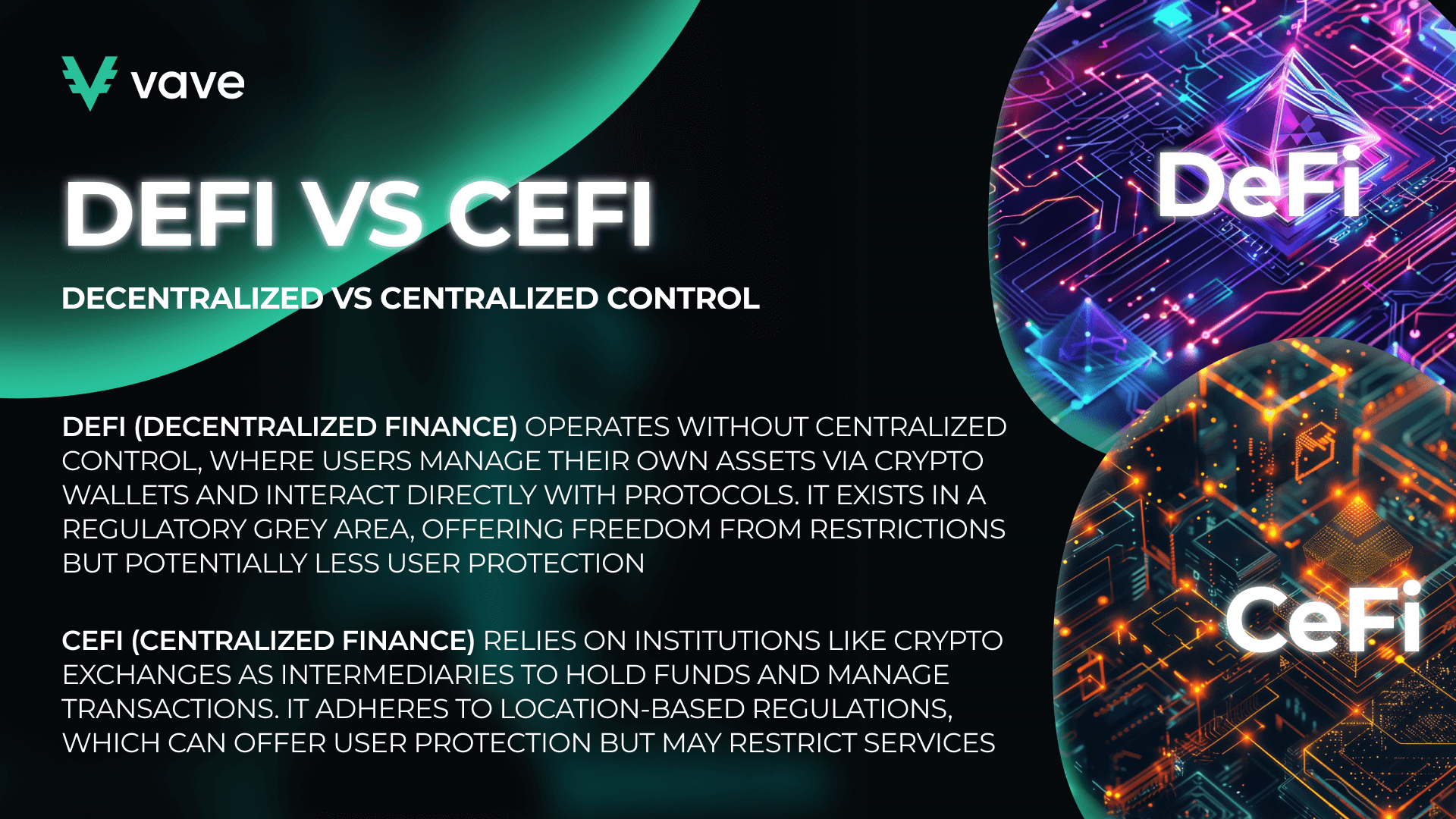

Understanding the Financial Landscape: DeFi vs CeFi Explained

Are you a crypto rookie? Or a veteran in this highly competitive field? No matter how much you are an expert in blockchain and general finance, it’s great to sometimes mix up the common ideas that seem easy to others. For instance, do you know what the difference is between Centralized and Decentralized Finance? Changing only one letter “C” (in CeFi) with the “D” (in DeFi) will lead to an entirely different financial landscape.

Even though both are related to cryptocurrencies, each system offers its unique features. So, for crypto enthusiasts who are really keen to learn about the differences between DeFi and CeFi, no worries. Just enjoy reading this review to learn more.

This article will cover the basic stuff that you must understand in the DeFi/CeFi dimension. Moreover, we will compare DeFi and CeFi while highlighting their benefits, drawbacks, and cons. Now, it is time to start!

What Is DeFi in Simple Words

The #1 question is: What is decentralized finance? Decentralized finance, or DeFi, is a pioneering financial model that uses blockchain technology to enable actors to lend money, trade assets, or earn interest. Now, it is time to explore the variety of pros and cons of DeFi.

Pros and Cons of DeFi

DeFi offers plenty of advantages. First, you can save money by reducing the transaction fees. Second, with DeFi, you enjoy 100% control over your funds; no third parties are involved in transactions. This is fantastic for security!

Although we believe that DeFi has changed the classic financial landscape to a more advanced version, some cons might make you wonder, “Is DeFi safe?” The biggest issue is that you may face security issues like hackers trying to steal your crypto assets. Also, DeFi can’t provide any valid insurance if you’re experiencing financial problems.

Plus, some DeFi issues can be hard to understand, especially for new blockchain devotees. Finally, you can pay higher transaction fees due to the network congestion.

How to Make Money with DeFi

How to trade DeFi, that is the question! The best thing about DeFi is that you can trade assets using both its general and specific financial services. One way to make money is by trading. You can use decentralized exchanges (DEX) to trade assets peer-to-peer, which means without third parties. P2P trading is a good option for earning money with middlemen involved. You only need to have a crypto wallet, known as a DeFi wallet sometimes, and understand the decentralized trading basics.

Moreover, you can use decentralized lending and borrowing services to lend your assets and earn interest. By the way, do you know what “flash loans” are? This is a fast trading feature that allows you to borrow money with just a little collateral. These are uncollateralized loans that the DeFi ecosystem offers. Funds are borrowed and returned within the same blockchain transaction.

Smart contracts facilitate these flash loans. You don’t need upfront collateral, and this is why flash loans are pretty unique tools in the financial world. Just make a list of the best DeFi platforms and choose a reliable one to keep your crypto assets working. The trick is to smartly use arbitrage when you take advantage of different prices on different DeFi exchanges. As you can see, it is all about catching the moment!

Another curious DeFi option is “yield farming.” This is about depositing tokens into a liquidity pool on a DeFi protocol to earn rewards. These rewards are typically paid out in the protocol’s governance token. There are different types of DeFi yield farming to choose from. Yet, the most common involve depositing cryptocurrency in either a DeFi lending or trading pool to provide liquidity. Look for a reliable yield farming platform like Uniswap or Sushiswap.

Finally, staking is another way to make money in DeFi. It is about crypto investing and earning interest. You lock your crypto assets for a set period to help support the operation of a blockchain. In return for staking your crypto, you earn more cryptocurrency as interest based on the preset percentage.

Drawbacks of DeFi: Security Risks, Complexity, and Limited Use Cases

DeFi, though an advanced financial model, is not without its drawbacks. There are risks of DeFi flash loans as well as issues with yield farming and staking. Want to know more about it? You can conduct your own research to train as a DeFi devotee.

The biggest liability is that cryptocurrency has high volatility by its nature, unlike most fiat currencies. Bitcoin and other cryptocurrencies can go up and down, though they are still on a bullish trend in the long term. Due to its high volatility, you can lose money if the cryptocurrency exchange rate suddenly dips. In the worst-case scenario, you can go bust because you have invested in a trash coin. This relates to all DeFi earning money models.

What is CeFi in Simple Words

To truly understand the difference between decentralized vs centralized finance, let’s explain CeFi in simple terms. Then, we can discuss its pros and cons and how to use it to earn money.

So what is Centralized Finance? It stands for CeFi and this is when private companies provide cryptocurrency services. Unlike DeFi, where software and people directly manage operations, CeFi uses a third party, it’s like a private authority.

Pros and Cons of CeFi

There are several essential benefits of CeFi:

- You don’t have to worry about your assets’ security.

- CeFi platforms typically have a user-friendly UX; they are easy to navigate, too.

- CeFi platforms offer a similar range of services, compared to traditional banks.

- You don’t have to obtain security keys to access your funds; there’s no need to worry about these issues.

However, there are also downsides to centralized finance. One significant drawback is that CeFi platforms accumulate large amounts of crypto. This makes them a pretty attractive target for hackers who may attempt to steal funds. Plus, you can’t count on the government to protect your crypto assets.

How to Make Money with CeFi

Let’s name some of the best CeFi platforms like Binance, Kraken, and Gateio. These online platforms have centralized control over funds. They also offer various trading methods, such as spot and future options. One of the most profitable methods is crypto trading.

Another way to answer ‘How to trade CeFi?’ is to find a reliable CeFi exchange like Binance. Any decent centralized crypto exchange offers plenty of services like crypto-to-crypto trading, crypto-to-fiat exchanges, and derivatives trading.

Let us give you an example. You can buy Bitcoin on the bullish trend and wait till it starts to go bullish. The right moment to sell it for fiat money may bring you great revenues: we call it a crypto trader’s paradise! A very important thing here is to fix the point of no return when the cryptocurrency goes down: you must smell this moment!

Also, CeFi exchanges may act as launchpads for new projects, allowing you to join initial coin offerings (ICOs) and token sales. You can participate in decentralized finance projects through CeFi exchange platforms.

Disadvantages of CeFi: Counterparty Risk, Less Transparency, and Potential Fees

Is CeFi safe? Sure, generally, it is. This financial system is quite reliable and protected by national and international regulations.

Now that you understand the difference between centralized and decentralized finance, you might wonder “Gosh, which approach is right?” Don’t worry; you will find it in the next section!

Comparing DeFi vs CeFi

Let’s dive deeper and learn the industry insights. Let’s also check out the differences between DeFi and CeFi. Obviously, both finance concepts have pros and cons. It would be a great idea to find the right balance between them.

Finding the Right Fit: DeFi vs CeFi for Your Needs

It is essential to assess the benefits and drawbacks of DeFi vs CeFi. This way, we can find out what best suits your needs. One thing is for sure: there is no universal solution. It all depends on the situation. So, ideally, you will be making the right decision at the right moment. The best practice would be to engage both options and smartly use them. The downside is that you must have deep inside expertise in finance.

DeFi vs CeFi: A Feature-by-Feature Comparison

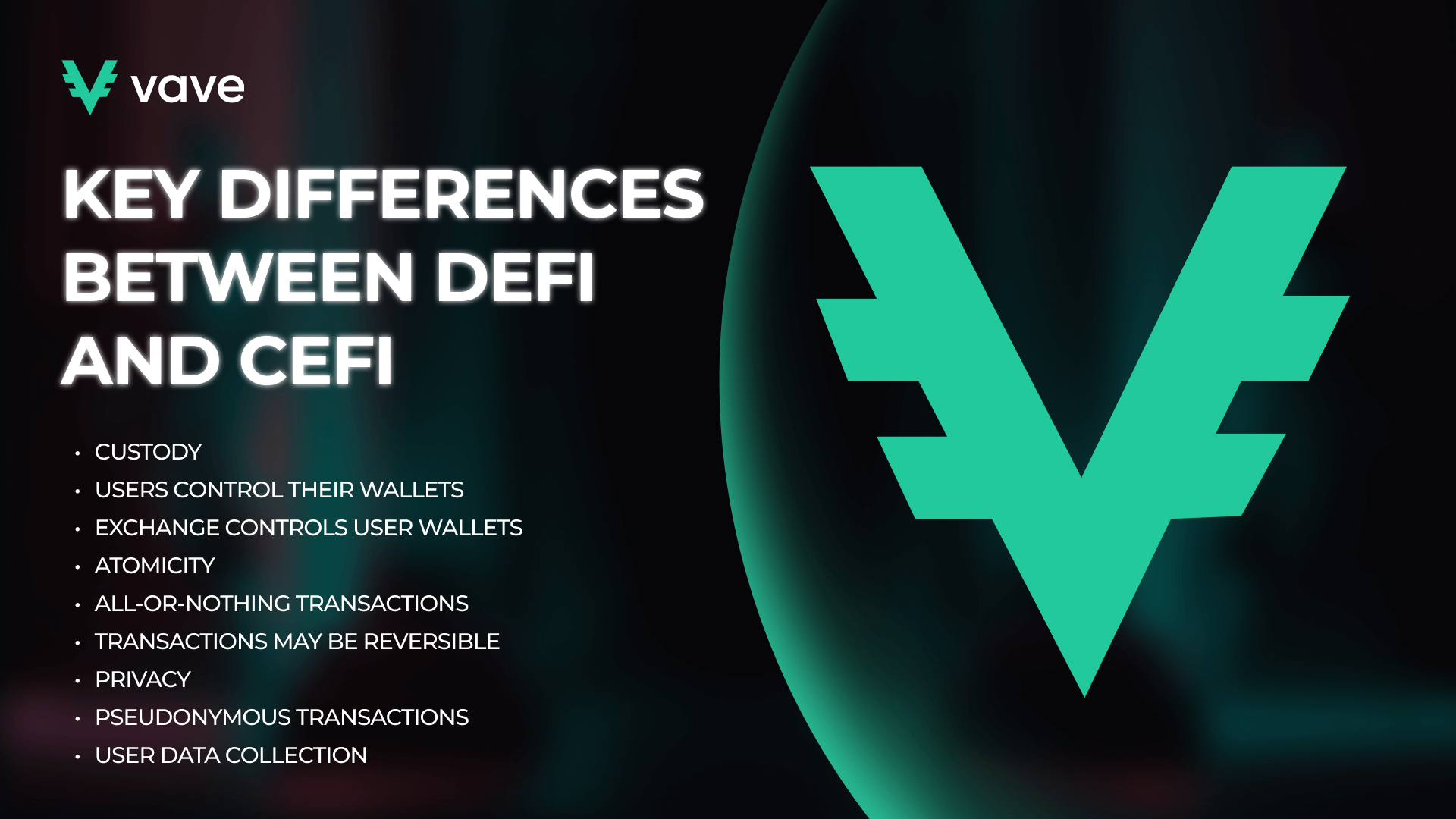

Now, it is time to compare centralized and decentralized technologies. To do this, we must examine their five key features: Custody, Atomicity, Privacy, Risks, and Exchange. So, let’s do just that.

| Feature | DeFi | CeFi |

| Custody | Customers directly control their assets. | Centralized exchanges look after assets. |

| Atomicity | Transactions happen all at once. | Transactions might rely on legal agreements that may cause delays. |

| Privacy | Maximum privacy. | Policies and rules may reveal customer’s information. |

| Arbitrage Risks | High risk-free probability. | Subject to market price volatility. |

| Exchange | Limited options for converting money. | Provides fiat-to-crypto exchange. |

If you are looking for more information about cryptocurrency, please visit our Vave casino blog pages.

The Future of Finance: DeFi, CeFi, or a Hybrid Approach?

Deciding between DeFi and CeFi is not an easy task. Each model offers advantages and drawbacks, depending on the customer’s needs. DeFi appeals to those seeking an off-beaten path, i.e. more financial autonomy and privacy, whereas investors often favor regulated CeFi platforms. All these conditions and facts still make us wonder which side will have the upper hand and dominate the world in the coming years.

The recipe is to go in between – the middle-way approach rules!

What’s More to Read:

Check out this nice article: Crypto Decreasing in 2024

FAQ

Are DeFi and CeFi regulated in the cryptocurrency market?

Do DeFi and CeFi provide insurance options?