It is well-known that Bitcoin’s price is highly volatile. This cryptocurrency has encountered a lot of challenges. Moreover, it has yet to reach its most recent peak of $69,000 since March 2024. Regardless, it has demonstrated concrete growth over a long-term period.

Bitcoin (BTC) has the potential to rise significantly in the coming years if its use expands and major businesses start accepting it alongside “traditional” currencies.

In this article, we will cover different methods of indirect Bitcoin investment and provide you with all the information you need to invest in crypto without exposing yourself directly to it. So let’s begin!

Understanding Indirect Bitcoin Investment

Bitcoin is a virtual currency created to act as money and a form of payment outside the control of any person, group, commodity, or entity. As such, it removes the need for trusted third-party involvement (e.g., a mint or bank) in financial transactions.

The cryptocurrency was introduced to the public in 2009 by an anonymous developer or group of developers using the name Satoshi Nakamoto. As you imagine, since then, it has become the most well-known and largest cryptocurrency in the world.

There are several ways of using Bitcoin, even if you don’t want to mine it. For instance, you can buy it using a cryptocurrency exchange. Most people are unable to purchase an entire BTC because of its price, but you can buy portions of it. This can be done on numerous exchanges in fiat currency, such as U.S. dollars.

While Bitcoin was initially designed and released as a peer-to-peer payment method, its use cases are constantly growing. This is due to its increasing importance and challenges from other blockchains and cryptocurrencies.

Benefits of Investing in Bitcoin Indirectly

There are several options if you are not very keen on opening an account on a crypto exchange. You can also invest in Bitcoin indirectly through conventional methods such as stocks, mutual funds, and Exchange-Traded Funds (ETFs).

There are, quite naturally, a lot of pros and cons to consider, including security, fees, and the risk of losses. However, indirect cryptocurrency investment methods come with their own perks:

- Diversification: Purchasing stocks or funds that include Bitcoin offers a diversified investment portfolio.

- Accessibility: Using traditional financial tools and having the possibility to purchase a fraction of a Bitcoin makes it more convenient for inexperienced or average users.

- Reduced Risks: Having a diversified portfolio can mitigate the risks associated with crypto trading.

Choosing the Right Indirect Investment Method for You

Yes, we get it – knowing how to invest in crypto is not an easy task at all, due to the complexity of blockchain technology, the hype surrounding it, and the many available digital coins. Therefore, the first natural step is to get up to speed on the fundamentals of cryptocurrencies.

Learning how blockchain technology underpins them and the type of crypto wallet you will need is crucial. Fathoming the differences between cryptocurrencies like Bitcoin, Ether, and altcoins will also give you a massive advantage.

Ways to Invest in Bitcoin Without Buying One

Before getting into the details, we have to understand what ‘indirect’ means here. Indirect investment in Bitcoin is a nice way to benefit from the crypto market’s effects without actually buying it. This approach can help you stand out from your competitors by getting exposure to Bitcoin’s price movements without directly holding the asset.

In the following sections, we will explore different financial products and services that offer exposure to Bitcoin without requiring direct ownership. Some of these methods include investing in stocks, cloud mining, and ETFs, each with their own risks and benefits.

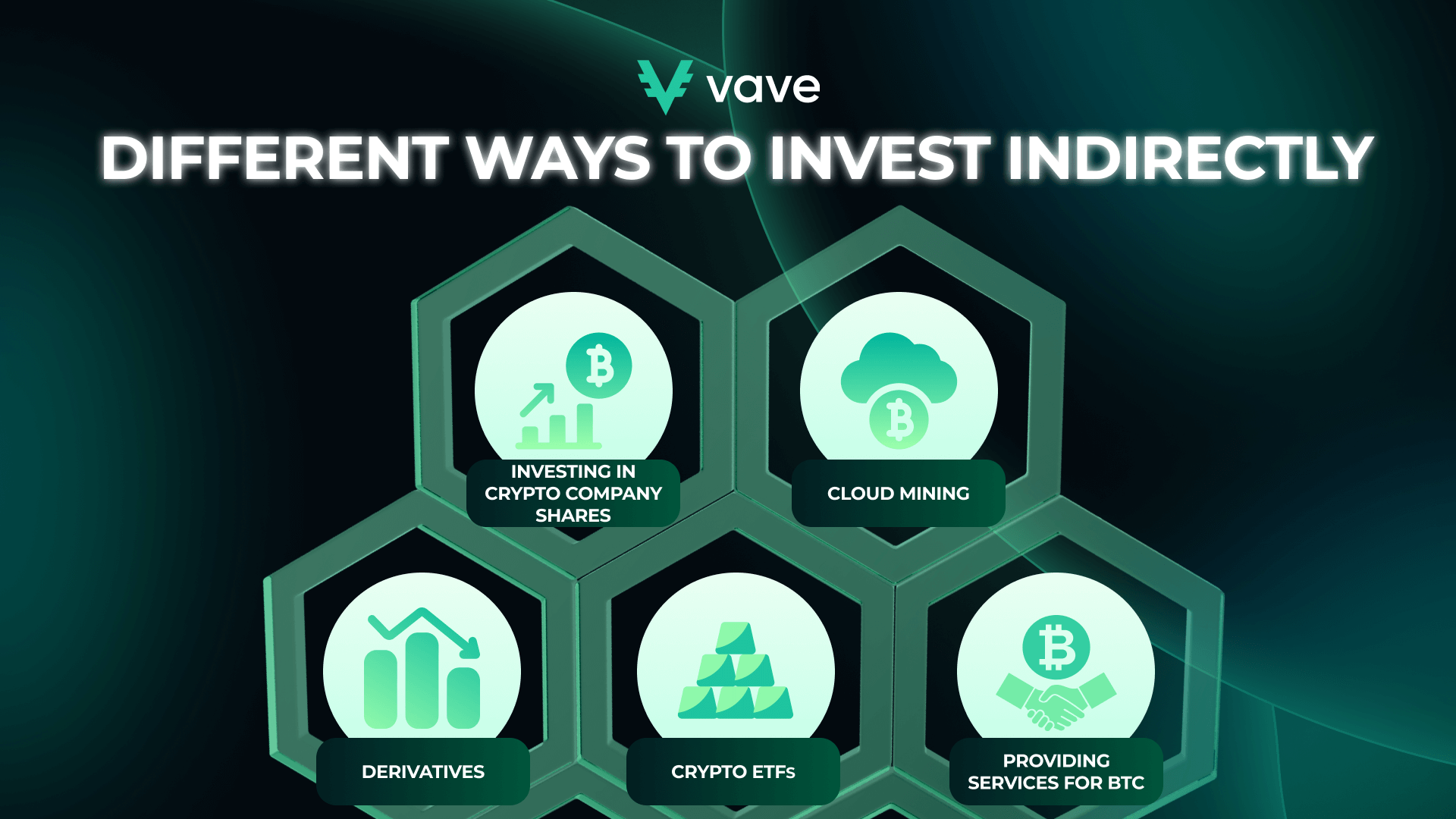

1) Investing in Crypto Company Shares & Stocks

The world of crypto isn’t all about digital coins. There are a lot of big companies that work with the blockchain technology behind these coins. If you are curious about how to invest in Bitcoin without buying Bitcoin, you can consider investing in these organizations that operate behind the scenes. It is like owning a piece of a company that is part of the crypto world without taking excessive risks.

You can buy shares and stocks through legitimate places such as stock exchanges and brokerage accounts. This way, you are not directly buying Bitcoin but still getting a chance to be part of the action. Your risk remains minimal but the reward is high.

2) Investing in Cloud Mining

Cloud mining is another way to invest in crypto coins without directly owning or managing them. With this method, you can earn crypto coins by renting computing power from other companies with mining setups. You have to pay regular fees, and in return, you get a share of the total profit from mining.

This is a convenient approach because you do not have to worry about maintaining the machines, which require a lot of servicing to operate at full capacity. Still, investing in companies that mine Bitcoin can be dangerous because the value of BTC fluctuates a lot. Mining is hard and needs a lot of dynamism. Furthermore, the regulations governing Bitcoin could change, thus making it harder for these companies to make a good profit.

3) Understanding How Derivatives Can Help You Invest in Bitcoin Indirectly

If given the opportunity to do so, you can also consider derivatives. They are special tools that let you participate in cryptocurrencies without owning them. They allow you to predict how the prices of Bitcoin (or cryptos in general) might change and how well they perform in the future, without actually having to buy them.

It is essential to understand that using derivatives can be more challenging than it might sound. They come with their own set of risks and things to understand. Before you decide to take the plunge, do some research and take the time to learn how they work and what could happen if things don’t go as planned.

4) Buying Crypto ETFs

Exchange-traded funds are financial instruments that offer exposure to various assets, including cryptocurrencies. Instead of buying individual tokens, investors can buy and sell shares in the corresponding ETF. These funds are usually supported by major financial organisations. Thus, they can lend a great degree of stability to your investment.

Crypto ETFs are attractive for those looking for an indirect, diversified way of crypto investing but just like any asset, they come with risks. Sometimes, ETFs may not perfectly track the performance of their underlying assets which can lead to discrepancies. Also, they can be very volatile and are often accompanied by management fees that can greatly reduce your returns.

So, if you prefer direct investment at the end of they day, you can always use a crypto wallet to buy Bitcoin and wait for the right moment to sell it.

5) Providing Services in Exchange for BTC

The last but by no means the least effective method of investing in Bitcoin without buying it is by offering services and accepting BTC as a payment method. This can work well for freelancers and other service providers.

By using this method, you can collect Bitcoin through various platforms that allow you to receive payments in cryptocurrency for your services. Consequently, clients will be able to pay you by adding your Bitcoin wallet address to the invoices.

Taking the First Step: How to Start Your Indirect Bitcoin Investment Journey

Taking the first step in your investment journey is challenging and there is surely no easy way to do it. If you prefer a more orthodox investment strategy, you can gain exposure to the crypto market via your existing share trading account by investing in crypto ETFs or publicly listed companies. These methods provide a way to benefit from the growth of Bitcoin and other cryptocurrencies without directly owning them.

Once you take the first step in indirect investment, the rest of the journey will become easier as you will find it more manageable and rewarding over time.

Conclusion

The convergence of conventional finance and cryptocurrency markets has opened up a lot of new opportunities for savvy investors and entrepreneurs to explore the blockchain world with minimal effort.

By choosing indirect investment, you can mitigate some of the risks associated with direct cryptocurrency trading while still participating in the market’s potential growth. Nonetheless, you must understand the risks involved and consider your strategies and needs before dipping your toes in it.

Read more:

FAQ

Is Bitcoin worth investing in?

Which investment method has zero risk?

Is Bitcoin safe to invest in?