly, a fair distribution ensures that no person or entity can dominate the market.

Legitimate projects will include a transparent breakdown of token distribution. Also, legit tokens reserve a considerable portion for development, promotion, and community rewards rather than concentrating them in the hands of a select few.

Project Whitepaper

Every project has a whitepaper that describes its mission and goals. If the whitepaper is well structured, this is good for the project. It proves that the developers are serious. Make sure that the whitepaper has a clear roadmap, including realistic milestones. Also, check its technical explanations. If the language is vague or overly technical, it is probably an intentional tactic to confuse you.

Avoid projects whose whitepapers are filled with buzzwords and provide little to no details on how they intend to accomplish their stated goals; for instance, legitimate projects will provide an audit of their code (performed by a third-party security firm).

Best Advice to Avoid Rug Pulls

The tips in the section above will help you identify rug pulls. However, scam developers constantly devise new ways to avoid detection. So, what happens if you fail to spot a rug pull project? Below are tips on how to avoid crypto rug pulls.

Invest in Reputable Platforms

To avoid falling victim, use only well-established cryptocurrency exchanges, such as Binance, Coinbase, or Kraken. These reputable platforms vet projects before listing them on their exchange, reducing the risk of rug pulls. Investing in a reputable platform is the most critical crypto scam prevention strategy.

Be Wary of High Returns Promises

A project offering unbelievable returns in a very short period is most likely a scam. Tokens that will likely grow will consider gains over the longer term, not a fast and unbelievable yield.

Look for Security Audits

A project with an audit performed by a third party is less likely to be a scam. Audits help ensure the project’s code is secure and free from vulnerabilities.

Avoid FOMO (Fear of Missing Out)

Don’t just jump into an investment because you think you’ll miss out. Instead, make sure you have a reason to invest by evaluating the project.

Verify Smart Contracts

Carry out personal crypto project research, make sure there’s a smart contract. Also, check to see if it’s open source. Open-source, well-reviewed smart contracts are less likely to result in rug pulls.

Glossary of Terms

One of the best practices for crypto investment research is knowing key cryptocurrency terms. This will help you understand the intricacies of blockchain and digital assets. Here are important terms, especially when learning about rug pulls and related risks:

- DeFi (Decentralized Finance): This is a financial system that is built on blockchain technology. The structure eliminates the need for banks and similar middlemen. It offers financial services such as lending, borrowing, and trading through “smart contracts”. There have been incidents of DeFi rug pull. Avoid falling into such traps, and ensure you stay safe.

- NFT (Non-Fungible Token): What is an NFT (non-fungible token)? This is a digital token that ‘represents ownership’ of an item, usually art, music, etc, that’s stored on the blockchain. Unlike cryptocurrencies, NFTs aren’t interchangeable. They have unique values. NFT rug pull is also common in the industry.

- FOMO (Fear of Missing Out): This is a feeling of not wanting to miss out on investment in a project. This fear is influenced by widespread hype and sentiment surrounding a project. FOMO in the crypto world leads many investors to make irrational decisions without properly researching a project. Wondering how FOMO (fear of missing out) fuels rug pulls? The answer is simple, FOMO limits your ability to make rational investment decisions.

- Liquidity Lock: This safeguard mechanism ensures that a percentage of the project’s liquidity is locked for a fixed time so the developer or a single person can’t rug pull on the project. Liquidity lock protects you from both developers and whale wallets in crypto.

Real-World Examples of Crypto Rug Pulls

The history of crypto has witnessed several rug pulls in which people lost large sums of money in scam projects. If you suspect a scam, don’t hesitate to reach out to available resources for reporting crypto scams. Learning about these scams will help you avoid another rug pull. Here is a list of some real-world rug pulls that shook the crypto space:

- Thodex: At one point, Thodex was Turkey’s biggest crypto exchange. Without warning it shut down suddenly in 2021, leaving almost half a million users locked out of their accounts. Its founder, Faruk Fatih Özer, is reported to have fled the country with around $2 billion of investor funds. Thodex promised big returns on investment. This rug pull is one of the biggest in crypto history.

- AnubisDAO: This was a decentralized finance (DeFi) project that began trading in October 2021. Within 24 hours, all the AnubisDAO project’s liquidity was drained away. The anonymous developers were nowhere to be found. AnubisDAO investors were left stranded.

- Compounder Finance: In November 2020, another DeFi project called Compounder Finance pulled a similar scam on its investors, draining more than $12.5 million after exploiting a security bug in its own smart contract code.

Conclusion

The prevalence of crypto rug pulls emphasizes the need to be cautious. Start by doing a Google search on the projects. Avoid anything that sounds too good to be true, and ensure that the teams and smart contracts have been verified. Always use trusted exchanges and avoid anonymous projects. Understanding whale manipulation in crypto will also help you stay safe. Finally, don’t put all your eggs in one basket, you cannot underestimate the importance of diversification in crypto portfolio, this way, if you fall victim to rug pull on one project, you can profit on others.

FAQ

What Are Some Warning Signs of a Rug Pull?

How Can You Protect Your Crypto Assets From Rug Pulls?

Is It Possible to Invest in Crypto Without Risking a Rug Pull?