One of the most endearing features of the cryptocurrency industry is its ability to always offer something new and ways to earn. This yield farming guide shares insights on strategies for making passive income through yield farming and staking. There are several investment opportunities, but the extent of risk and the time these investments demand differ for each strategy.

This write-up will help you understand yield farming and its advantages and disadvantages. You’ll learn how it works and which one best fits your requirements in the context of decentralized finance (DeFi).

What Is Yield Farming?

Yield farming is an investment strategy that allows you to receive rewards when you deposit your token into liquidity pools. It is similar to planting a seed: your token is the seed, and the yield farming platform is the field. As your crypto grows, you earn rewards.

How Yield Farming Works

Yield farming platforms use liquidity pools to manage tokens for different financial activities. A liquidity pool is like a shared fund where people deposit their tokens to earn passive rewards. These deposited tokens make it possible for others to trade or use the funds for specific purposes. Whenever a transaction happens within the pool, the rewards or losses affect everyone contributing to the pool.

Once liquidity is provided by placing your cryptocurrency in any pool, it’s understood that the user will be a liquidity provider and will earn based on a sharing ratio coded into smart contracts.

Key Platforms and Protocols for Yield Farming

The platform or decentralized exchanges (DEXs) you use play a crucial role in determining the success of your investment. So, you need to conduct proper research before investing. Some tested and trusted platforms where you can gain yield farming rewards include:

- Uniswap

- Aave

- Yearn Finance

- SushiSwap

What Is Staking?

Crypto staking strategies involve locking your crypto to a blockchain network/liquidity provider. As a result, your reward will be a percentage of the total token staked. Like yield farming, this is another way to earn the right to participate in proof-of-stake blockchains.

Here’s how staking works: if a blockchain network offers a 10% reward over one month, and you stake 200 tokens, you will receive 20 additional tokens as a reward at the end of the period.

How Staking Works

The process of staking for passive income is easy. First, you need to own a crypto that uses a proof-of-stake blockchain. When you fund your tokens, you can delegate the amount you want to put up for staking at your discretion. You can select from different staking pools to find a validator.

The administrators will combine your assets with other investors’ assets to increase your chances of generating blocks. As a reward for participating in the network validation and locking your token, you will receive interest, known as “staking rewards.”

Popular Staking Platforms and Cryptocurrencies

Like farming, choosing reliable crypto-staking sites to secure your assets is essential. Some popular staking platforms include:

- Ethereum 2.0

- Cardano (ADA)

- Solana (SOL)

Yield Farming vs. Staking: A Comparative Overview

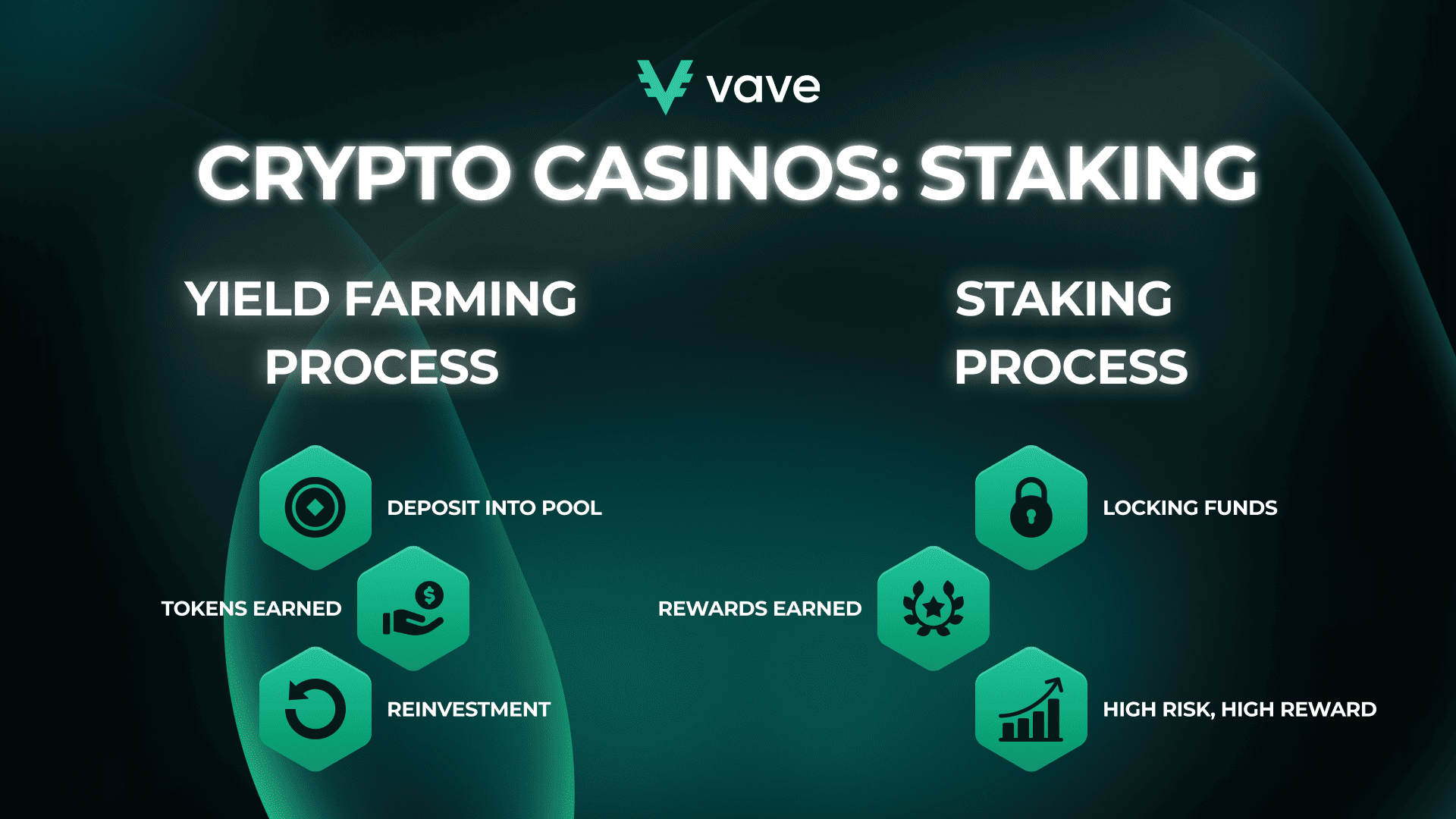

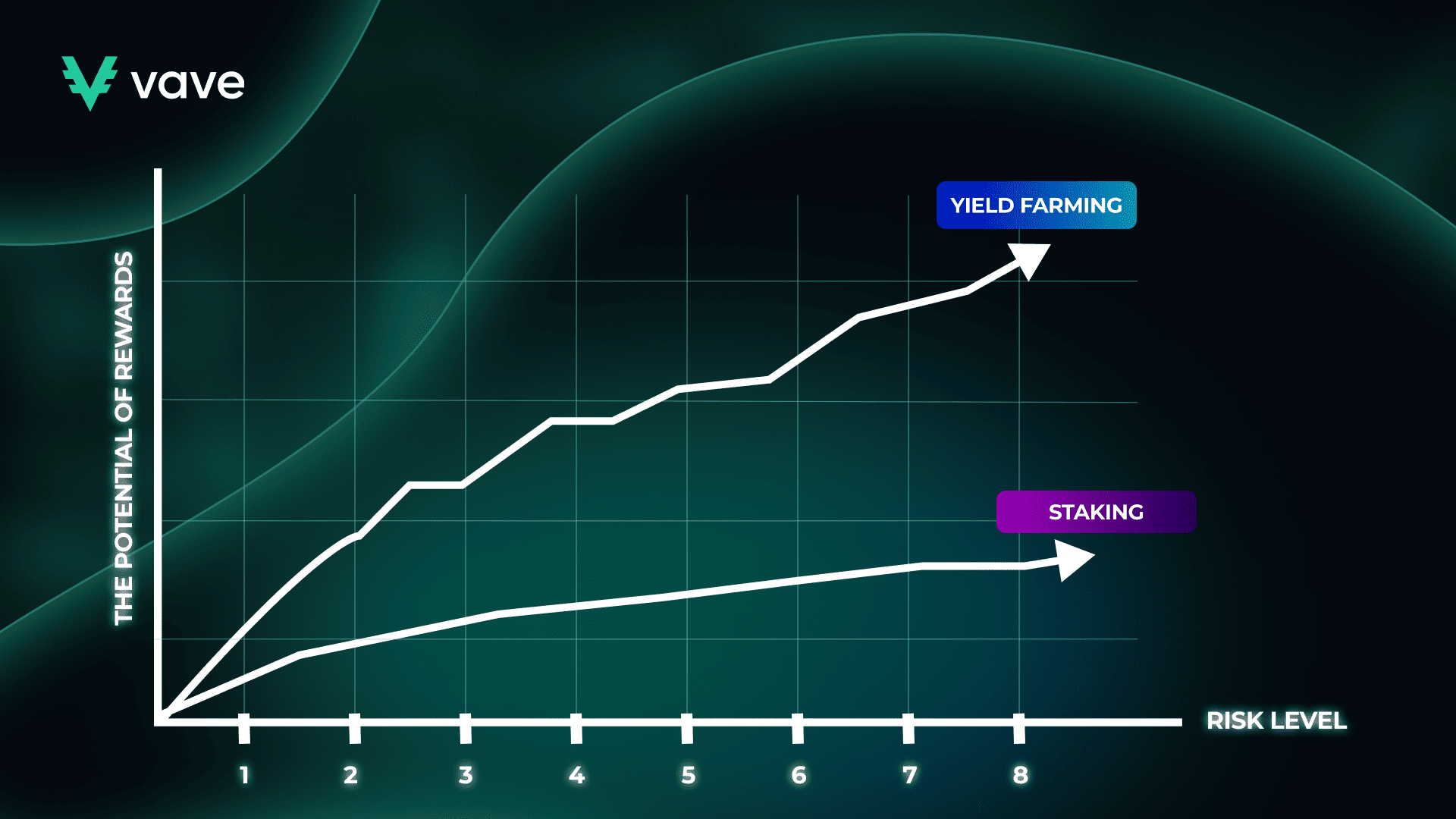

The fundamental differences between staking and farming are risks, complexity, and returns. With yield farming, you must constantly shift funds across different DeFi protocols to optimize your earnings. Staking requires less work as it uses more straightforward validation protocols. Here are five differences between these two investment strategies:

Returns and Profitability

Staking vs. farming returns distinguish these strategies. The profit margins are significantly different; farming usually generates higher profits but exposes you to smart contract vulnerabilities, hacks, and technical issues. On the other hand, staking crypto is steadier, safer, and more straightforward but offers lower income.

Complexity and User Experience

Another difference between yield farming and staking crypto is complexity and user experience. Your overall experience will affect your ability to make a profit. Yield farming is generally more complex: you need to understand decentralized finance (DeFi) protocols, liquidity pools, and market structure before becoming profitable.

To optimize earnings in yield farming, you’ll also need to navigate multiple platforms and monitor various assets. At the same time, you must monitor your profit. This whole thing can be very stressful, even for seasoned professionals, but you’re guaranteed a considerable profit margin.

By contrast, staking is simple and offers a far more straightforward user experience. Many blockchain networks have user-friendly wallets and interfaces that allow you to quickly select a validator and lock up some of your tokens.

Risk Factors

In yield farming, there are significant risks. Price fluctuations during the farming process may lead to loss. On the contrary, there is almost no risk in staking. But it’s fair to note that any of these strategies carries risk. The staking of crypto assets carries certain risks, which include slashing. Because the tokens are locked, this particular aspect limits liquidity, too. Moreover, the tokens you’ve staked are also subject to some risks regarding the price.

Liquidity and Flexibility

Another critical difference between these trading strategies is that yield farming has much greater liquidity and flexibility compared to staking. Yield farming allows you to move your assets from one DeFi pool to another, which provides scope for a more varied asset allocation, enabling you to take advantage of short-term opportunities.

In contrast, when staking, you lock your assets for a period, which means they have less liquidity. The inability to liquidate funds quickly is a disadvantage if you prefer quick access to your investments.

The upside is that staking compensates for its lack of substantial liquidity with stability.

Platform Security and Reliability

Yield farming depends on smart contracts for security, so if you invest in poorly verified platforms, you risk losing your assets to scam projects. Staking, by comparison, operates within more secure, established blockchain networks. This, however, does not make you immune to risk when staking. If you choose to stake your asset, you will continually be exposed to slashing.

Factors to Consider When Choosing Between Yield Farming and Staking

Focusing on the complexity of each strategy will give you a clearer picture of how to navigate the market and profit from it. It’s very important for you to pick the plan that aligns with your investment goals. In this section, we’ll look at the most critical factors to consider before choosing between each method.

Personal Investment Goals and Risk Tolerance

Your choice should depend on how well it fits with your personal investment goals. Invest in farming if you’re looking for massive earnings and are comfortable with risk. But if you want steady growth, then staking is the way to go.

Market Conditions and Cryptocurrency Trends

Market conditions play a significant role. Yield farming can give you extraordinary returns during bull markets when there’s a lot of demand for liquidity. In bear markets, staking becomes more profitable because changes do not influence token rewards.

Available Platforms and Their Features

As earlier stated, the choice of platform is crucial. Different platforms have different levels of security and reliability, and user experience varies. Check between platforms before you settle. Finally, transaction fees and minimum investment size should also influence your decision.

Tips for Successful Yield Farming and Staking

Like other crypto investment strategies, farming and staking require risk management and consistency. These staking and yield farming tips will help you make the right decisions, improve your profit, and reduce risks. Here are some of the best yield farming strategies:

- Diversify Your Investments: To minimize risk, consider spreading your capital across multiple platforms.

- Research Platforms Thoroughly: Invest only in platforms with good reputations.

- Monitor Market Conditions: It’s essential to stay updated on trends and market sentiment.

- Stay Updated on Regulations and Risks: Be aware of evolving regulations and legal risks.

Future Trends in Yield Farming and Staking

Trends to watch out for in the future include increased institutional adoption. With institutional involvement in yield farming and staking, expect more liquidity. Also, the market will be stable, and interoperability between blockchains is expected. This will open up new cross-platform yield opportunities. Also, with Layer 2 solutions, there will be an attempt to scale and decrease transaction fees.

Moreover, automated yield optimizer tools will improve staking or farming. As regulators take more interest in DeFi, there will be more compliance, and platforms will be more security-conscious. These trends should make DeFi accessible and more resilient, especially for newcomers.

Conclusion

Yield farming and staking have been around for some time. Investing in either strategy provides you with an opportunity to earn passive income. Both have unique structures that meet different investment plans. Yield farming has high risk but can help you win big, while staking is more stable but with a lower profit margin. It’s up to you to choose the investment that suits you best.